Question: Please fix the errors. 1. Prepare journal entries to record each of the following four separate issuances of stock. General Journal: Building Cash Common dividend

Please fix the errors.

1. Prepare journal entries to record each of the following four separate issuances of stock.

General Journal:

- Building

- Cash

- Common dividend payable

- Common stock dividend distributable

- Common stock, $2 par value

- Common stock, $2 stated value

- Common stock, $20 par value

- Common stock, no-par value

- Contributed capital, treasury stock

- Income summary

- Inventory

- Land

- Machinery

- Note payable

- Organization expenses

- Paid-in capital in excess of par value, Common stock

- Paid-in capital in excess of par value, preferred stock

- Paid-in capital in excess of stated value, common stock

- Preferred stock, $0.50 par value

- Preferred stock, $1 stated value

- Preferred stock, $1 stated value

- Preferred stock, $20 par value

- Preferred stock, $25 par value

- Preferred stock, $5 par value

- Preferred stock, no-par value

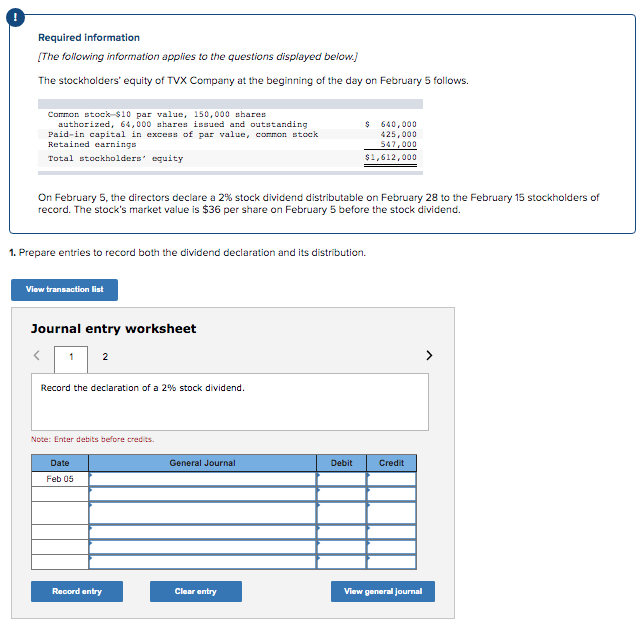

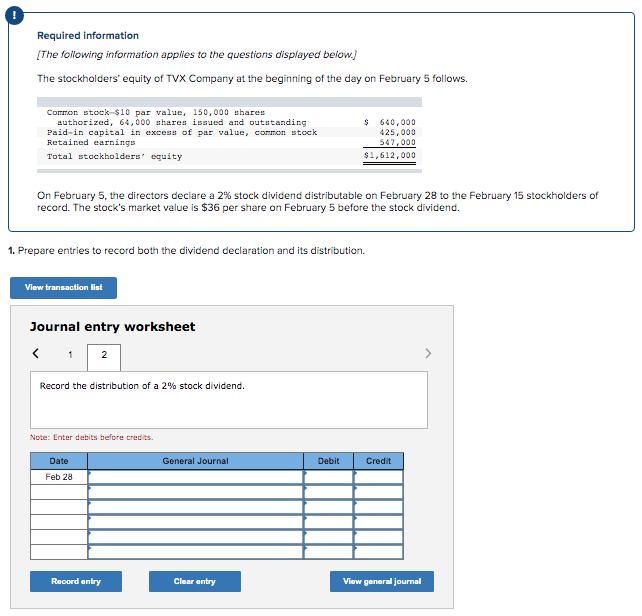

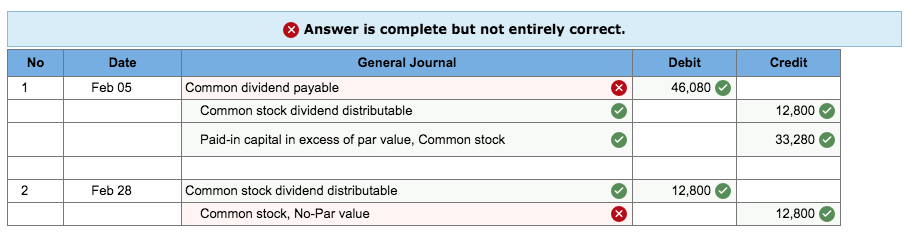

2. Prepare entries to record both the dividend declaration and its distribution.

General Journal:

- Building

- Cash

- Common dividend payable

- Common stock dividend distributable

- Common stock, $0.50 par value

- Common stock, $1 par value

- Common stock, $1 stated value

- Common stock, $10 par value

- Common stock, $8 stated value

- Common stock, No-Par value

- Contributed capital, Treasury stock

- Income summary

- Inventory

- Land

- Machinery

- Note payable

- Organization expenses

- Paid-in capital in excess of par value, Common stock

- Paid-in capital in excess of par value, Preferred stock

- Paid-in capital in excess of stated value, Common stock

- Preferred stock, $50 par value

- Retained earnings

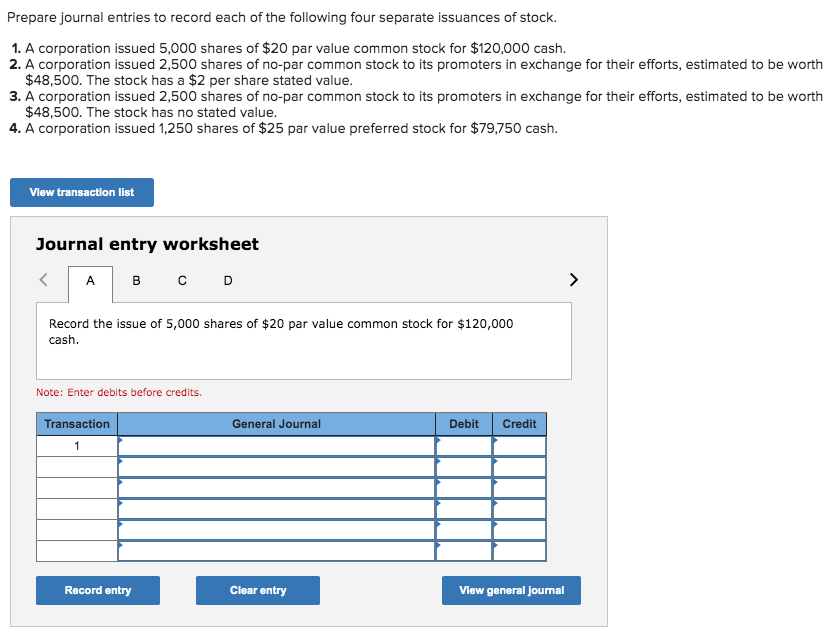

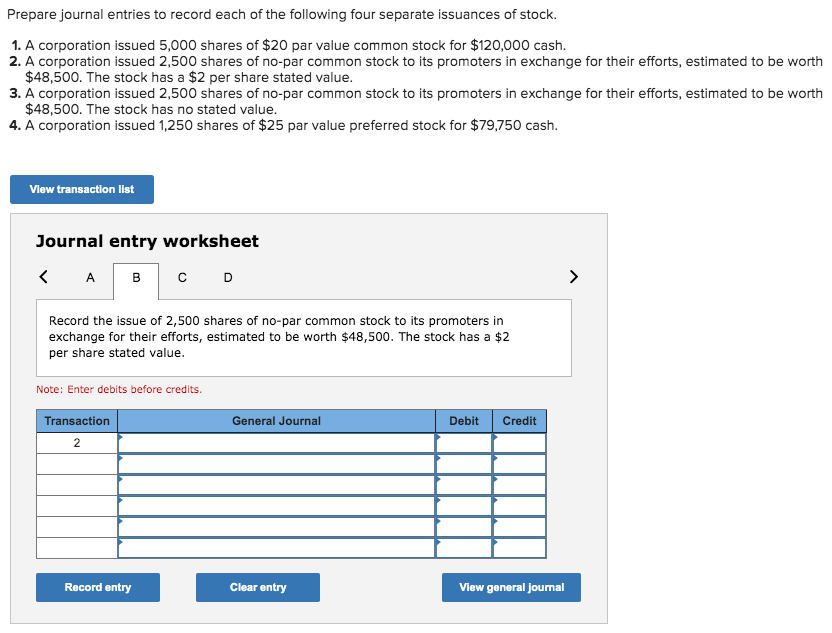

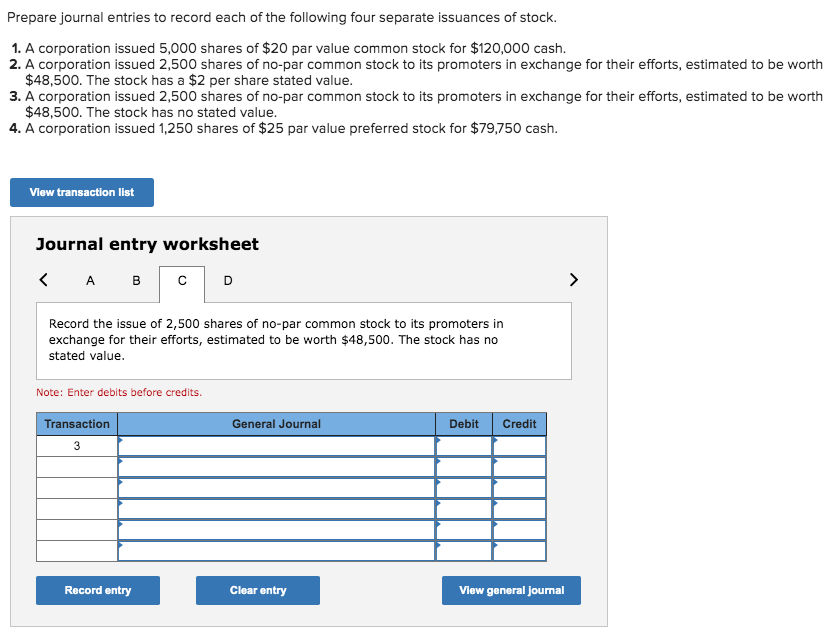

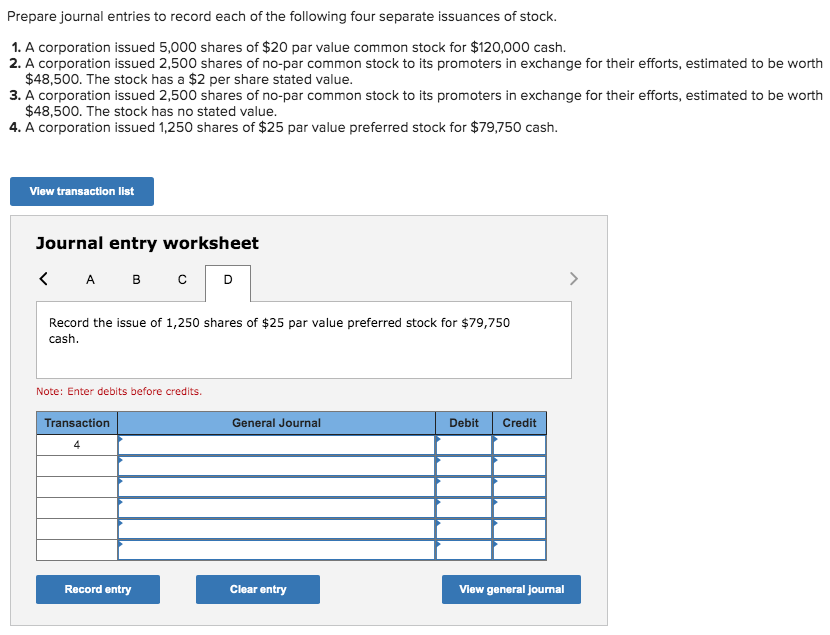

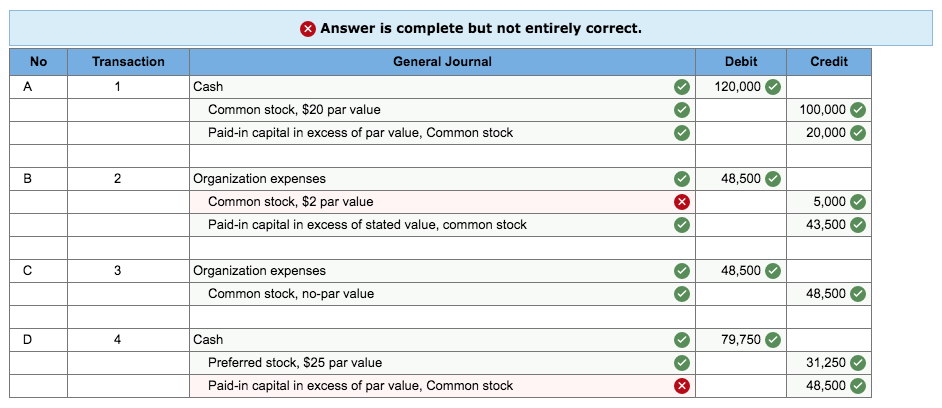

Prepare journal entries to record each of the following four separate issuances of stock. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has a $2 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has no stated value. 4. A corporation issued 1,250 shares of $25 par value preferred stock for $79,750 cash. View transaction list Journal entry worksheet Record the issue of 5,000 shares of $20 par value common stock for $120,000 cash. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general Journal Prepare journal entries to record each of the following four separate issuances of stock. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has a $2 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has no stated value. 4. A corporation issued 1,250 shares of $25 par value preferred stock for $79,750 cash. View transaction list Journal entry worksheet Record the issue of 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has a $2 per share stated value. Note: Enter debits before credits. Transaction General Journal Debit Credit 2 Record entry Clear entry View general Journal Prepare journal entries to record each of the following four separate issuances of stock. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has a $2 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has no stated value. 4. A corporation issued 1,250 shares of $25 par value preferred stock for $79,750 cash. View transaction list Journal entry worksheet Record the issue of 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has no stated value. Note: Enter debits before credits. Transaction General Journal Debit Credit 3 Record entry Clear entry View general Journal Prepare journal entries to record each of the following four separate issuances of stock. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has a $2 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $48,500. The stock has no stated value. 4. A corporation issued 1,250 shares of $25 par value preferred stock for $79,750 cash. View transaction list Journal entry worksheet Record the issue of 1,250 shares of $25 par value preferred stock for $79,750 cash. Note: Enter debits before credits. Transaction General Journal Debit Credit 4 Record entry Clear entry View general Journal Answer is complete but not entirely correct. No Transaction Debit Credit D 1 120,000 General Journal Cash Common stock, $20 par value Paid-in capital in excess of par value, Common stock 100,000 20,000 B 2 48,500 Organization expenses Common stock, $2 par value Paid-in capital in excess of stated value, common stock 5,000 43,500 3 48,500 Organization expenses Common stock, no-par value 48,500 D 4 79,750 Cash Preferred stock, $25 par value Paid-in capital in excess of par value, Common stock >> 31,250 48,500 Required information {The following information applies to the questions displayed below.] The stockholders' equity of TVX Company at the beginning of the day on February 5 follows. Common stock-$10 par value, 150,000 shares authorized, 64,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 640,000 425,000 547,000 $1,612,000 On February 5, the directors declare a 2% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $36 per share on February 5 before the stock dividend. 1. Prepare entries to record both the dividend declaration and its distribution. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts