Question: Please find 1-5 based on the financial statements given above. 3.Non Current Liabilities Chesapeake Energy, 2012 Attached please find balance sheet, income statement, and footnote

Please find 1-5 based on the financial statements given above.

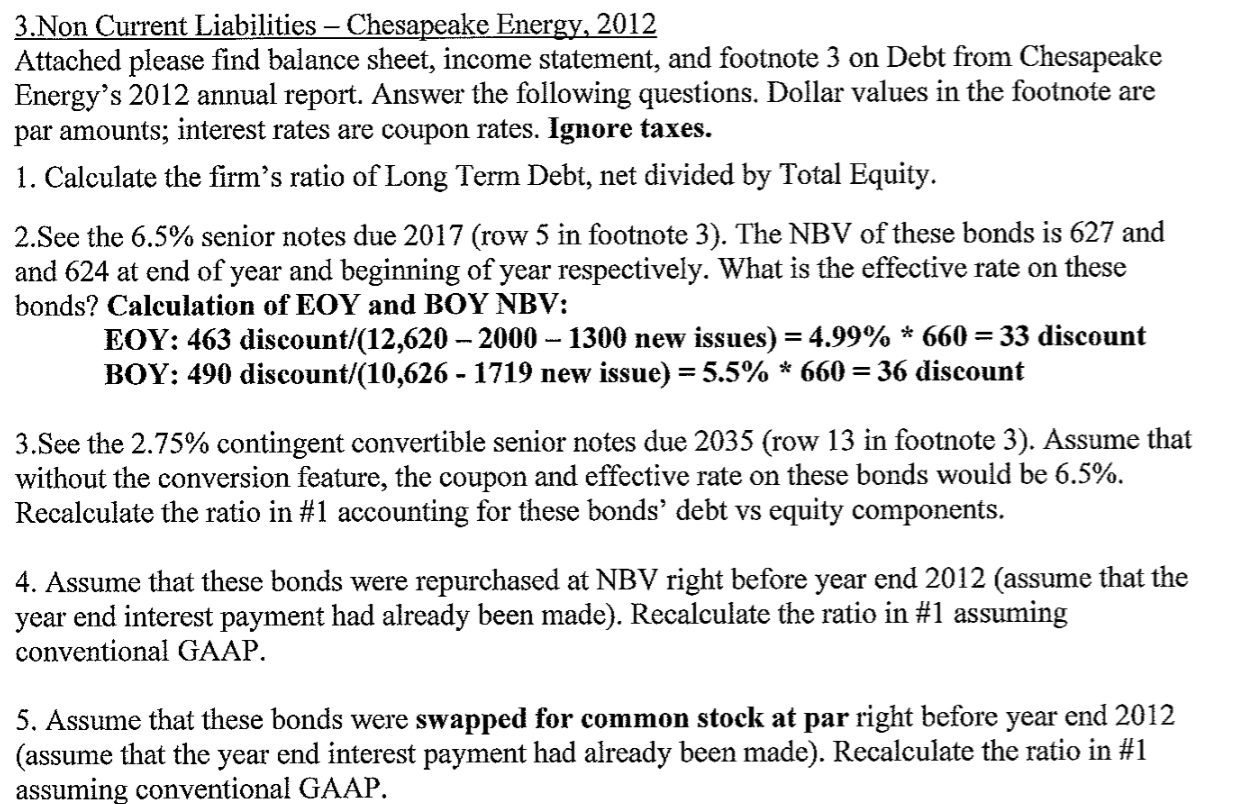

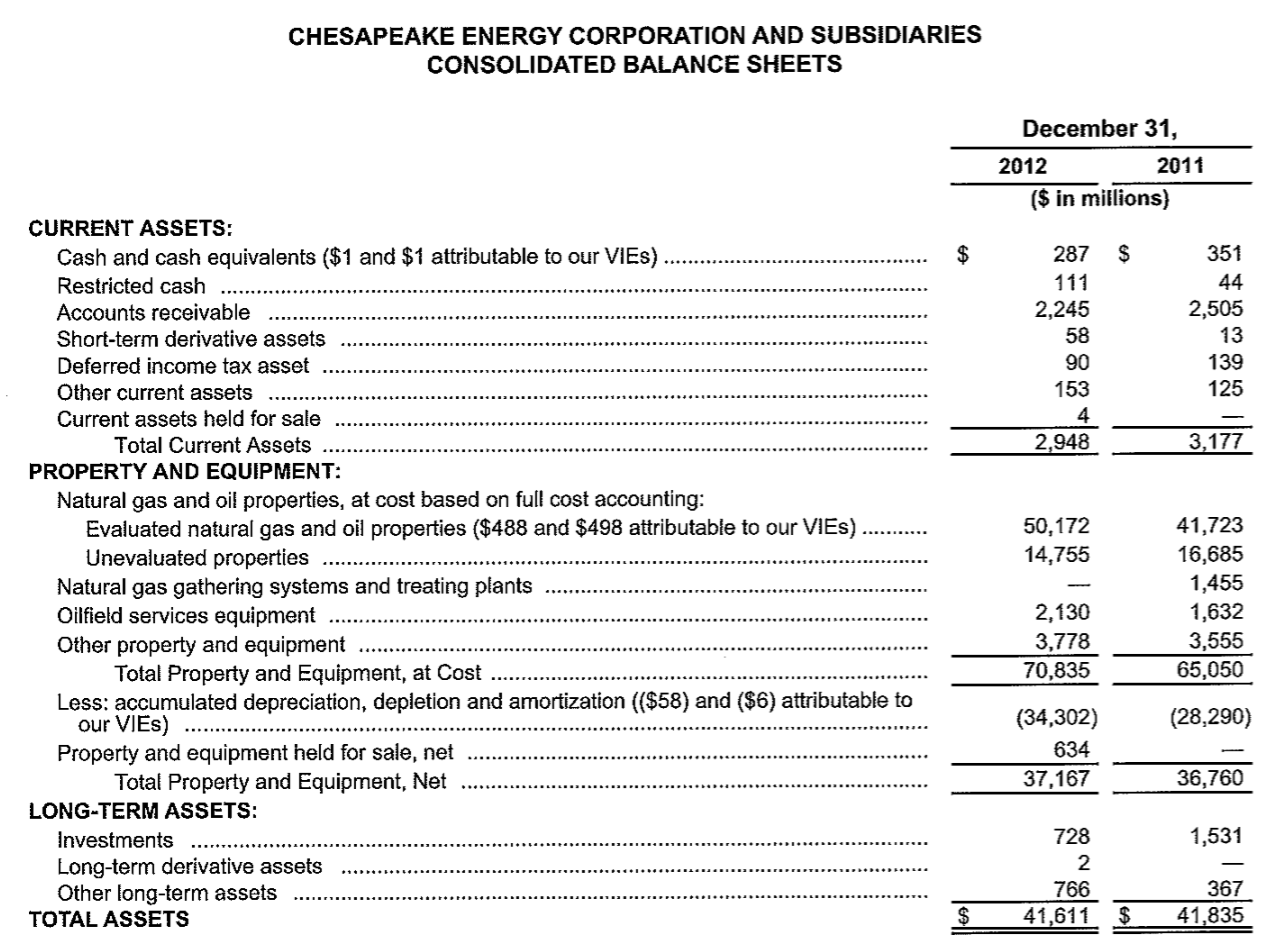

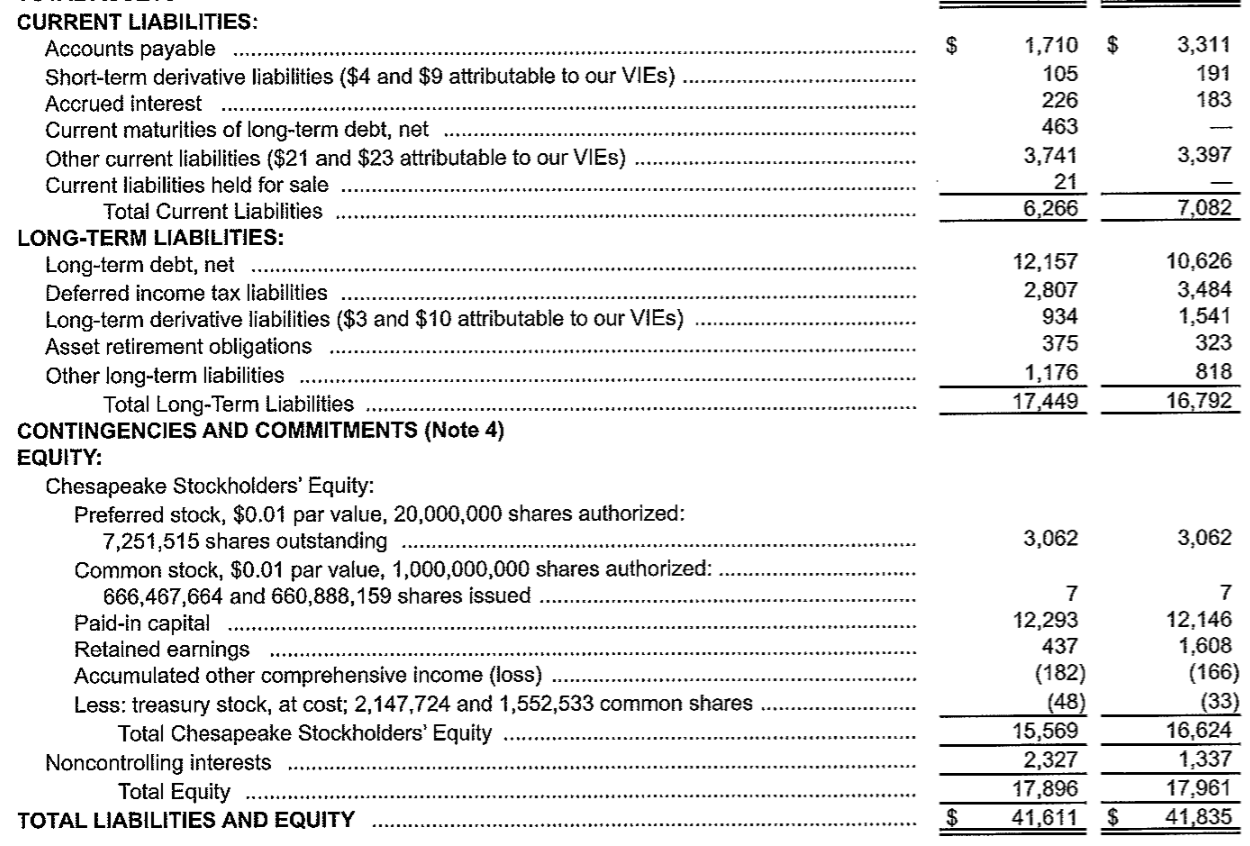

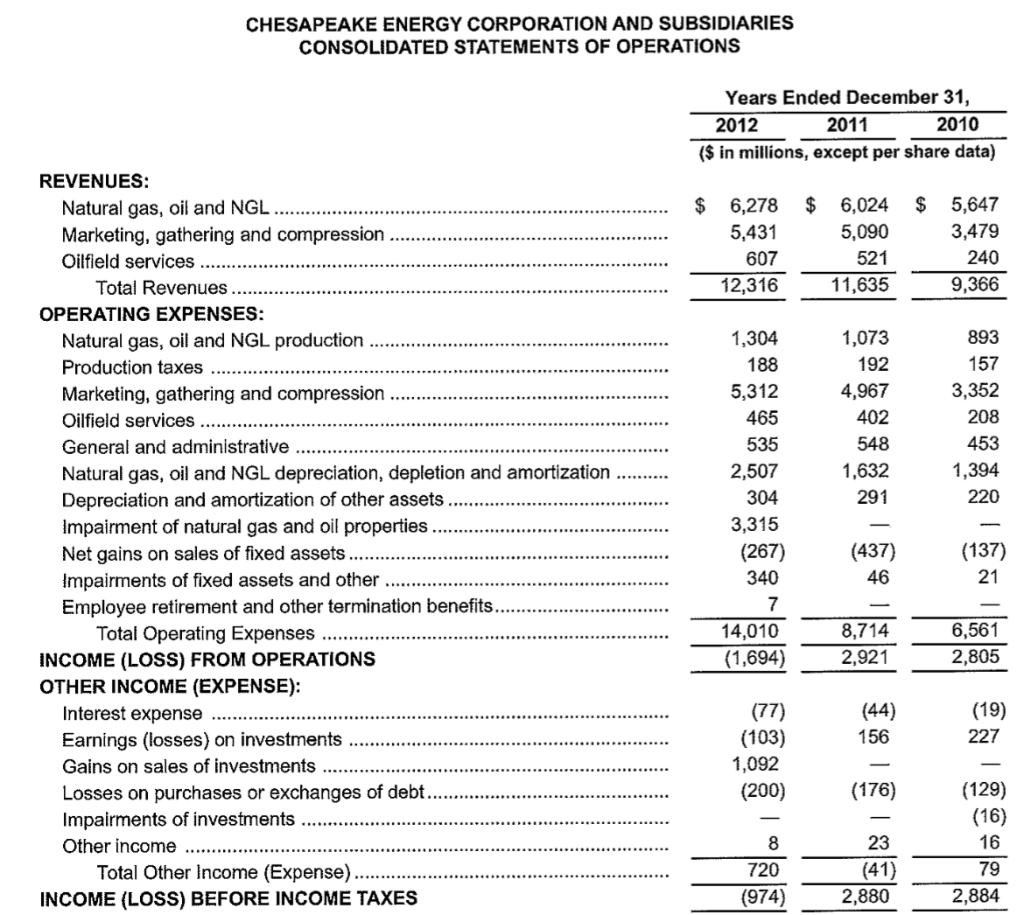

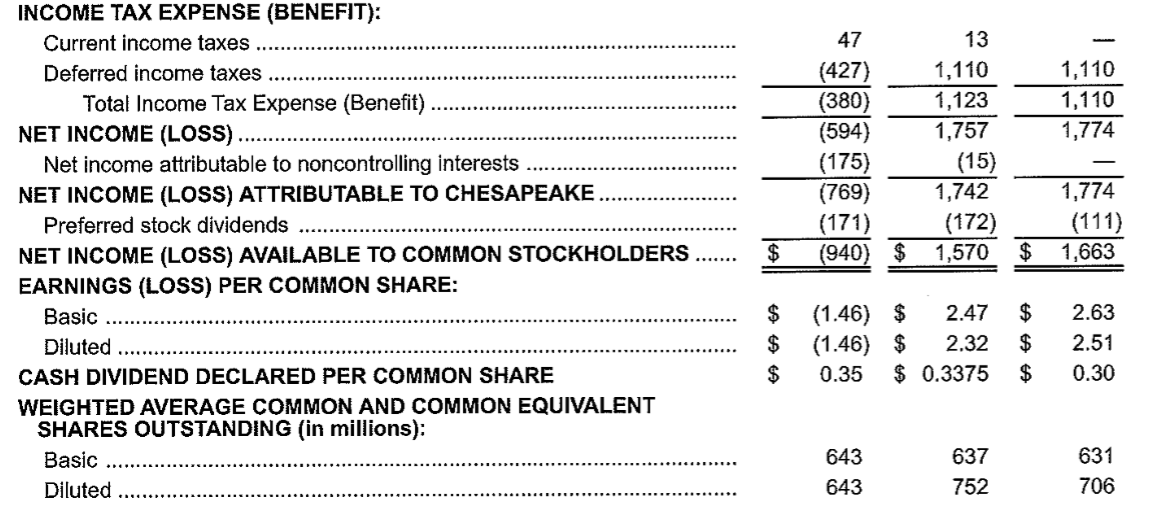

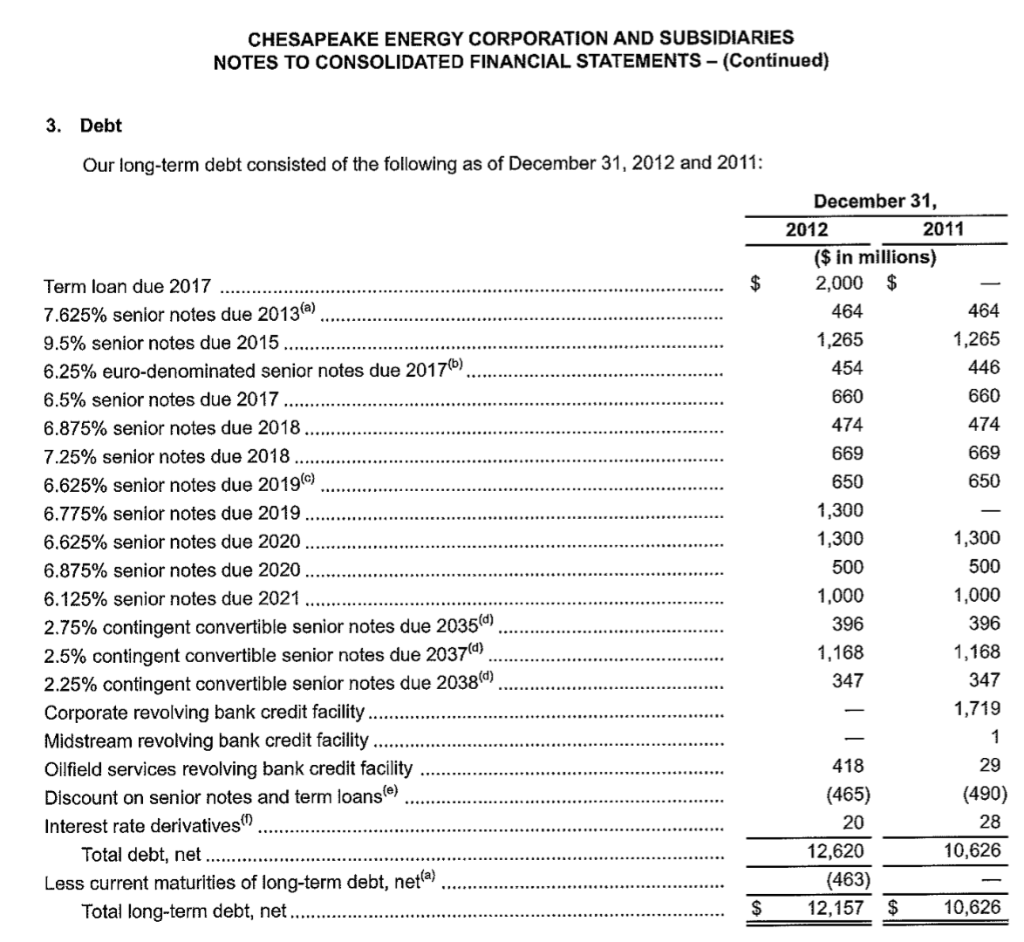

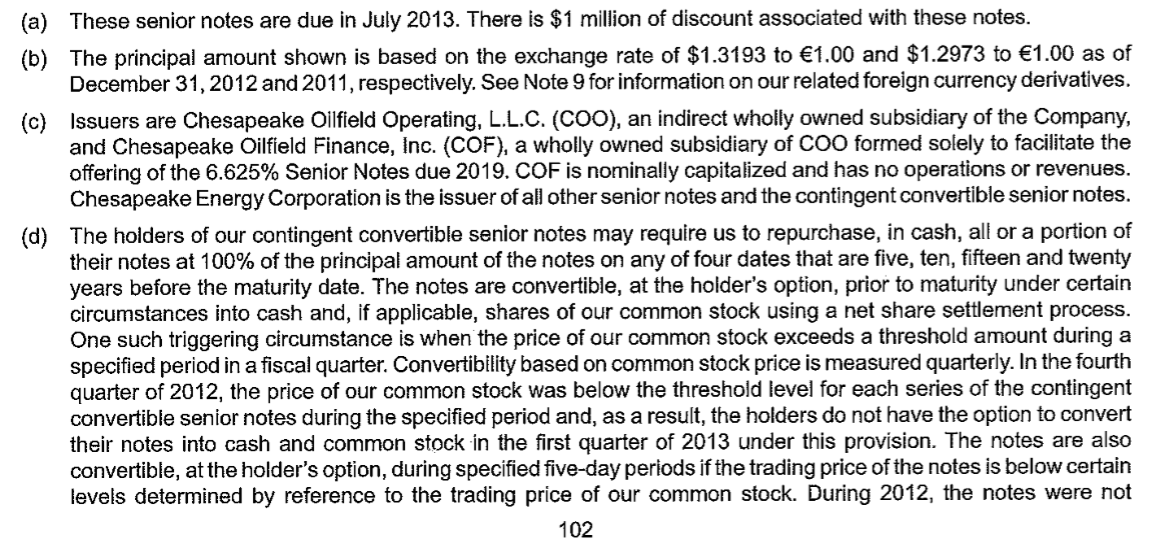

3.Non Current Liabilities Chesapeake Energy, 2012 Attached please find balance sheet, income statement, and footnote 3 on Debt from Chesapeake Energy's 2012 annual report. Answer the following questions. Dollar values in the footnote are par amounts; interest rates are coupon rates. Ignore taxes. 1. Calculate the firm's ratio of Long Term Debt, net divided by Total Equity. 2.See the 6.5% senior notes due 2017 (row 5 in footnote 3). The NBV of these bonds is 627 and and 624 at end of year and beginning of year respectively. What is the effective rate on these bonds? Calculation of EOY and BOY NBV: EOY: 463 discount/(12,620 - 2000 1300 new issues) = 4.99% * 660 = 33 discount BOY: 490 discount/(10,626 - 1719 new issue) = 5.5% * 660 = 36 discount = 3.See the 2.75% contingent convertible senior notes due 2035 (row 13 in footnote 3). Assume that without the conversion feature, the coupon and effective rate on these bonds would be 6.5%. Recalculate the ratio in #1 accounting for these bonds' debt vs equity components. 4. Assume that these bonds were repurchased at NBV right before year end 2012 (assume that the year end interest payment had already been made). Recalculate the ratio in #1 assuming conventional GAAP. 5. Assume that these bonds were swapped for common stock at par right before year end 2012 (assume that the year end interest payment had already been made). Recalculate the ratio in #1 assuming conventional GAAP. CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, 2012 2011 ($ in millions) $ $ 287 111 2,245 58 90 153 4 2,948 351 44 2,505 13 139 125 3,177 50,172 14,755 CURRENT ASSETS: Cash and cash equivalents ($1 and $1 attributable to our VIES) Restricted cash Accounts receivable Short-term derivative assets Deferred income tax asset Other current assets Current assets held for sale Total Current Assets PROPERTY AND EQUIPMENT: Natural gas and oil properties, at cost based on full cost accounting: Evaluated natural gas and oil properties ($488 and $498 attributable to our VIES) Unevaluated properties Natural gas gathering systems and treating plants Oilfield services equipment Other property and equipment Total Property and Equipment, at Cost Less: accumulated depreciation, depletion and amortization (($58) and ($6) attributable to our VIES) Property and equipment held for sale, net Total Property and Equipment, Net LONG-TERM ASSETS: Investments Long-term derivative assets Other long-term assets TOTAL ASSETS 41,723 16,685 1,455 1,632 3,555 65,050 2,130 3,778 70,835 (28,290) (34,302) 634 37,167 36,760 1,531 728 2 766 41,611 leal 367 41,835 $ $ $ $ 3,311 191 183 1,710 105 226 463 3,741 21 6,266 3,397 7,082 12,157 2,807 934 375 1,176 17,449 10,626 3,484 1,541 323 818 16,792 CURRENT LIABILITIES: Accounts payable Short-term derivative liabilities ($4 and $9 attributable to our VIES) Accrued interest Current maturities of long-term debt, net Other current liabilities ($21 and $23 attributable to our VIES) Current liabilities held for sale Total Current Liabilities LONG-TERM LIABILITIES: Long-term debt, net Deferred income tax liabilities Long-term derivative liabilities ($3 and $10 attributable to our VIES) Asset retirement obligations Other long-term liabilities Total Long-Term Liabilities CONTINGENCIES AND COMMITMENTS (Note 4) EQUITY: Chesapeake Stockholders' Equity: Preferred stock, $0.01 par value, 20,000,000 shares authorized: 7,251,515 shares outstanding Common stock, $0.01 par value, 1,000,000,000 shares authorized: 666,467,664 and 660,888,159 shares issued Paid-in capital Retained earnings Accumulated other comprehensive income (loss) Less: treasury stock, at cost; 2,147,724 and 1,552,533 common shares Total Chesapeake Stockholders' Equity Noncontrolling interests Total Equity TOTAL LIABILITIES AND EQUITY 3,062 3,062 7 12,293 437 (182) (48) 15,569 2,327 17,896 41,611 $ 7 12,146 1,608 (166) (33) 16,624 1,337 17,961 41,835 $ CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended December 31, 2012 2011 2010 ($ in millions, except per share data) $ $ 6,278 5,431 607 12,316 6,024 5,090 521 11,635 $ 5,647 3,479 240 9,366 1,073 192 4,967 402 1,304 188 5,312 465 535 2,507 304 3,315 (267) 340 7 14,010 (1,694) 893 157 3,352 208 453 1,394 220 REVENUES: Natural gas, oil and NGL Marketing, gathering and compression Oilfield services Total Revenues OPERATING EXPENSES: Natural gas, oil and NGL production Production taxes Marketing, gathering and compression Oilfield services General and administrative Natural gas, oil and NGL depreciation, depletion and amortization Depreciation and amortization of other assets ..... Impairment of natural gas and oil properties Net gains on sales of fixed assets Impairments of fixed assets and other Employee retirement and other termination benefits. Total Operating Expenses INCOME (LOSS) FROM OPERATIONS OTHER INCOME (EXPENSE): Interest expense Earnings (losses) on investments Gains on sales of investments Losses on purchases or exchanges of debt. Impairments of investments Other income Total Other Income (Expense). INCOME (LOSS) BEFORE INCOME TAXES 548 1,632 291 (437) 46 (137) 21 8,714 2,921 6,561 2,805 (44) 156 (19) 227 (77) (103) 1,092 (200) (176) 8 720 (974) 23 (41) 2,880 (129) (16) 16 79 2,884 1 1,110 1,110 1,774 INCOME TAX EXPENSE (BENEFIT): Current income taxes Deferred income taxes Total Income Tax Expense (Benefit) NET INCOME (LOSS). Net income attributable to noncontrolling interests NET INCOME (LOSS) ATTRIBUTABLE TO CHESAPEAKE Preferred stock dividends NET INCOME (LOSS) AVAILABLE TO COMMON STOCKHOLDERS EARNINGS (LOSS) PER COMMON SHARE: Basic Diluted CASH DIVIDEND DECLARED PER COMMON SHARE WEIGHTED AVERAGE COMMON AND COMMON EQUIVALENT SHARES OUTSTANDING (in millions): Basic Diluted 47 (427) (380) (594) (175) (769) (171) (940) $ 13 1,110 1,123 1,757 (15) 1,742 (172) 1,570 1,774 (111) 1,663 $ $ $ $ $ (1.46) $ 2.47 (1.46) $ 2.32 0.35 $ 0.3375 $$ $ 2.63 2.51 0.30 $ 643 643 637 752 631 706 CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 3. Debt Our long-term debt consisted of the following as of December 31, 2012 and 2011: $ 454 474 Term loan due 2017 7.625% senior notes due 2013(a) 9.5% senior notes due 2015 6.25% euro-denominated senior notes due 2017(b) 6.5% senior notes due 2017. 6.875% senior notes due 2018 7.25% senior notes due 2018 6.625% senior notes due 2019) 6.775% senior notes due 2019 6.625% senior notes due 2020 6.875% senior notes due 2020 6.125% senior notes due 2021 2.75% contingent convertible senior notes due 2035(d) 2.5% contingent convertible senior notes due 2037() 2.25% contingent convertible senior notes due 2038(4) Corporate revolving bank credit facility Midstream revolving bank credit facility Oilfield services revolving bank credit facility Discount on senior notes and term loanse) Interest rate derivatives Total debt, net ...... Less current maturities of long-term debt, net(a) Total long-term debt, net.. December 31, 2012 2011 ($ in millions) 2,000 $ 464 464 1,265 1,265 446 660 660 474 669 669 650 650 1,300 1,300 1,300 500 500 1,000 1,000 396 396 1,168 1,168 347 347 1,719 11 1 28 418 (465) 20 12,620 (463) 12,157 29 (490) 28 10,626 $ $ 10,626 (a) These senior notes are due in July 2013. There is $1 million of discount associated with these notes. (b) The principal amount shown is based on the exchange rate of $1.3193 to 1.00 and $1.2973 to 1.00 as of December 31, 2012 and 2011, respectively. See Note 9 for information on our related foreign currency derivatives. (c) Issuers are Chesapeake Oilfield Operating, L.L.C. (COO), an indirect wholly owned subsidiary of the Company, and Chesapeake Oilfield Finance, Inc. (COF), a wholly owned subsidiary of COO formed solely to facilitate the offering of the 6.625% Senior Notes due 2019. COF is nominally capitalized and has no operations or revenues. Chesapeake Energy Corporation is the issuer of all other senior notes and the contingent convertible senior notes. (d) The holders of our contingent convertible senior notes may require us to repurchase, in cash, all or a portion of their notes at 100% of the principal amount of the notes on any of four dates that are five, ten, fifteen and twenty years before the maturity date. The notes are convertible, at the holder's option, prior to maturity under certain circumstances into cash and, if applicable, shares of our common stock using a net share settlement process. One such triggering circumstance is when the price of our common stock exceeds a threshold amount during a specified period in a fiscal quarter. Convertibility based on common stock price is measured quarterly. In the fourth quarter of 2012, the price of our common stock was below the threshold level for each series of the contingent convertible senior notes during the specified period and, as a result, the holders do not have the option to convert their notes into cash and common stock in the first quarter of 2013 under this provision. The notes are also convertible, at the holder's option, during specified five-day periods if the trading price of the notes is below certain levels determined by reference to the trading price of our common stock. During 2012, the notes were not 102 3.Non Current Liabilities Chesapeake Energy, 2012 Attached please find balance sheet, income statement, and footnote 3 on Debt from Chesapeake Energy's 2012 annual report. Answer the following questions. Dollar values in the footnote are par amounts; interest rates are coupon rates. Ignore taxes. 1. Calculate the firm's ratio of Long Term Debt, net divided by Total Equity. 2.See the 6.5% senior notes due 2017 (row 5 in footnote 3). The NBV of these bonds is 627 and and 624 at end of year and beginning of year respectively. What is the effective rate on these bonds? Calculation of EOY and BOY NBV: EOY: 463 discount/(12,620 - 2000 1300 new issues) = 4.99% * 660 = 33 discount BOY: 490 discount/(10,626 - 1719 new issue) = 5.5% * 660 = 36 discount = 3.See the 2.75% contingent convertible senior notes due 2035 (row 13 in footnote 3). Assume that without the conversion feature, the coupon and effective rate on these bonds would be 6.5%. Recalculate the ratio in #1 accounting for these bonds' debt vs equity components. 4. Assume that these bonds were repurchased at NBV right before year end 2012 (assume that the year end interest payment had already been made). Recalculate the ratio in #1 assuming conventional GAAP. 5. Assume that these bonds were swapped for common stock at par right before year end 2012 (assume that the year end interest payment had already been made). Recalculate the ratio in #1 assuming conventional GAAP. CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, 2012 2011 ($ in millions) $ $ 287 111 2,245 58 90 153 4 2,948 351 44 2,505 13 139 125 3,177 50,172 14,755 CURRENT ASSETS: Cash and cash equivalents ($1 and $1 attributable to our VIES) Restricted cash Accounts receivable Short-term derivative assets Deferred income tax asset Other current assets Current assets held for sale Total Current Assets PROPERTY AND EQUIPMENT: Natural gas and oil properties, at cost based on full cost accounting: Evaluated natural gas and oil properties ($488 and $498 attributable to our VIES) Unevaluated properties Natural gas gathering systems and treating plants Oilfield services equipment Other property and equipment Total Property and Equipment, at Cost Less: accumulated depreciation, depletion and amortization (($58) and ($6) attributable to our VIES) Property and equipment held for sale, net Total Property and Equipment, Net LONG-TERM ASSETS: Investments Long-term derivative assets Other long-term assets TOTAL ASSETS 41,723 16,685 1,455 1,632 3,555 65,050 2,130 3,778 70,835 (28,290) (34,302) 634 37,167 36,760 1,531 728 2 766 41,611 leal 367 41,835 $ $ $ $ 3,311 191 183 1,710 105 226 463 3,741 21 6,266 3,397 7,082 12,157 2,807 934 375 1,176 17,449 10,626 3,484 1,541 323 818 16,792 CURRENT LIABILITIES: Accounts payable Short-term derivative liabilities ($4 and $9 attributable to our VIES) Accrued interest Current maturities of long-term debt, net Other current liabilities ($21 and $23 attributable to our VIES) Current liabilities held for sale Total Current Liabilities LONG-TERM LIABILITIES: Long-term debt, net Deferred income tax liabilities Long-term derivative liabilities ($3 and $10 attributable to our VIES) Asset retirement obligations Other long-term liabilities Total Long-Term Liabilities CONTINGENCIES AND COMMITMENTS (Note 4) EQUITY: Chesapeake Stockholders' Equity: Preferred stock, $0.01 par value, 20,000,000 shares authorized: 7,251,515 shares outstanding Common stock, $0.01 par value, 1,000,000,000 shares authorized: 666,467,664 and 660,888,159 shares issued Paid-in capital Retained earnings Accumulated other comprehensive income (loss) Less: treasury stock, at cost; 2,147,724 and 1,552,533 common shares Total Chesapeake Stockholders' Equity Noncontrolling interests Total Equity TOTAL LIABILITIES AND EQUITY 3,062 3,062 7 12,293 437 (182) (48) 15,569 2,327 17,896 41,611 $ 7 12,146 1,608 (166) (33) 16,624 1,337 17,961 41,835 $ CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended December 31, 2012 2011 2010 ($ in millions, except per share data) $ $ 6,278 5,431 607 12,316 6,024 5,090 521 11,635 $ 5,647 3,479 240 9,366 1,073 192 4,967 402 1,304 188 5,312 465 535 2,507 304 3,315 (267) 340 7 14,010 (1,694) 893 157 3,352 208 453 1,394 220 REVENUES: Natural gas, oil and NGL Marketing, gathering and compression Oilfield services Total Revenues OPERATING EXPENSES: Natural gas, oil and NGL production Production taxes Marketing, gathering and compression Oilfield services General and administrative Natural gas, oil and NGL depreciation, depletion and amortization Depreciation and amortization of other assets ..... Impairment of natural gas and oil properties Net gains on sales of fixed assets Impairments of fixed assets and other Employee retirement and other termination benefits. Total Operating Expenses INCOME (LOSS) FROM OPERATIONS OTHER INCOME (EXPENSE): Interest expense Earnings (losses) on investments Gains on sales of investments Losses on purchases or exchanges of debt. Impairments of investments Other income Total Other Income (Expense). INCOME (LOSS) BEFORE INCOME TAXES 548 1,632 291 (437) 46 (137) 21 8,714 2,921 6,561 2,805 (44) 156 (19) 227 (77) (103) 1,092 (200) (176) 8 720 (974) 23 (41) 2,880 (129) (16) 16 79 2,884 1 1,110 1,110 1,774 INCOME TAX EXPENSE (BENEFIT): Current income taxes Deferred income taxes Total Income Tax Expense (Benefit) NET INCOME (LOSS). Net income attributable to noncontrolling interests NET INCOME (LOSS) ATTRIBUTABLE TO CHESAPEAKE Preferred stock dividends NET INCOME (LOSS) AVAILABLE TO COMMON STOCKHOLDERS EARNINGS (LOSS) PER COMMON SHARE: Basic Diluted CASH DIVIDEND DECLARED PER COMMON SHARE WEIGHTED AVERAGE COMMON AND COMMON EQUIVALENT SHARES OUTSTANDING (in millions): Basic Diluted 47 (427) (380) (594) (175) (769) (171) (940) $ 13 1,110 1,123 1,757 (15) 1,742 (172) 1,570 1,774 (111) 1,663 $ $ $ $ $ (1.46) $ 2.47 (1.46) $ 2.32 0.35 $ 0.3375 $$ $ 2.63 2.51 0.30 $ 643 643 637 752 631 706 CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 3. Debt Our long-term debt consisted of the following as of December 31, 2012 and 2011: $ 454 474 Term loan due 2017 7.625% senior notes due 2013(a) 9.5% senior notes due 2015 6.25% euro-denominated senior notes due 2017(b) 6.5% senior notes due 2017. 6.875% senior notes due 2018 7.25% senior notes due 2018 6.625% senior notes due 2019) 6.775% senior notes due 2019 6.625% senior notes due 2020 6.875% senior notes due 2020 6.125% senior notes due 2021 2.75% contingent convertible senior notes due 2035(d) 2.5% contingent convertible senior notes due 2037() 2.25% contingent convertible senior notes due 2038(4) Corporate revolving bank credit facility Midstream revolving bank credit facility Oilfield services revolving bank credit facility Discount on senior notes and term loanse) Interest rate derivatives Total debt, net ...... Less current maturities of long-term debt, net(a) Total long-term debt, net.. December 31, 2012 2011 ($ in millions) 2,000 $ 464 464 1,265 1,265 446 660 660 474 669 669 650 650 1,300 1,300 1,300 500 500 1,000 1,000 396 396 1,168 1,168 347 347 1,719 11 1 28 418 (465) 20 12,620 (463) 12,157 29 (490) 28 10,626 $ $ 10,626 (a) These senior notes are due in July 2013. There is $1 million of discount associated with these notes. (b) The principal amount shown is based on the exchange rate of $1.3193 to 1.00 and $1.2973 to 1.00 as of December 31, 2012 and 2011, respectively. See Note 9 for information on our related foreign currency derivatives. (c) Issuers are Chesapeake Oilfield Operating, L.L.C. (COO), an indirect wholly owned subsidiary of the Company, and Chesapeake Oilfield Finance, Inc. (COF), a wholly owned subsidiary of COO formed solely to facilitate the offering of the 6.625% Senior Notes due 2019. COF is nominally capitalized and has no operations or revenues. Chesapeake Energy Corporation is the issuer of all other senior notes and the contingent convertible senior notes. (d) The holders of our contingent convertible senior notes may require us to repurchase, in cash, all or a portion of their notes at 100% of the principal amount of the notes on any of four dates that are five, ten, fifteen and twenty years before the maturity date. The notes are convertible, at the holder's option, prior to maturity under certain circumstances into cash and, if applicable, shares of our common stock using a net share settlement process. One such triggering circumstance is when the price of our common stock exceeds a threshold amount during a specified period in a fiscal quarter. Convertibility based on common stock price is measured quarterly. In the fourth quarter of 2012, the price of our common stock was below the threshold level for each series of the contingent convertible senior notes during the specified period and, as a result, the holders do not have the option to convert their notes into cash and common stock in the first quarter of 2013 under this provision. The notes are also convertible, at the holder's option, during specified five-day periods if the trading price of the notes is below certain levels determined by reference to the trading price of our common stock. During 2012, the notes were not 102

Step by Step Solution

There are 3 Steps involved in it

To solve the questions stepbystep based on Chesapeake Energys 2012 financial statements lets tackle ... View full answer

Get step-by-step solutions from verified subject matter experts