Question: Please fill the box below, and provide a step-by-step analysis using either a formula or Excel. Thanks. The following table presents the long-term liabilities and

Please fill the box below, and provide a step-by-step analysis using either a formula or Excel. Thanks.

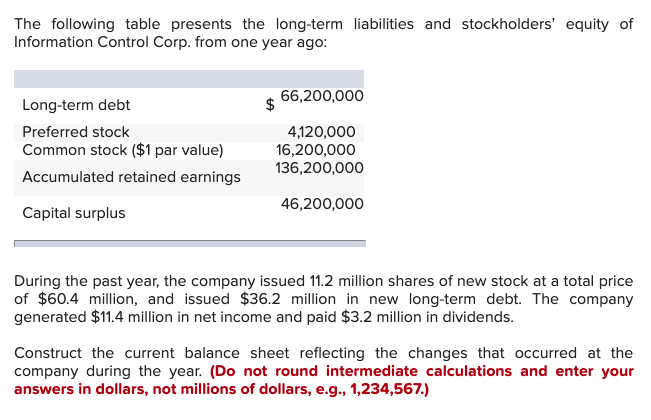

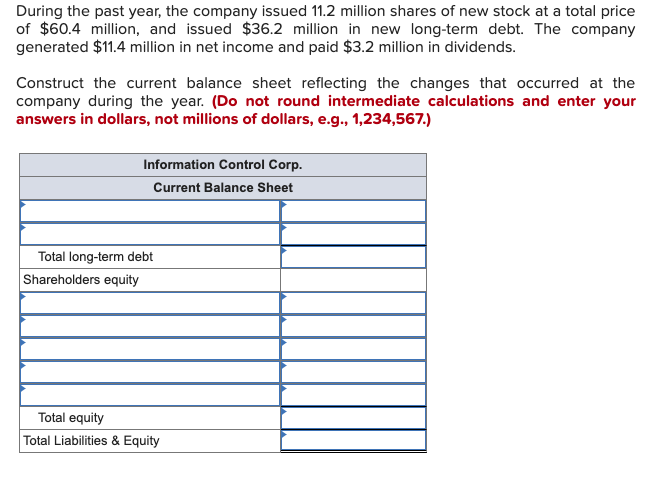

The following table presents the long-term liabilities and stockholders' equity of Information Control Corp. from one year ago: 66,200,000 Long-term debt Preferred stock Common stock ($1 par value) 4,120,000 16,200,000 136,200,000 Accumulated retained earnings 46,200,000 Capital surplus During the past year, the company issued 11.2 million shares of new stock at a total price of $60.4 million, and issued $36.2 million in new long-term debt. The company generated $11.4 million in net income and paid $3.2 million in dividends. Construct the current balance sheet reflecting the changes that occurred at the company during the year. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) During the past year, the company issued 11.2 million shares of new stock at a total price of $60.4 million, and issued $36.2 million in new long-term debt. The company generated $11.4 million in net income and paid $3.2 million in dividends Construct the current balance sheet reflecting the changes that occurred at the company during the year. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) Information Control Corp Current Balance Sheet Total long-term debt Shareholders equity Total equity Total Liabilities & Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts