Question: please find the solution ASAP Question 3 I Mediclinic plc is considering upgrading its laboratory equipment. The existing machines currently generate an annual cash flow

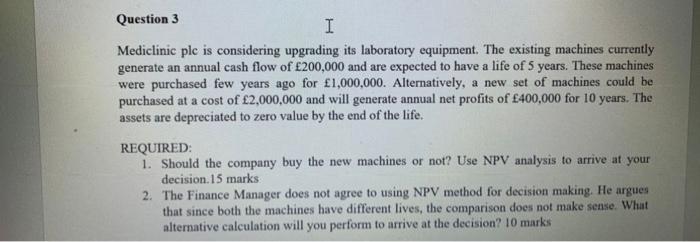

Question 3 I Mediclinic plc is considering upgrading its laboratory equipment. The existing machines currently generate an annual cash flow of 200,000 and are expected to have a life of 5 years. These machines were purchased few years ago for 1,000,000. Alternatively, a new set of machines could be purchased at a cost of 2,000,000 and will generate annual net profits of 400,000 for 10 years. The assets are depreciated to zero value by the end of the life. REQUIRED: 1. Should the company buy the new machines or not? Use NPV analysis to arrive at your decision. 15 marks 2. The Finance Manager does not agree to using NPV method for decision making. He argues that since both the machines have different lives, the comparison does not make sense. What alternative calculation will you perform to arrive at the decision? 10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts