Question: Please finish off c) on the third image. *Exercise 9-? (Part Level Submission) On December 31, 2016, Monty Corp. provided you with the following pre-adjustment

Please finish off c) on the third image.

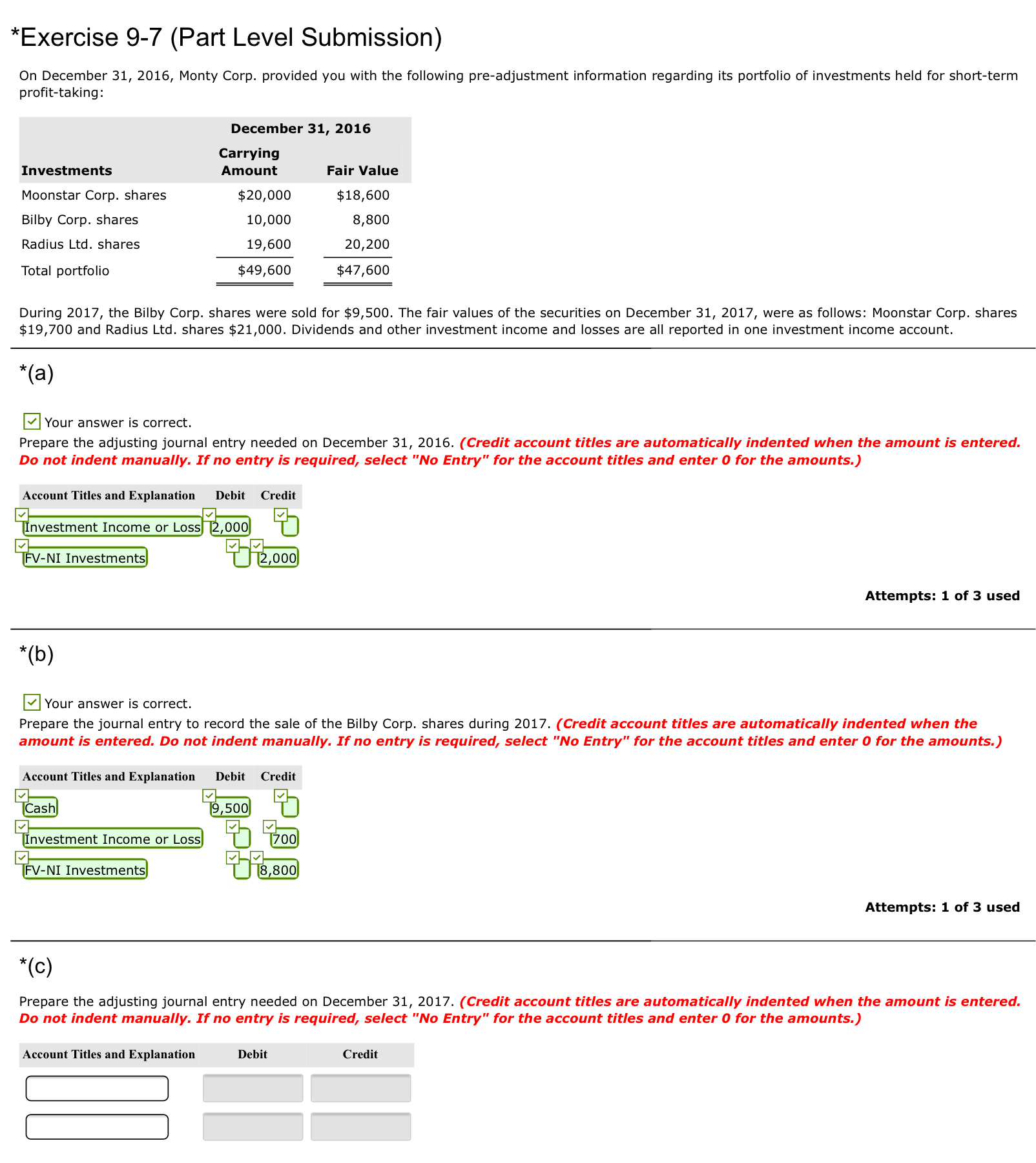

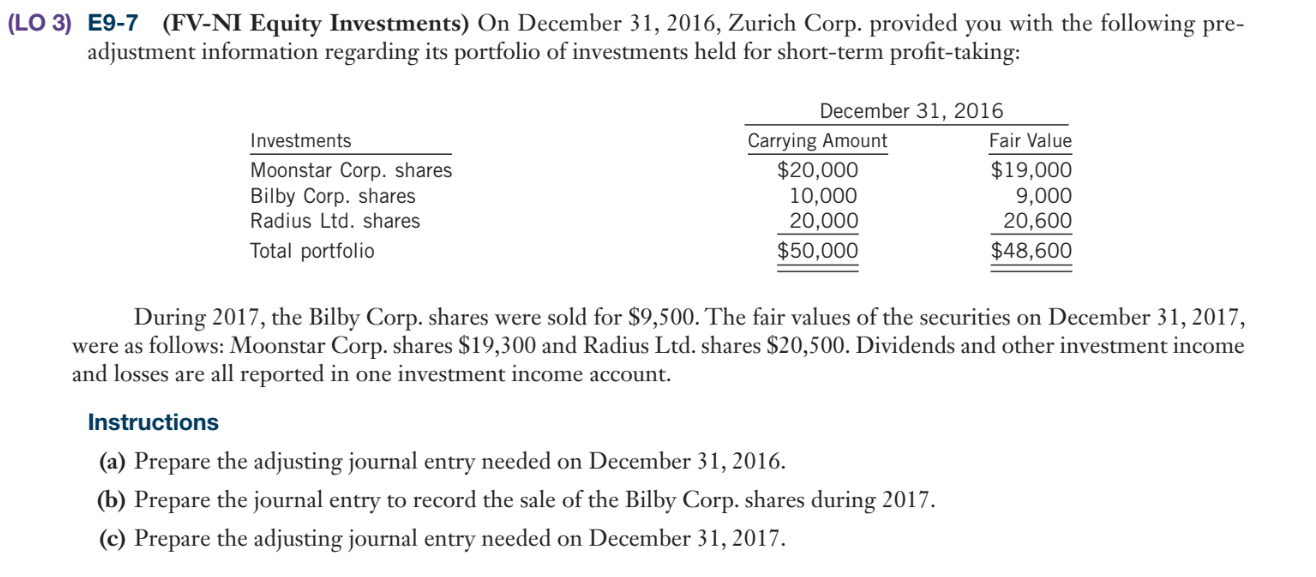

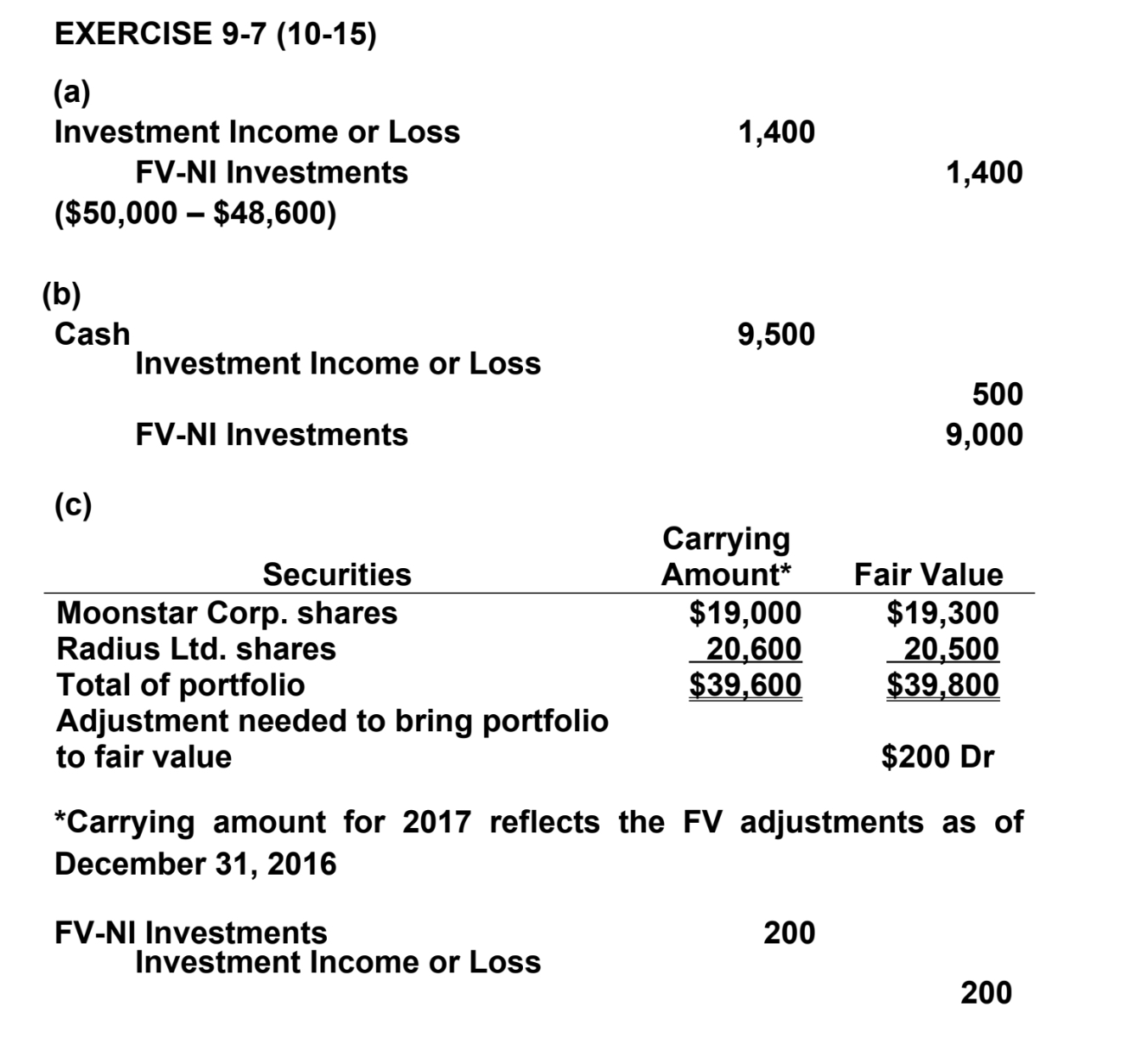

*Exercise 9-? (Part Level Submission) On December 31, 2016, Monty Corp. provided you with the following pre-adjustment information regarding its portfolio of investments held for short-term profit-ta king: December 31, 2016 Carrying Investments Amount Fair Value Moonstar Corp. shares $20,000 $18,600 Bilby Corp. shares 10,000 8,800 Radius Ltd. shares 19,600 20,200 Total portfolio m m During 2017, the Bilby Corp. shares were sold for $9,500. The fair values of the securities on December 31, 2017, were as follows: Moonstar Corp. shares $19,700 and Radius Ltd. shares $21,000. Dividends and other investment income and losses are all reported in one investment income account. *(3) Your answer is correct. Prepare the adjusting journal entry needed on December 31, 2016. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit nvestment Income or Loss [m I -NI Investments I m Attempts: 1 of 3 used *(b) Your answer is correct. Prepare the journal entry to record the sale of the Bilby Corp. shares during 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Cash Investment Income or Loss FV-NI Investments Attempts: 1 of 3 used *(C) Prepare the adjusting journal entry needed on December 31, 2017. ( Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit :1 [:1 (LO 3) E9-7 (FV-NI Equity Investments) On December 31, 2016, Zurich Corp. provided you with the following pre- adjustment information regarding its portfolio of investments held for short-term profit-taking: December 31, 2016 Investments Carrying Amount Fair Value Moonstar Corp. shares $20,000 $19,000 Bilby Corp. shares 10,000 9,000 Radius Ltd. shares 20,000 20,600 Total portfolio $50,000 $48,600 During 2017, the Bilby Corp. shares were sold for $9,500. The fair values of the securities on December 31, 2017, were as follows: Moonstar Corp. shares $19,300 and Radius Ltd. shares $20,500. Dividends and other investment income and losses are all reported in one investment income account. Instructions (a) Prepare the adjusting journal entry needed on December 31, 2016. (b) Prepare the journal entry to record the sale of the Bilby Corp. shares during 2017. (c) Prepare the adjusting journal entry needed on December 31, 2017.EXERCISE 9-7 (10-15) (a) Investment Income or Loss 1,400 FV-NI Investments 1,400 ($50,000 - $48,600) (b) Cash 9,500 Investment Income or Loss 500 FV-NI Investments 9,000 (c) Carrying Securities Amount* Fair Value Moonstar Corp. shares $19,000 $19,300 Radius Ltd. shares 20,600 20,500 Total of portfolio $39,600 $39,800 Adjustment needed to bring portfolio to fair value $200 Dr *Carrying amount for 2017 reflects the FV adjustments as of December 31, 2016 FV-NI Investments 200 Investment Income or Loss 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts