Question: Please find the below attached question and give the answer properly. 10. The directors of Kingston & Co. were concerned about the company's cash flow.

Please find the below attached question and give the answer properly.

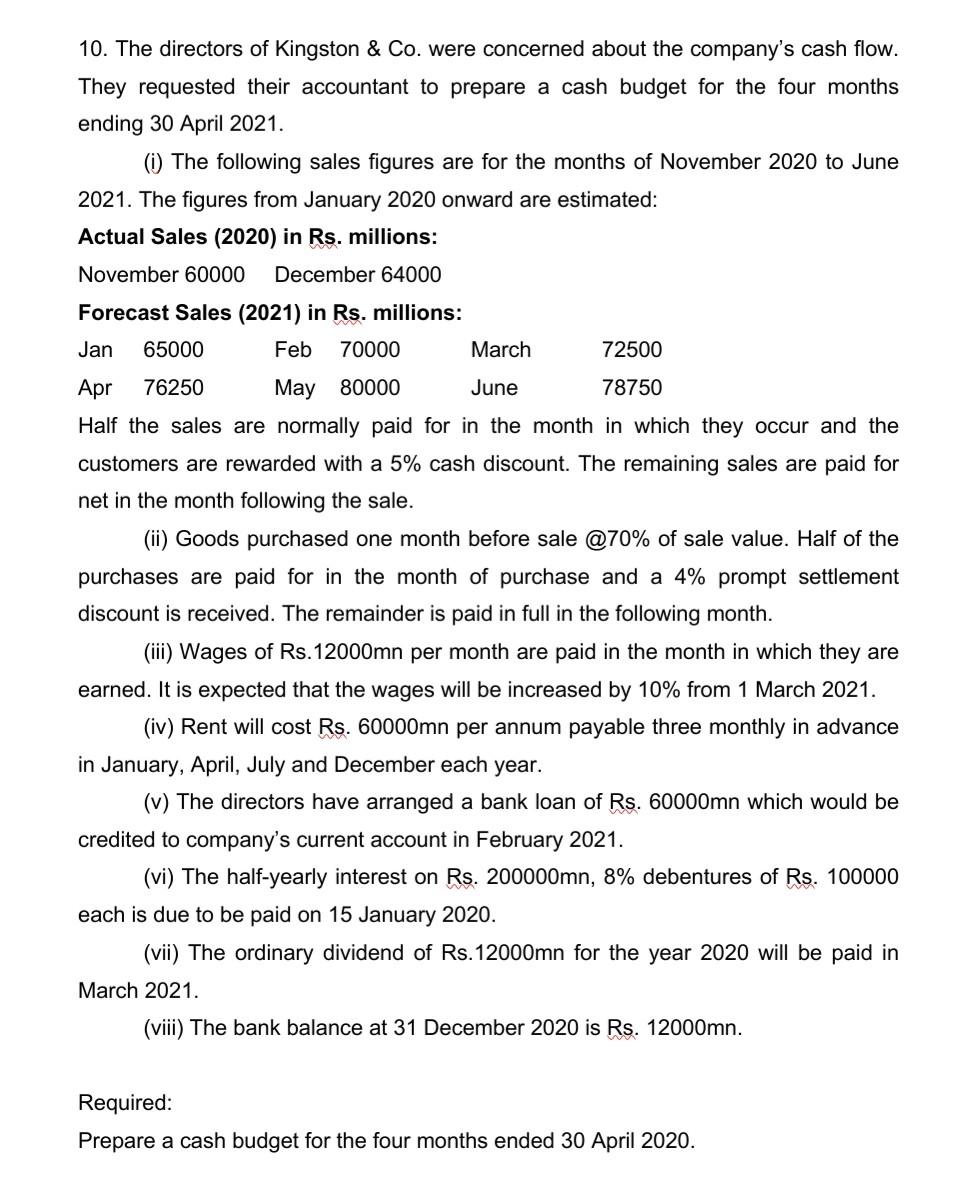

10. The directors of Kingston & Co. were concerned about the company's cash flow. They requested their accountant to prepare a cash budget for the four months ending 30 April 2021. (i) The following sales figures are for the months of November 2020 to June 2021. The figures from January 2020 onward are estimated: Actual Sales (2020) in Rs. millions: November 60000 December 64000 Forecast Sales (2021) in Rs. millions: Jan 65000 Feb 70000 March 72500 Apr 76250 May 80000 June 78750 Half the sales are normally paid for in the month in which they occur and the customers are rewarded with a 5% cash discount. The remaining sales are paid for net in the month following the sale. (ii) Goods purchased one month before sale @70% of sale value. Half of the purchases are paid for in the month of purchase and a 4% prompt settlement discount is received. The remainder is paid in full in the following month. (iii) Wages of Rs. 12000mn per month are paid in the month in which they are earned. It is expected that the wages will be increased by 10% from 1 March 2021. (iv) Rent will cost Rs. 60000mn per annum payable three monthly in advance in January, April, July and December each year. (v) The directors have arranged a bank loan of Rs. 60000mn which would be credited to company's current account in February 2021. (vi) The half-yearly interest on Rs. 200000mn, 8% debentures of Rs. 100000 each is due to be paid on 15 January 2020. (vii) The ordinary dividend of Rs. 12000mn for the year 2020 will be paid in March 2021. (viii) The bank balance at 31 December 2020 is Rs. 12000mn. Required: Prepare a cash budget for the four months ended 30 April 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts