Question: Please finish solving 6.719 ces Check my work Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical

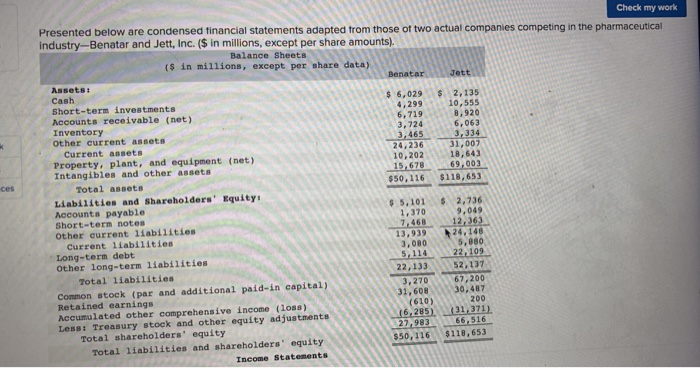

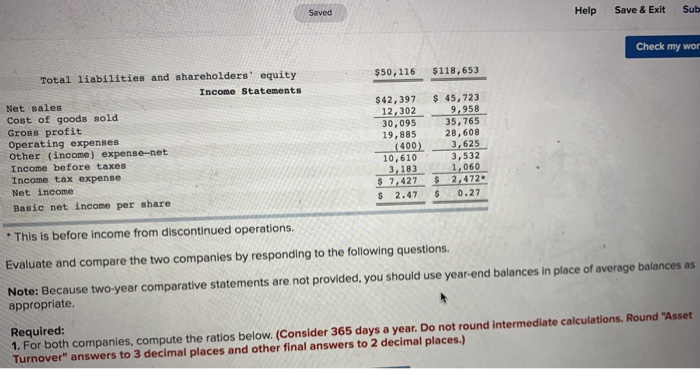

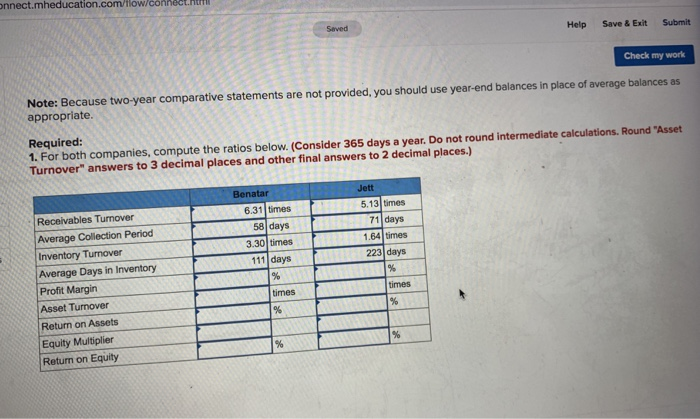

6.719 ces Check my work Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical Industry-Benatar and Jett, Inc. ($ in millions, except per share amounts). Balance Sheets ($ in millions, except per share data) Benatar Jett Assets: Cash $ 6,029 $ 2,135 Short-term investments 4.299 10.555 Accounts receivable (net) 8.920 Inventory 3,724 6,063 Other current assets 3,465 3,334 Current assets 24,236 31,007 Property, plant, and equipment (net) 10,202 18.643 Intangibles and other assets 15,678 Total assets $50, 116 $118,653 Liabilities and shareholders' Equity $ 5,101 $ Accounts payable 2.236 Short-term notes 1.370 9.049 Other current liabilities 7.468 12.36) Current liabilities 13,39 24,148 3.000 5.880 Long-term debt 5,114 22. 109 Other long-term liabilities 22,13352,137 Total liabilities 3,27067,200 Common stock (par and additional paid-in capita Retained earnings 31,60830,487 (610) Accumulated other comprehensive income (los) 16.285) 31,371). Less: Treasury stock and other equity adjustments 27,983 66,516 Total shareholders' equity 550, 116 $118,653 Total liabilities and shareholders' equity Income Statements 200 Saved Help Save & Exit Sub Check my wor $50,116 $118,653 Total liabilities and shareholders' equity Income Statements Net sales Cost of goods sold Gross profit Operating expenses Other (income) expense-net Income before taxes Income tax expense Net income Basic net income per share $42,397 $ 45,723 12,302 9,958 30,095 35,765 19,885 28,608 (400) 3,625 10,610 3.1831 ,060 $ 7,427 $ 2,472 $ 2.47 $ 0.27 3,532 * This is before income from discontinued operations. Evaluate and compare the two companies by responding to the following questions. Note: Because two-year comparative statements are not provided, you should use year-end balances in place of average balances as appropriate. Required: 1. For both companies, compute the ratios below. (Consider 365 days a year. Do not round intermediate calculations. Round "Asset Turnover" answers to 3 decimal places and other final answers to 2 decimal places.) Seved Help Save & Exit Submit Check my work Note: Because two-year comparative statements are not provided, you should use year-end balances in place of average balances as appropriate. Required: 1. For both companies, compute the ratios below. (Consider 365 days a year. Do not round intermediate calculations. Round "Asset Turnover" answers to 3 decimal places and other final answers to 2 decimal places.) Jett Benatar 6.31 times 58 days 3.30 times 111 days 5.13 times days 1.64 times 223 days Receivables Turnover Average Collection Period Inventory Turnover Average Days in Inventory Profit Margin Asset Turnover Return on Assets Equity Multiplier Return on Equity times times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts