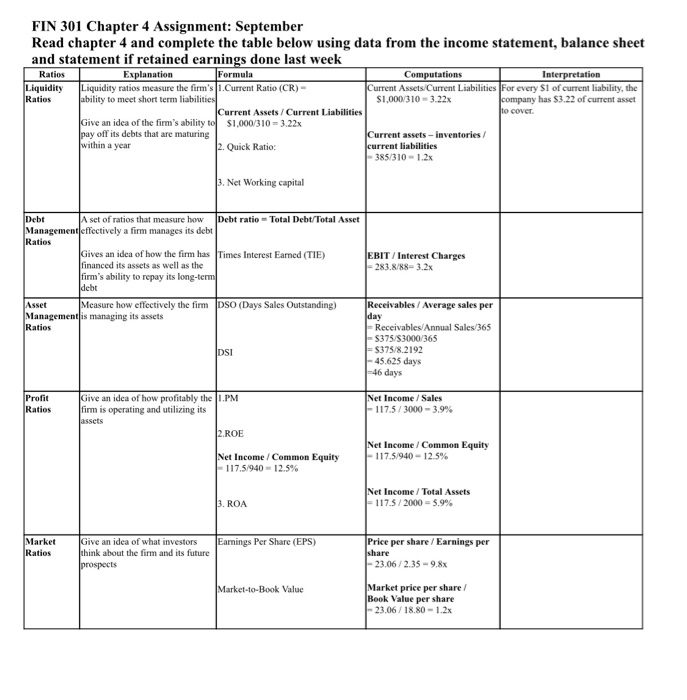

Question: please fill the interpretation FIN 301 Chapter 4 Assignment: September Read chapter 4 and complete the table below using data from the income statement, balance

FIN 301 Chapter 4 Assignment: September Read chapter 4 and complete the table below using data from the income statement, balance sheet and statement if retained earnings done last week Ratios Explanation Formula Computations Interpretation Liquidity Liquidity ratios measure the firm's 1.Current Ratio (CR) - Current Assets Current Liabilities for every S1 of current liability, the Ratios ability to meet short term liabilities $1,000/310 3.22x company has 3.22 of current asset Current Assets / Current Liabilities to cover Give an idea of the firm's ability to $1,000/310 = 3.22x pay off its debts that are maturing Current assets - inventories/ within a year 2. Quick Ratio: current liabilities - 385/310 -1.2x 3. Net Working capital Debt A set of ratios that measure how Debt ratio - Total Debt/Total Asset Management effectively a firm manages its debt Ratios Gives an idea of how the firm has Times Interest Eamed (TIE) EBIT / Interest Charges financed its assets as well as the - 283.8/88-3.2x firm's ability to repay its long-term debt Asset Measure how effectively the firm PSO (Days Sales Outstanding) Receivables / Average sales per Management is managing its assets day Ratios Receivables/Annual Sales/365 |-5375/83000/365 PSI F$375/8.2192 - 45.625 days -46 days Profit Ratios Give an idea of how profitably the 1.PM firm is operating and utilizing its assets 2. ROE Net Income / Sales 117.5/3000 - 3.9% Net Income / Common Equity -117.5/940 -12.5% Net Income / Common Equity 117.5/940 -12.5% Net Income / Total Assets 117.5 /2000 = 5.9% 3. ROA Market Ratios Earings Per Share (EPS) Give an idea of what investors think about the firm and its future prospects Price per share / Earnings per share - 23.06/2.35 - 9.8% Market-to-Book Value Market price per share/ Book Value per share - 23.06/18.80 - 1.2x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts