Question: *** Please finish Req A2 and B *** The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash S

*** Please finish Req A2 and B ***

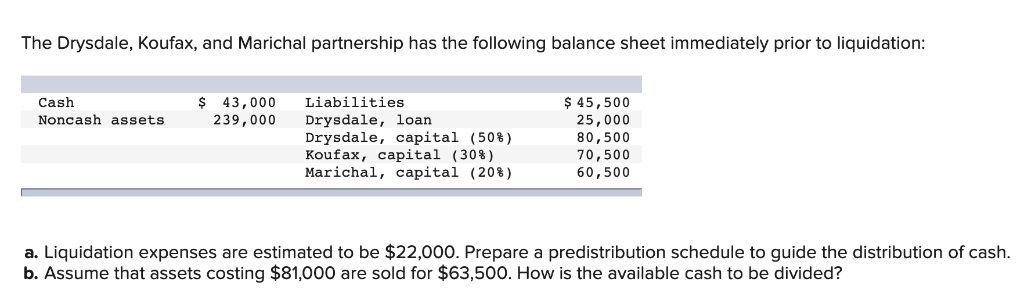

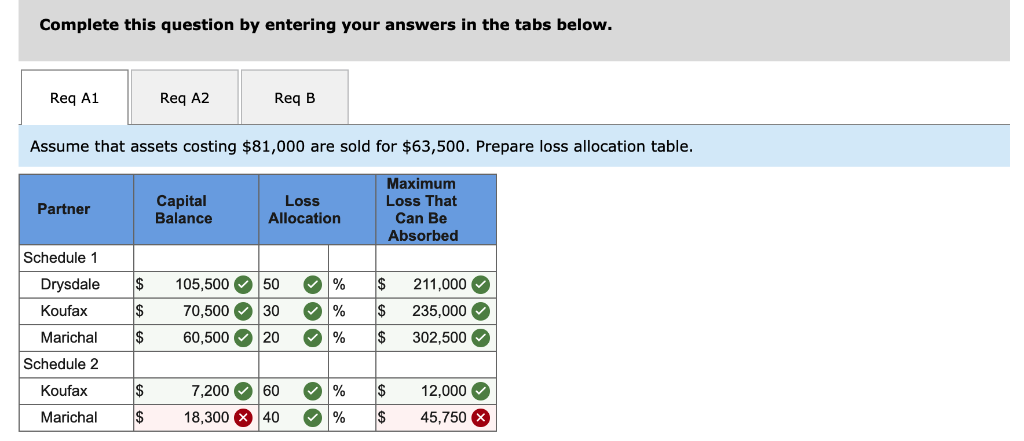

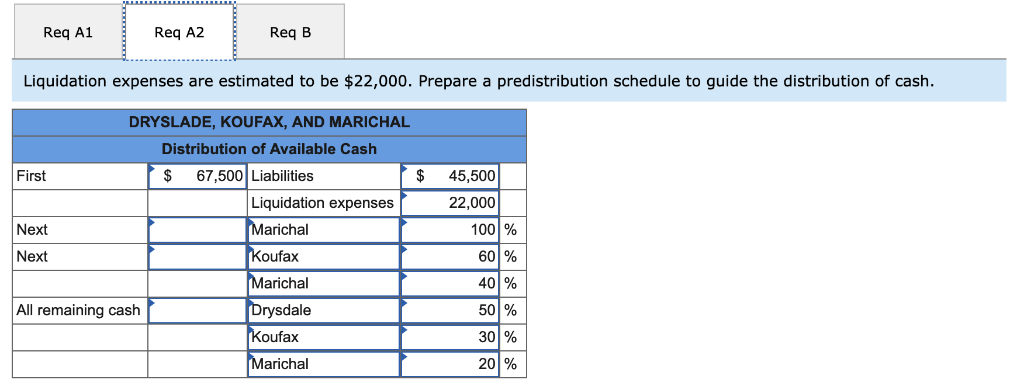

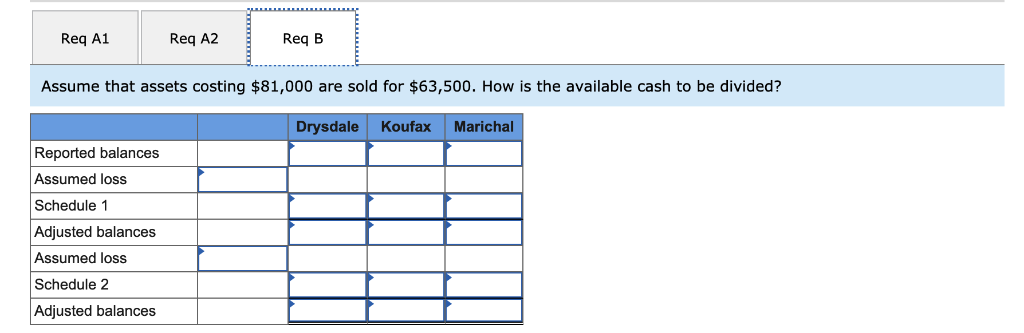

The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash S 43,000 239,000 Liabilities $ 45,500 25,000 80,500 70,500 60,500 Drysdale, loan Drysdale, capital (508) Koufax, capital (30%) Marichal, capital (20%) Noncash assets a. Liquidation expenses are estimated to be $22,000. Prepare a predistribution schedule to guide the distribution of cash b. Assume that assets costing $81,000 are sold for $63,500. How is the available cash to be divided? Complete this question by entering your answers in the tabs below. Req A2 Req A1 Req B Assume that assets costing $81,000 are sold for $63,500. Prepare loss allocation table. Maximum Loss That Can Be Absorbed Capital Balance Loss Partner Allocation Schedule 1 % 105,500 50 211,000 Drysdale 70,500 30 % Koufax 235,000 60,500 20 % $ Marichal $ 302,500 Schedule 2 % $ 7,200 60 $ Koufax 12,000 18,300 40 % $ 45,750 Marichal Req A1 Req A2 Req B Liquidation expenses are estimated to be $22,000. Prepare a predistribution schedule to guide the distribution of cash DRYSLADE, KOUFAX, AND MARICHAL Distribution of Available Cash 67,500 Liabilities S First 45,500 Liquidation expenses 22,000 Marichal Next 100 % Next Koufax 60 % Marichal 40 % Drysdale 50 % All remaining cash Koufax 30 % Marichal 20% Req A2 Req B Req A1 Assume that assets costing $81,000 are sold for $63,500. How is the available cash to be divided? Drysdale Koufax Marichal Reported balances Assumed loss Schedule 1 Adjusted balances Assumed loss Schedule 2 Adjusted balances The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash S 43,000 239,000 Liabilities $ 45,500 25,000 80,500 70,500 60,500 Drysdale, loan Drysdale, capital (508) Koufax, capital (30%) Marichal, capital (20%) Noncash assets a. Liquidation expenses are estimated to be $22,000. Prepare a predistribution schedule to guide the distribution of cash b. Assume that assets costing $81,000 are sold for $63,500. How is the available cash to be divided? Complete this question by entering your answers in the tabs below. Req A2 Req A1 Req B Assume that assets costing $81,000 are sold for $63,500. Prepare loss allocation table. Maximum Loss That Can Be Absorbed Capital Balance Loss Partner Allocation Schedule 1 % 105,500 50 211,000 Drysdale 70,500 30 % Koufax 235,000 60,500 20 % $ Marichal $ 302,500 Schedule 2 % $ 7,200 60 $ Koufax 12,000 18,300 40 % $ 45,750 Marichal Req A1 Req A2 Req B Liquidation expenses are estimated to be $22,000. Prepare a predistribution schedule to guide the distribution of cash DRYSLADE, KOUFAX, AND MARICHAL Distribution of Available Cash 67,500 Liabilities S First 45,500 Liquidation expenses 22,000 Marichal Next 100 % Next Koufax 60 % Marichal 40 % Drysdale 50 % All remaining cash Koufax 30 % Marichal 20% Req A2 Req B Req A1 Assume that assets costing $81,000 are sold for $63,500. How is the available cash to be divided? Drysdale Koufax Marichal Reported balances Assumed loss Schedule 1 Adjusted balances Assumed loss Schedule 2 Adjusted balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts