Question: please find a depreciation . Project 010 esu Share Comment Formulas Data Review SeDrawPage Layout Conditional Formatting F Format as Table Da Coll Styles Cells

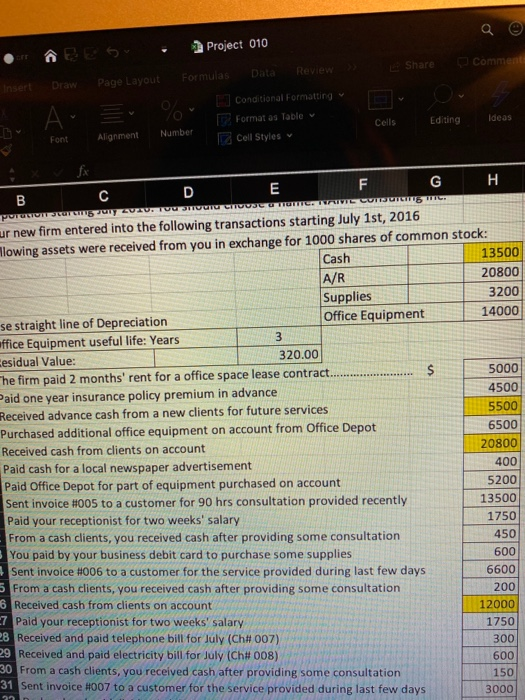

. Project 010 esu Share Comment Formulas Data Review SeDrawPage Layout Conditional Formatting F Format as Table Da Coll Styles Cells Editing Ideas Font Alignment Number F G " ur new firm entered into the following transactions starting July 1st, 2016 Mowing assets were received from you in exchange for 1000 shares of common stock: Cash 13500 A/R 20800 Supplies 3200 Office Equipment 14000 se straight line of Depreciation office Equipment useful life: Years Cesidual Value: 320.00 5000 he firm paid 2 months' rent for a office space lease contract... 4500 Paid one year insurance policy premium in advance 5500 Received advance cash from a new clients for future services Purchased additional office equipment on account from Office Depot 6500 Received cash from clients on account 20800 Paid cash for a local newspaper advertisement 400 Paid Office Depot for part of equipment purchased on account 5200 Sent invoice #005 to a customer for 90 hrs consultation provided recently 13500 Paid your receptionist for two weeks' salary 1750 From a cash clients, you received cash after providing some consultation 450 You paid by your business debit card to purchase some supplies 600 Sent invoice #006 to a customer for the service provided during last few days 6600 5 From a cash clients, you received cash after providing some consultation 200 16 Received cash from clients on account 12000 27 Paid your receptionist for two weeks' salary 1750 28 Received and paid telephone bill for July (Ch# 007) 300 29 Received and paid electricity bill for July (Ch#008) 600 30 From a cash clients, you received cash after providing some consultation 150 31 Sent invoice #007 to a customer for the service provided during last few days 3000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts