Question: Please fill up the blank that needed and explain how the number coming up BP Company sponsors a defined benefit pension plan for its employees.

Please fill up the blank that needed and explain how the number coming up

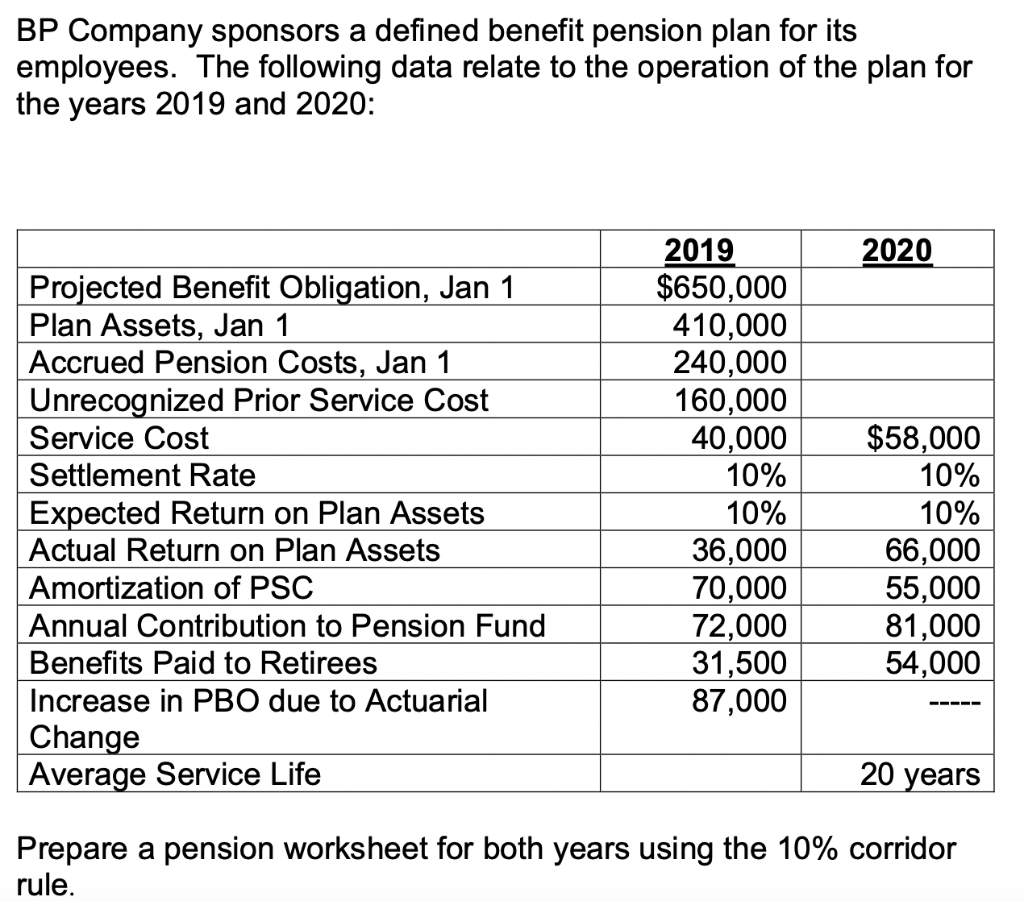

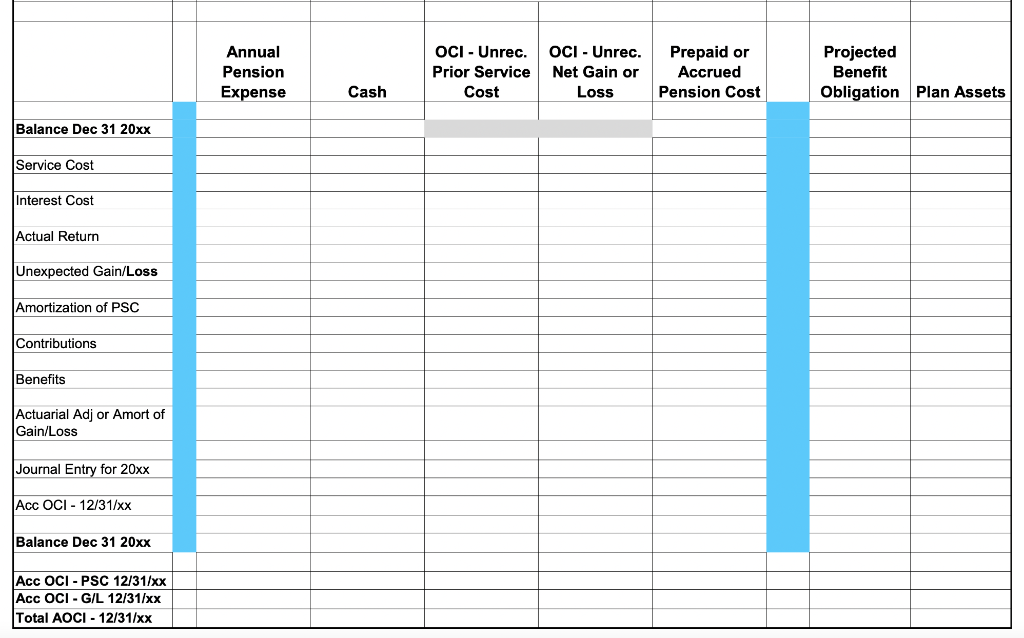

BP Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2019 and 2020: 2020 2019 $650,000 Projected Benefit Obligation, Jan 1 Plan Assets, Jan 1 410,000 Accrued Pension Costs, Jan 1 240,000 160,000 Unrecognized Prior Service Cost Service Cost 40,000 $58,000 Settlement Rate 10% 10% Expected Return on Plan Assets 10% 10% Actual Return on Plan Assets 36,000 66,000 Amortization of PSC 70,000 55,000 Annual Contribution to Pension Fund 72,000 81,000 Benefits Paid to Retirees 31,500 54,000 Increase in PBO due to Actuarial 87,000 Change Average Service Life 20 years Prepare a pension worksheet for both years using the 10% corridor rule. Balance Dec 31 20xx Service Cost Interest Cost Actual Return Unexpected Gain/Loss Amortization of PSC Contributions Benefits Actuarial Adj or Amort of Gain/Loss Journal Entry for 20xx Acc OCI - 12/31/xx Balance Dec 31 20xx Acc OCI - PSC 12/31/xx Acc OCI - G/L 12/31/xx Total AOCI - 12/31/xx Annual Pension Expense Cash OCI - Unrec. Prior Service Cost OCI - Unrec. Net Gain or Loss Prepaid or Accrued Pension Cost Projected Benefit Obligation Plan Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts