Question: please fix the answer Exercise 16-13 (Algo) Deferred tax asset; income tax payable given; previous balance in valuation allowance [LO16-4] At the end of 2020

![tax payable given; previous balance in valuation allowance [LO16-4] At the end](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67178898b974f_544671788980fa98.jpg)

please fix the answer

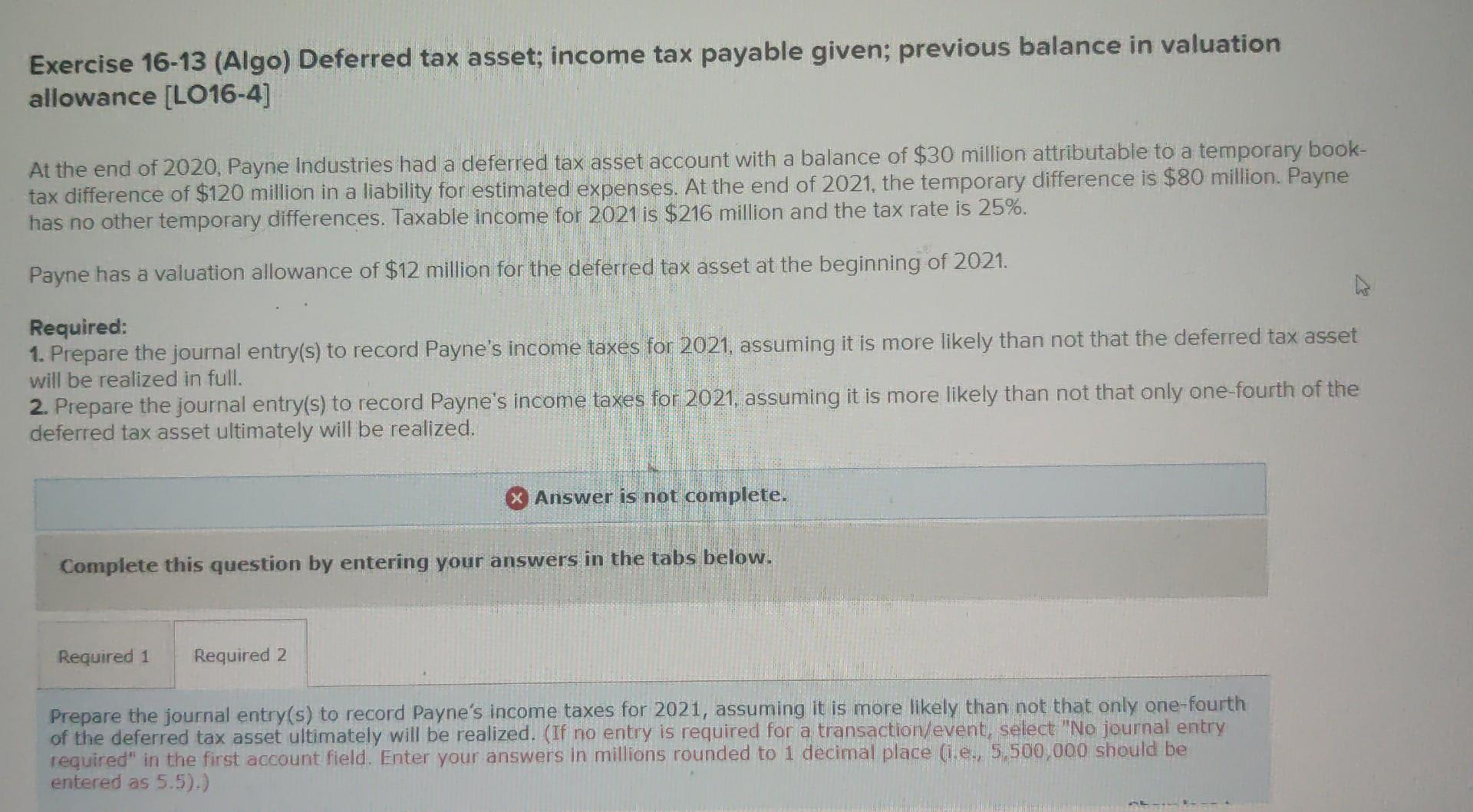

Exercise 16-13 (Algo) Deferred tax asset; income tax payable given; previous balance in valuation allowance [LO16-4] At the end of 2020 , Payne Industries had a deferred tax asset account with a balance of $30 million attributable to a temporary booktax difference of $120 million in a liability for estimated expenses. At the end of 2021 , the temporary difference is $80 million. Payne has no other temporary differences. Taxable income for 2021 is $216 million and the tax rate is 25%. Payne has a valuation allowance of $12 million for the deferred tax asset at the beginning of 2021 . Required: 1. Prepare the journal entry(s) to record Payne's income taxes for 2021 , assuming it is more likely than not that the deferred tax asset will be realized in full. 2. Prepare the journal entry(s) to record Payne's income taxes for 2021 , assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized. x Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the journal entry(s) to record Payne's income taxes for 2021 , assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Prepare the journal entry(s) to record Payne's income taxes for 2021 , assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5)-.) Show legsA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts