Question: please finish the chart and answer what isnt done 7. Based on your answers for questions 5 and 6, select which financial institution's mortgage rate

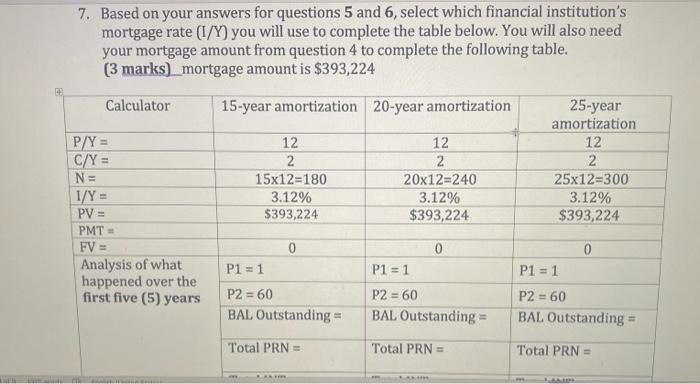

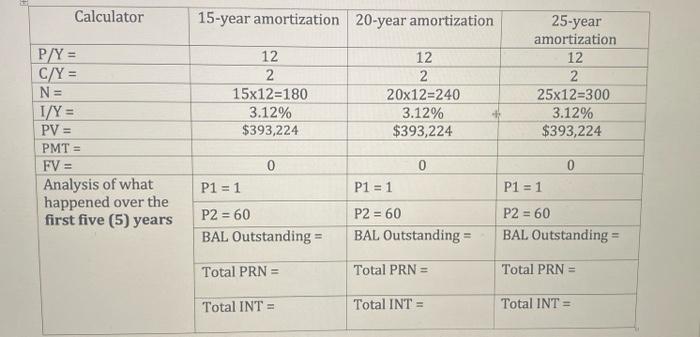

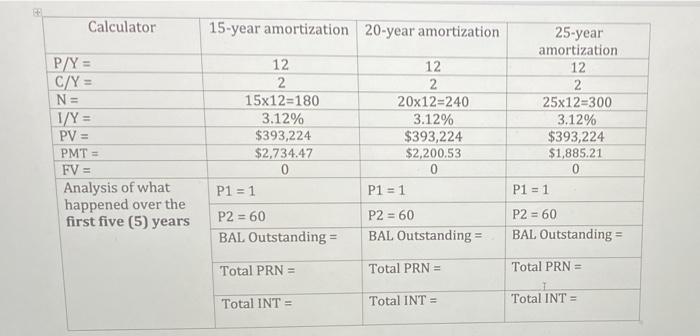

7. Based on your answers for questions 5 and 6, select which financial institution's mortgage rate I/Y) you will use to complete the table below. You will also need your mortgage amount from question 4 to complete the following table, (3 marks) mortgage amount is $393,224 Calculator 15-year amortization 20-year amortization P/Y = C/Y= N= 1/Y= PV = PMT - FV = Analysis of what happened over the first five (5) years 12 2 15x12=180 3.12% $393,224 12 2 20x12=240 3.12% $393,224 25-year amortization 12 2 25x12=300 3.12% $393,224 0 P1 = 1 0 P1 = 1 P2 = 60 BAL Outstanding = 0 P1 = 1 P2 = 60 BAL Outstanding P2 = 60 BAL Outstanding = Total PRN = Total PRN = Total PRN = Calculator 15-year amortization 20-year amortization 12 2 15x12=180 3.12% $393,224 P/Y= C/Y = N= I/Y = PV = PMT = FV = Analysis of what happened over the first five (5) years 12 2 20x12=240 3.12% $393,224 25-year amortization 12 2 25x12=300 3.12% $393,224 . 0 P1 = 1 0 P1 = 1 P2 = 60 BAL Outstanding = 0 P1 = 1 P2 = 60 BAL Outstanding = P2 = 60 BAL Outstanding = Total PRN = Total PRN = Total PRN = Total INT = Total INT = Total INT = Calculator 15-year amortization 20-year amortization P/Y = C/Y = N= 1/Y = PV = PMT= FV = Analysis of what happened over the first five (5) years 12 2 15x12=180 3.12% $393,224 $2,734.47 0 P1 = 1 12 2 20x12=240 3.12% $393,224 $2,200.53 0 P1 = 1 25-year amortization 12 2 25x12=300 3.12% $393,224 $1,885.21 P1 = 1 P2 = 60 BAL Outstanding = P2 = 60 BAL Outstanding = P2 = 60 BAL Outstanding = Total PRN = Total PRN = Total PRN = Total INT = Total INT = Total INT = 7. Based on your answers for questions 5 and 6, select which financial institution's mortgage rate I/Y) you will use to complete the table below. You will also need your mortgage amount from question 4 to complete the following table, (3 marks) mortgage amount is $393,224 Calculator 15-year amortization 20-year amortization P/Y = C/Y= N= 1/Y= PV = PMT - FV = Analysis of what happened over the first five (5) years 12 2 15x12=180 3.12% $393,224 12 2 20x12=240 3.12% $393,224 25-year amortization 12 2 25x12=300 3.12% $393,224 0 P1 = 1 0 P1 = 1 P2 = 60 BAL Outstanding = 0 P1 = 1 P2 = 60 BAL Outstanding P2 = 60 BAL Outstanding = Total PRN = Total PRN = Total PRN = Calculator 15-year amortization 20-year amortization 12 2 15x12=180 3.12% $393,224 P/Y= C/Y = N= I/Y = PV = PMT = FV = Analysis of what happened over the first five (5) years 12 2 20x12=240 3.12% $393,224 25-year amortization 12 2 25x12=300 3.12% $393,224 . 0 P1 = 1 0 P1 = 1 P2 = 60 BAL Outstanding = 0 P1 = 1 P2 = 60 BAL Outstanding = P2 = 60 BAL Outstanding = Total PRN = Total PRN = Total PRN = Total INT = Total INT = Total INT = Calculator 15-year amortization 20-year amortization P/Y = C/Y = N= 1/Y = PV = PMT= FV = Analysis of what happened over the first five (5) years 12 2 15x12=180 3.12% $393,224 $2,734.47 0 P1 = 1 12 2 20x12=240 3.12% $393,224 $2,200.53 0 P1 = 1 25-year amortization 12 2 25x12=300 3.12% $393,224 $1,885.21 P1 = 1 P2 = 60 BAL Outstanding = P2 = 60 BAL Outstanding = P2 = 60 BAL Outstanding = Total PRN = Total PRN = Total PRN = Total INT = Total INT = Total INT =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts