Question: Please find the answer to the yellow cells only. (include excel function next to final answer) B D E TASTY FOODS CORPORATION (PARTI) Capital Budgeting

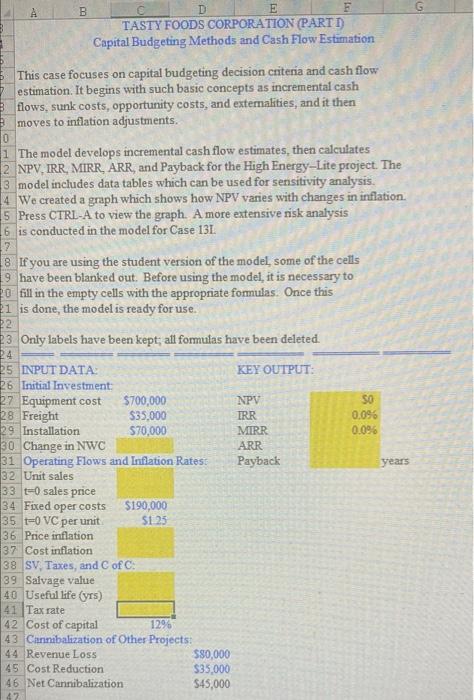

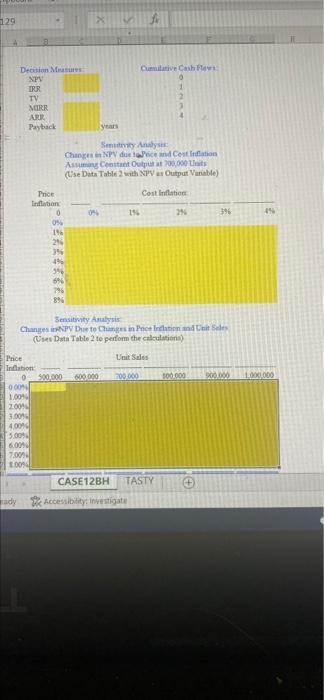

B D E TASTY FOODS CORPORATION (PARTI) Capital Budgeting Methods and Cash Flow Estimation This case focuses on capital budgeting decision criteria and cash flow estimation. It begins with such basic concepts as incremental cash flows, sunk costs, opportunity costs, and externalities, and it then moves to inflation adjustments. 10 1 The model develops incremental cash flow estimates, then calculates 2 NPV, IRR, MIRR, ARR, and Payback for the High Energy-Lite project. The 3 model includes data tables which can be used for sensitivity analysis. 4 We created a graph which shows how NPV varies with changes in inflation. 5 Press CTRL-A to view the graph. A more extensive risk analysis 6 is conducted in the model for Case 131 18. If you are using the student version of the model, some of the cells 9 have been blanked out. Before using the model, it is necessary to 20 fill in the empty cells with the appropriate formulas. Once this 1 is done, the model is ready for use. 22 23 Only labels have been kept all formulas have been deleted. 24 25 INPUT DATA KEY OUTPUT: 26 Initial Investment 27 Equipment cost $700,000 NPV SO 28 Freight $35,000 IRR 0.096 29 Installation $70,000 MIRR 0.09 30 Change in NWC ARR 31 Operating Flows and Inflation Rates Payback years 32 Unit sales 33 t=0 sales price 34 Fixed oper costs $190,000 35 t0 VC per unit $123 36 Price inflation 37 Cost inflation 38 SV, Taxes, and C of C. 39 Salvage value 40 Useful life (yrs) 41 Tax rate 42 Cost of capital 1296 43 Cannibalization of Other Projects 44 Revenue Loss $80,000 45 Cost Reduction $35,000 46 Net Cannibalization $45,000 47 129 CumilivCash Decision Mass NPU TRR TV MRR ARE Payback 4 years Sendy Analyser Change NPV duce and Cestation ACO 700,000 Uits (Use Data Table2with NPV Output Viable) Cost Inflation Price Inflation 0 15. 396 45 196 24 396 696 1996 894 1.000.000 Sensitivity Analysis Changes PV Due to Change in Phoenite (Us Data Table 2 te perform the calentations) Price Unit Sades Inflation 0 500.000 600.000 209.000 300.000 0001 1.001 2009 3.00 4.0014 5.00 6.001 7.00 100% CASE12BH TASTY rady accessibility Investigate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts