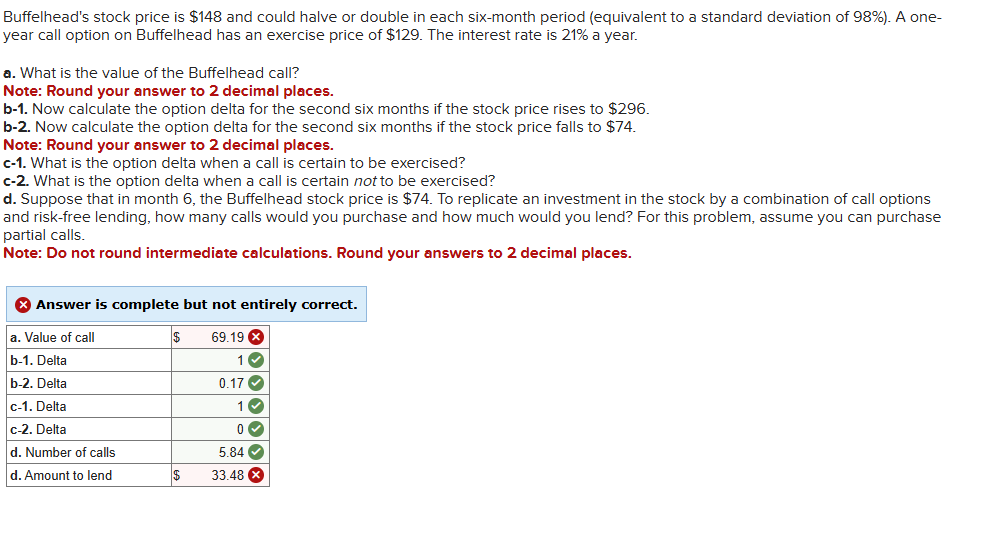

Question: Please fix the errors in the attached screenshot. Buffelhead's stock price is $ 1 4 8 and could halve or double in each six -

Please fix the errors in the attached screenshot.

Buffelhead's stock price is $ and could halve or double in each sixmonth period equivalent to a standard deviation of A one

year call option on Buffelhead has an exercise price of $ The interest rate is a year.

a What is the value of the Buffelhead call?

Note: Round your answer to decimal places.

b Now calculate the option delta for the second six months if the stock price rises to $

b Now calculate the option delta for the second six months if the stock price falls to $

Note: Round your answer to decimal places.

c What is the option delta when a call is certain to be exercised?

c What is the option delta when a call is certain not to be exercised?

d Suppose that in month the Buffelhead stock price is $ To replicate an investment in the stock by a combination of call options

and riskfree lending, how many calls would you purchase and how much would you lend? For this problem, assume you can purchase

partial calls.

Note: Do not round intermediate calculations. Round your answers to decimal places.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock