Question: Please fix the answer and answer both part a and Part b correctly. Derek Tosh and Yen-Dollar Parity. Derek Tosh is attempting to determine whether

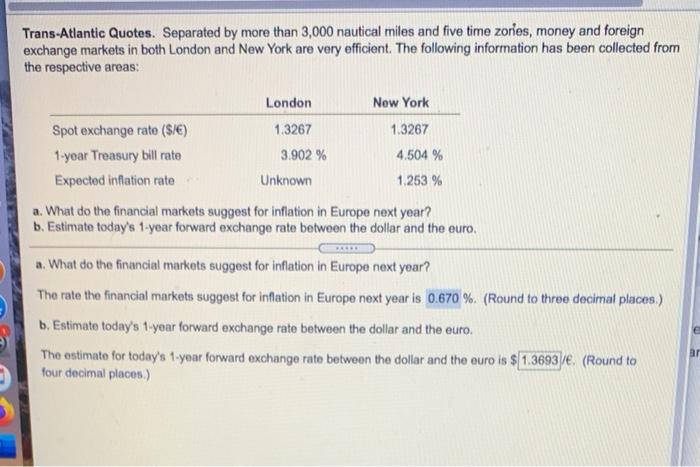

Derek Tosh and Yen-Dollar Parity. Derek Tosh is attempting to determine whether US/Japanese financial conditions are at parity. The current spot rate is a flat 489.00/$, while the 360-day forward rate is 84.90/$. Forecast inflation is 1.097% for Japan, and 5.905% for the US. The 360-day euro-yen deposit rate is 4.703%, and the 360-day euro-dollar deposit rate is 9.497%. a. Calculate whether international parity conditions hold between Japan and the United States. b. Find the forecasted change in the Japanese yen/U.S. dollar (W/$) exchange rate one year from now. a. Calculate whether international parity conditions hold between Japan and the United States. The forecast difference in rates of inflation is 0.1 % (U.S. higher than Japan). (Round to one decimal place.) Trans-Atlantic Quotes. Separated by more than 3,000 nautical miles and five time zories, money and foreign exchange markets in both London and New York are very efficient. The following information has been collected from the respective areas: London New York Spot exchange rate ($/) 1.3267 1.3267 1-year Treasury bill rate 3.902 % 4.504 % Expected inflation rate Unknown 1.253 % a. What do the financial markets suggest for inflation in Europe next year? b. Estimate today's 1-year forward exchange rate between the dollar and the euro a. What do the financial markets suggest for inflation in Europe next year? The rate the financial markets suggest for inflation in Europe next year is 0.670 %. (Round to three decimal places.) b. Estimate today's 1-year forward exchange rate between the collar and the euro. The estimate for today's 1.year forward exchange rate between the dollar and the euro is $ 1.3693/e. (Round to four decimal places.) ar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts