Question: please find the solution ASAP Question 1 Tel Tech, a software company reported revenues 2 million and net income of 300,000 for the latest year.

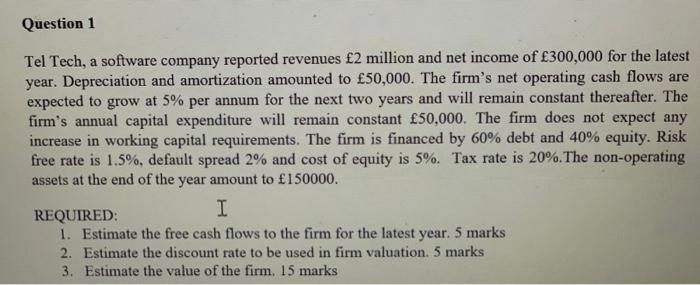

Question 1 Tel Tech, a software company reported revenues 2 million and net income of 300,000 for the latest year. Depreciation and amortization amounted to 50,000. The firm's net operating cash flows are expected to grow at 5% per annum for the next two years and will remain constant thereafter. The firm's annual capital expenditure will remain constant 50,000. The firm does not expect any increase in working capital requirements. The firm is financed by 60% debt and 40% equity. Risk free rate is 1.5%, default spread 2% and cost of equity is 5%. Tax rate is 20%. The non-operating assets at the end of the year amount to 150000. REQUIRED: I 1. Estimate the free cash flows to the firm for the latest year. 5 marks 2. Estimate the discount rate to be used in firm valuation. 5 marks 3. Estimate the value of the firm. 15 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts