Question: please fillout the following using excel formulas. explain how you got the answers also. thank you in advance Required: Using the information below, prepare the

please fillout the following using excel formulas. explain how you got the answers also. thank you in advance

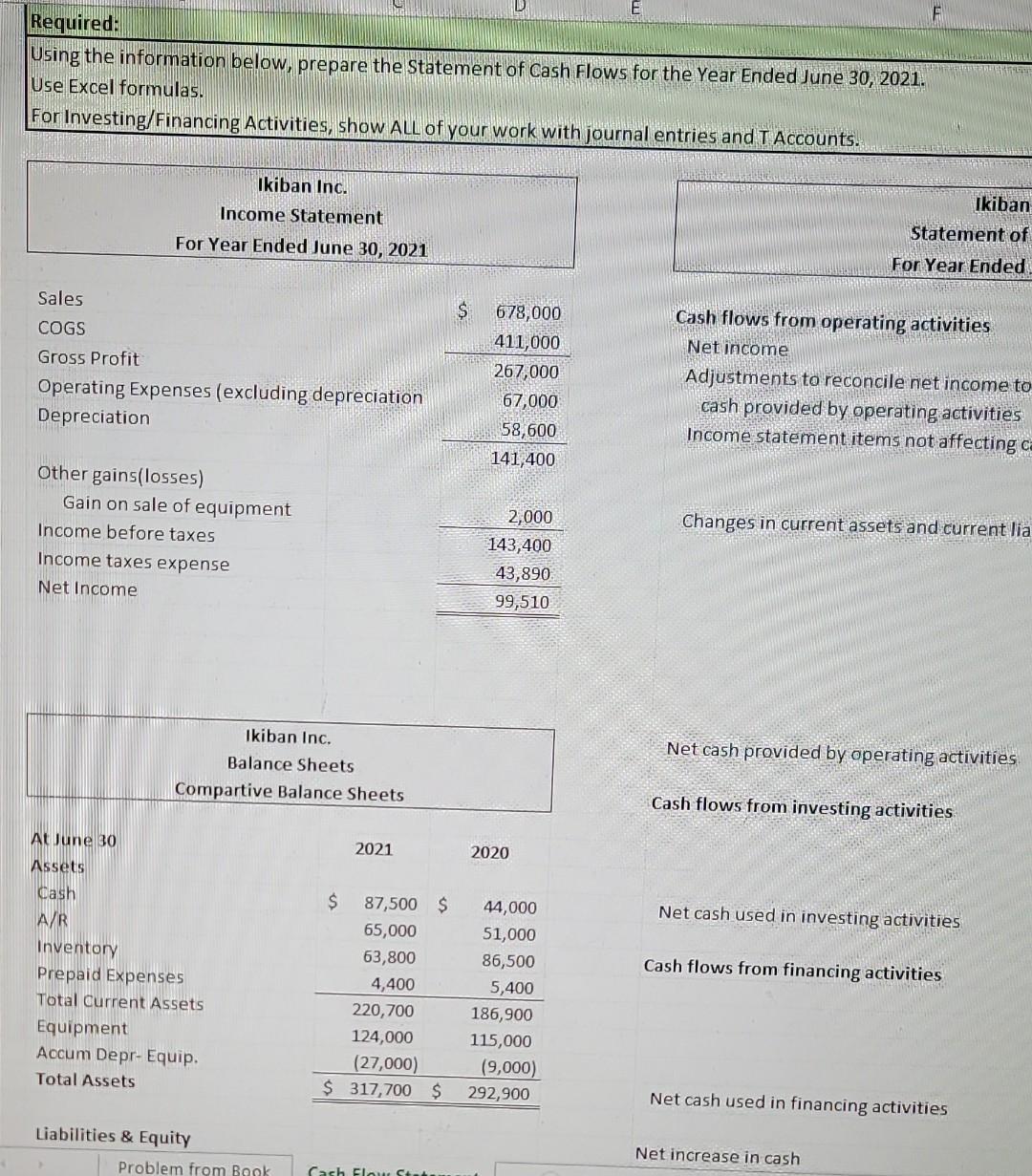

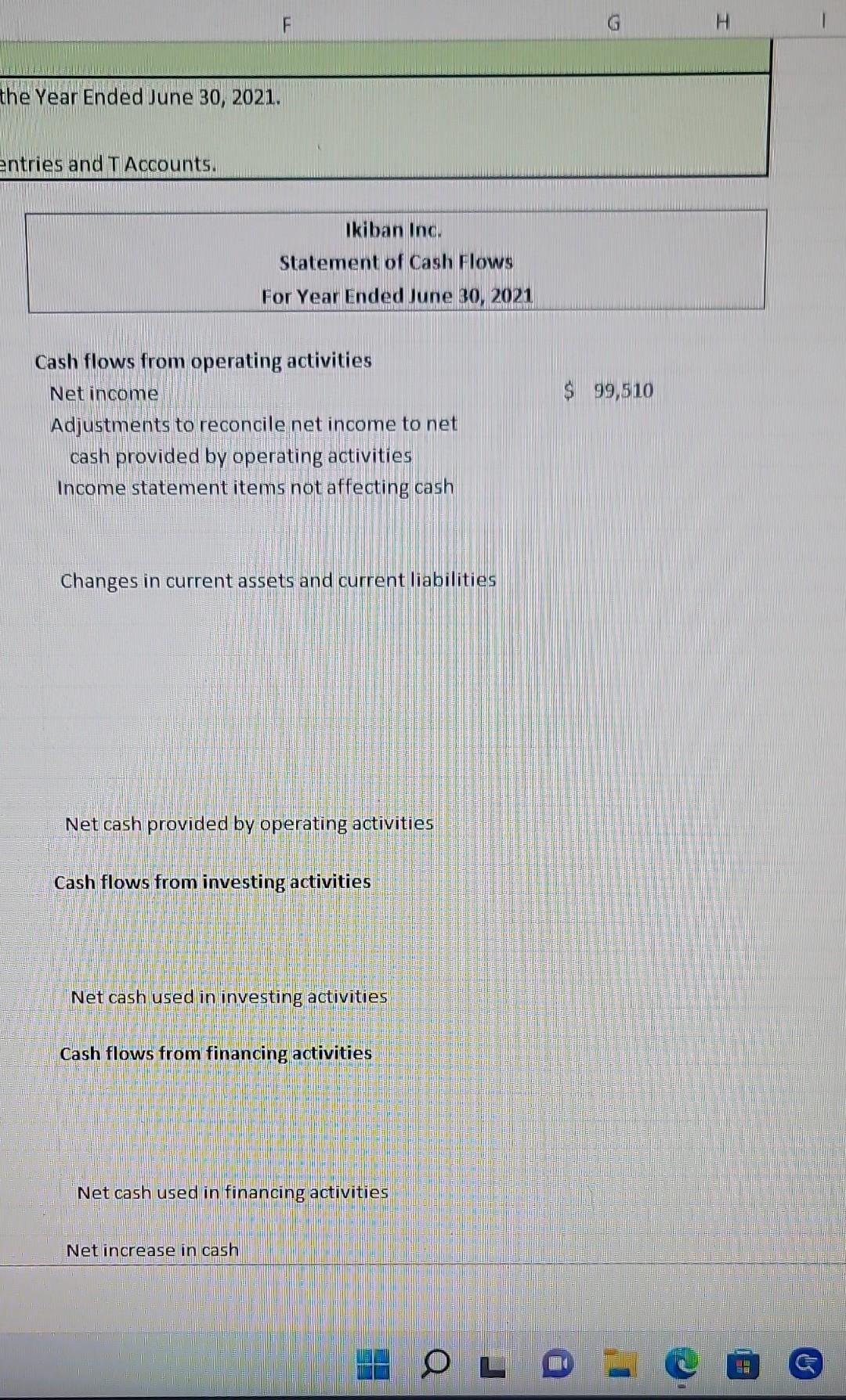

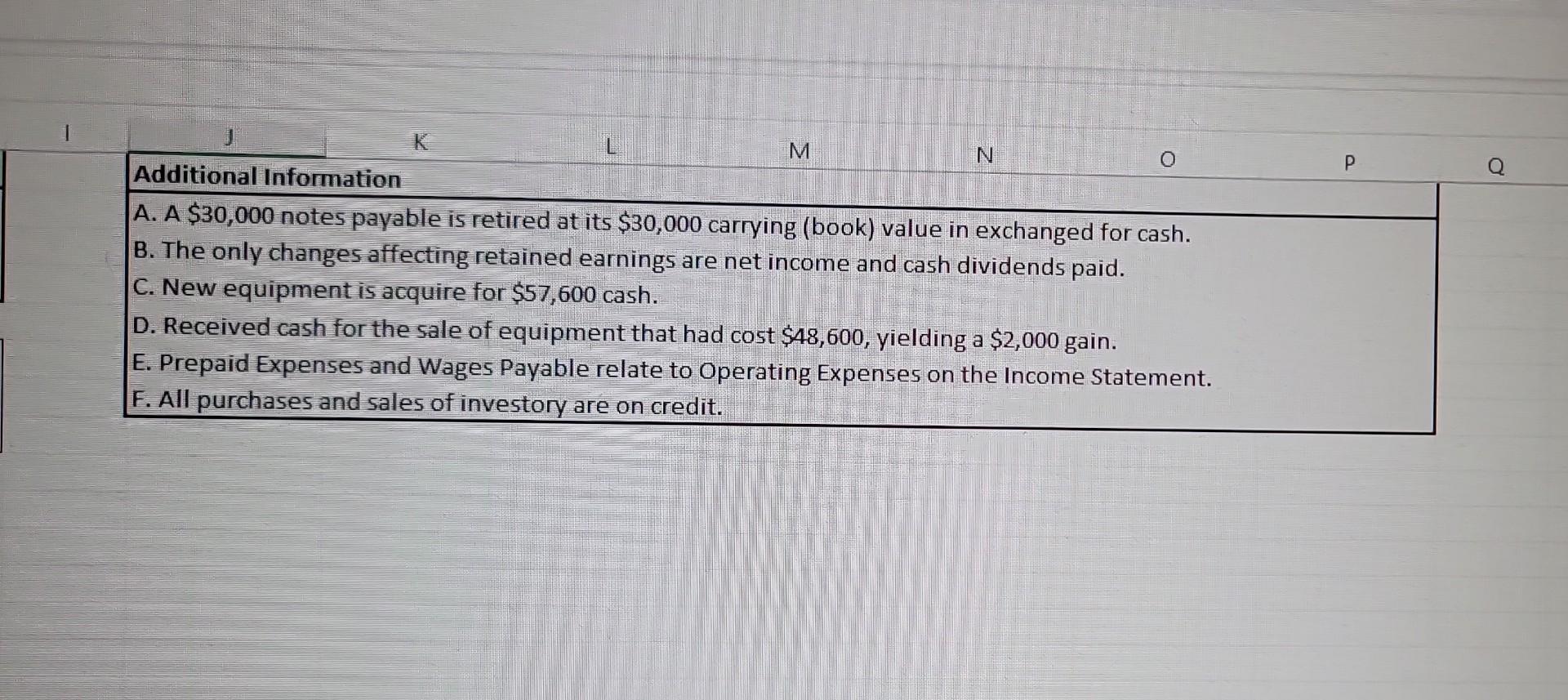

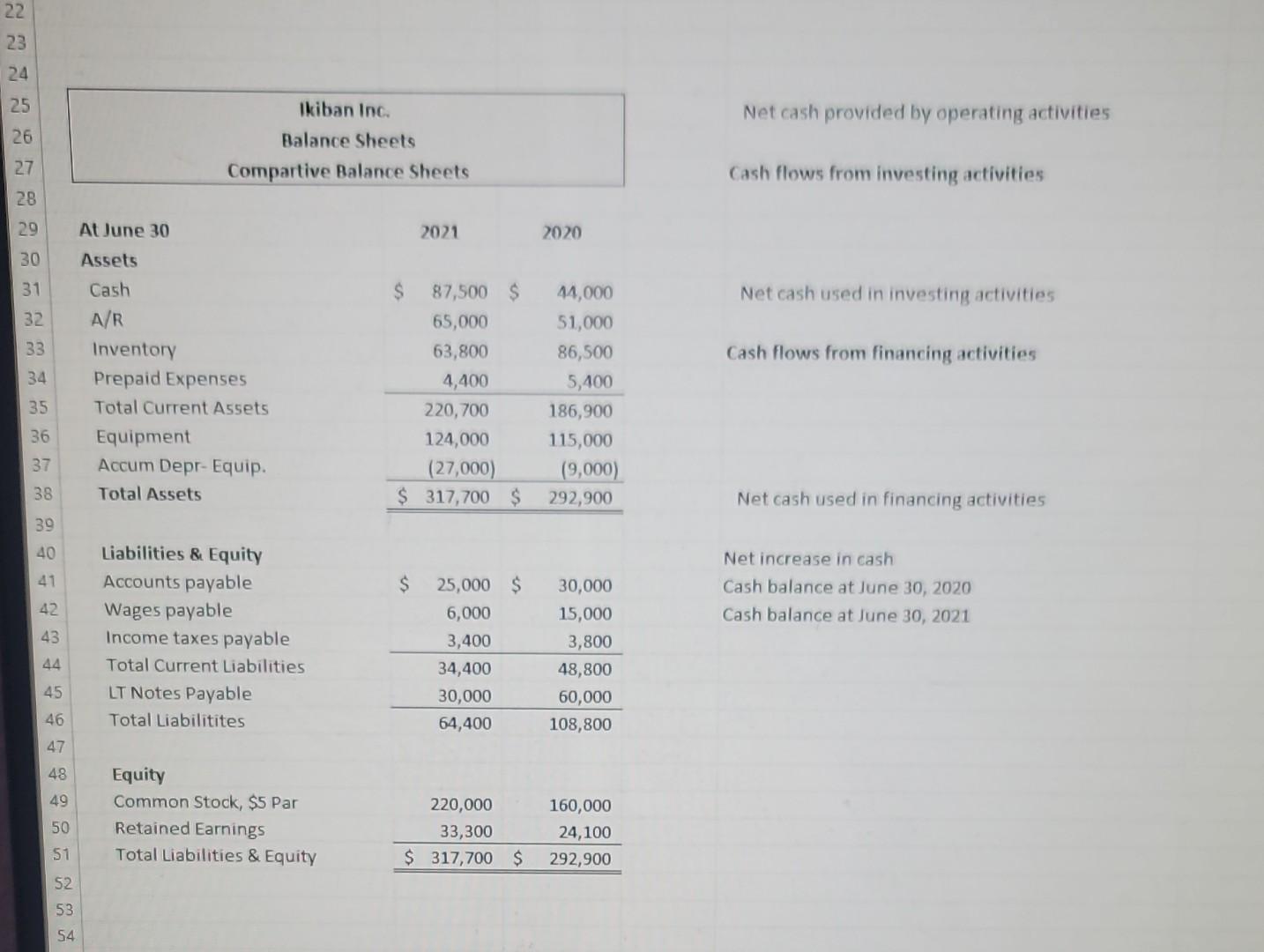

Required: Using the information below, prepare the Statement of Cash Flows for the Year Ended June 30,2021. Use Excel formulas. For Investing/Financing Activities, show ALL of your work with journal entries and T Accounts. the Year Ended June 30, 2021. entries and T Accounts. Cash flows from operating activities Net income Adjustments to reconcile net income cash provided by operating activitie Income statement items not affecting Changes in current assets and current Net cash provided by operating activit Cash flows from investing activities Net cash used in investing activities Cash flows from financing activities Net cash used in financing activities \begin{tabular}{|l|} \hline \multicolumn{1}{|c}{K} \\ Additional Information \\ A. A$30,000 notes payable is retired at its $30,000 carrying (book) value in exchanged for cash. \\ B. The only changes affecting retained earnings are net income and cash dividends paid. \\ C. New equipment is acquire for $57,600 cash. \\ D. Received cash for the sale of equipment that had cost $48,600, yielding a $2,000 gain. \\ E. Prepaid Expenses and Wages Payable relate to Operating Expenses on the Income Statement. \\ F. All purchases and sales of investory are on credit. \end{tabular} Net cash provided by operating activ Cash flows from investing activities At June 30 Assets Net cash used in financing activities Liabilities \& Equity Equity Common Stock, \$5 Par Retained Earnings Total Liabilities \& Equity \begin{tabular}{rrr} \hline 2021 & 2020 \\ & & \\ 87,500 & $ & 44,000 \\ 65,000 & 51,000 \\ 63,800 & 86,500 \\ 4,400 & 5,400 \\ \hline 220,700 & 186,900 \\ 124,000 & 115,000 \\ & (27,000) & (9,000) \\ \hline$317,700 & $ & 292,900 \\ \hline & & \\ \hline & & \\ \hline 25,000 & $ & 30,000 \\ 6,000 & & 15,000 \\ 3,400 & 3,800 \\ \hline 34,400 & & 48,800 \\ 30,000 & 60,000 \\ \hline 64,400 & 108,800 \\ & & \\ \hline 220,000 & & 160,000 \\ 33,300 & 24,100 \\ \hline \hline 317,700 & $ & 292,900 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts