Question: Please fill the Sheet 1 and sheet 2 and explain clearly...Please first pic, there we have complete details Part 2 - Car Loan Payments and

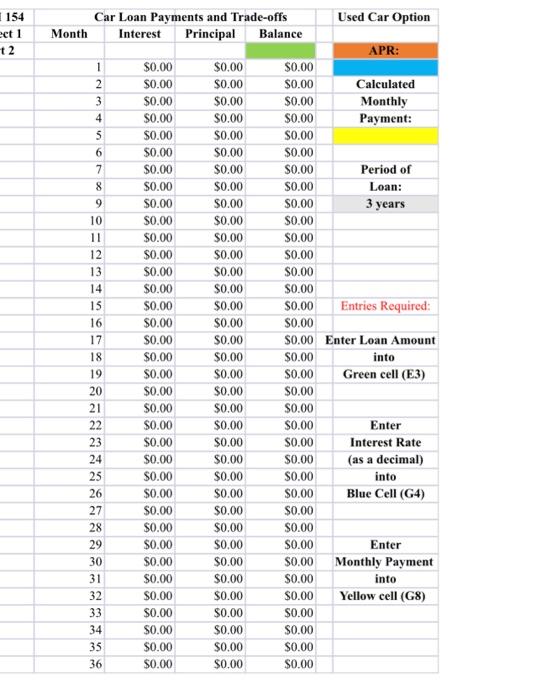

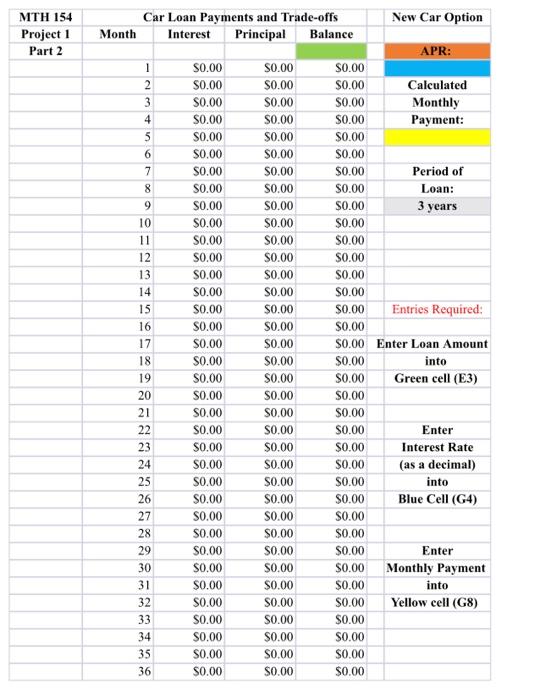

Part 2 - Car Loan Payments and Trade-offs Instructions For Part 2, you will pretend you are deciding between buying a new car or a used car. Please note, the amount you can spend on the car does not depend on or is in any way associated with bow much money you gained or lost in this project's Part 1 (Stock Market Investing.) You will also do a Trade-off Analysis, i.e, calculate how much money you would make if you invested the money you would save by buying the used car instead of the new car. Process: a. Decide on the kind of new car you would consider purchasing and research its price. b. Decide on the kind of used car you would consider purchasing and research its price. c. Complete the Part 2 Worksheet (next page), Questions \#1 through #3. Important notes for Questions 1 through 3: 1. The amount of the down-payment - Most car dealers want a down-payment of at least 10.9% of the car price so assume 10.9% for your down-payment. 2. The amount of the loan you will require (also called the amount to be financed) - The amount of the loan = the price of the car - the down-payment 3. The interest rate (assume the same interest rate for both car choices) 4. Assume a three-year ( 36 months) car loan for both car choices. Note: Average car loan period is 6 years -72 months) d. Complete the two Part 2 Excel Spreadsheets (instructions in the Part 2 Worksheet), one for the New Car and one for the Used Car. Please note the Excel spreadsheets will automatically calculate columns C,D and E. Column C shows how much interest your payment includes each month. Column D show how much principal your payment includes each month. Column E shows the balance of the loan still to be paid off after each monthly payment. Part 2 - Car Loan Payments and Trade-offs Instructions For Part 2, you will pretend you are deciding between buying a new car or a used car. Please note, the amount you can spend on the car does not depend on or is in any way associated with bow much money you gained or lost in this project's Part 1 (Stock Market Investing.) You will also do a Trade-off Analysis, i.e, calculate how much money you would make if you invested the money you would save by buying the used car instead of the new car. Process: a. Decide on the kind of new car you would consider purchasing and research its price. b. Decide on the kind of used car you would consider purchasing and research its price. c. Complete the Part 2 Worksheet (next page), Questions \#1 through #3. Important notes for Questions 1 through 3: 1. The amount of the down-payment - Most car dealers want a down-payment of at least 10.9% of the car price so assume 10.9% for your down-payment. 2. The amount of the loan you will require (also called the amount to be financed) - The amount of the loan = the price of the car - the down-payment 3. The interest rate (assume the same interest rate for both car choices) 4. Assume a three-year ( 36 months) car loan for both car choices. Note: Average car loan period is 6 years -72 months) d. Complete the two Part 2 Excel Spreadsheets (instructions in the Part 2 Worksheet), one for the New Car and one for the Used Car. Please note the Excel spreadsheets will automatically calculate columns C,D and E. Column C shows how much interest your payment includes each month. Column D show how much principal your payment includes each month. Column E shows the balance of the loan still to be paid off after each monthly payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts