Question: please fix the ones i got wrong Shamrock, Inc. has accounts receivable of $96,800 at March 31,2022 Credit terms are 2/10,n/30. At March 31, 2022,

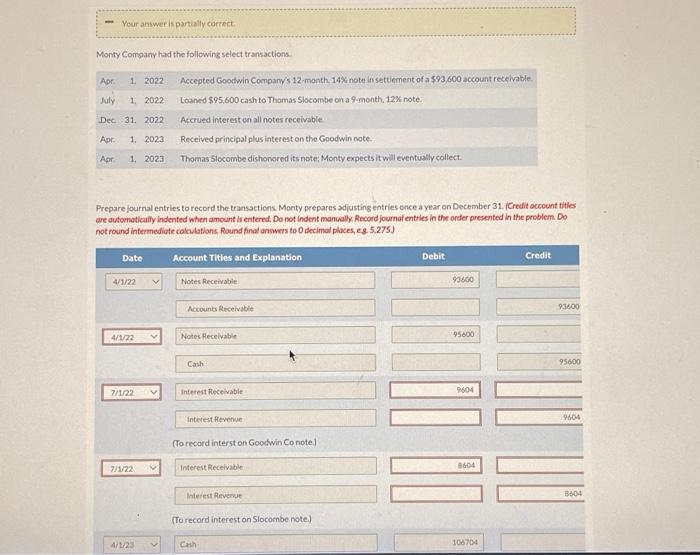

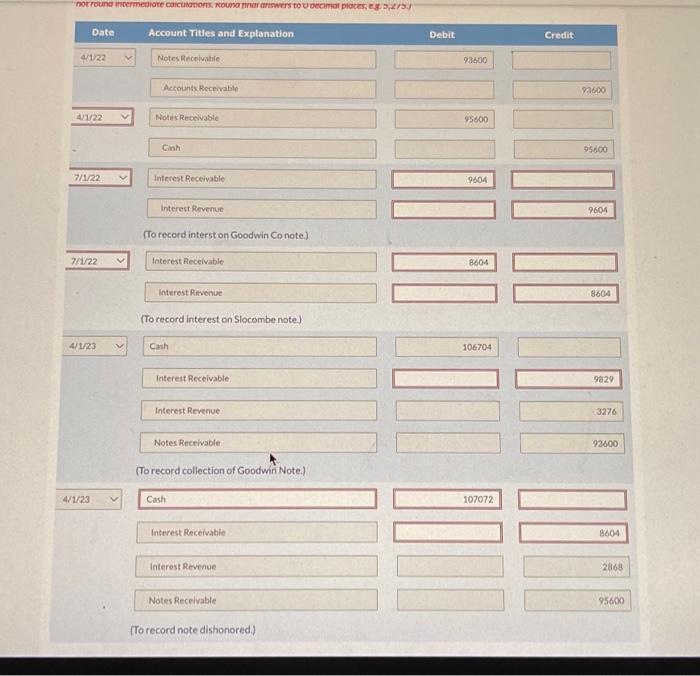

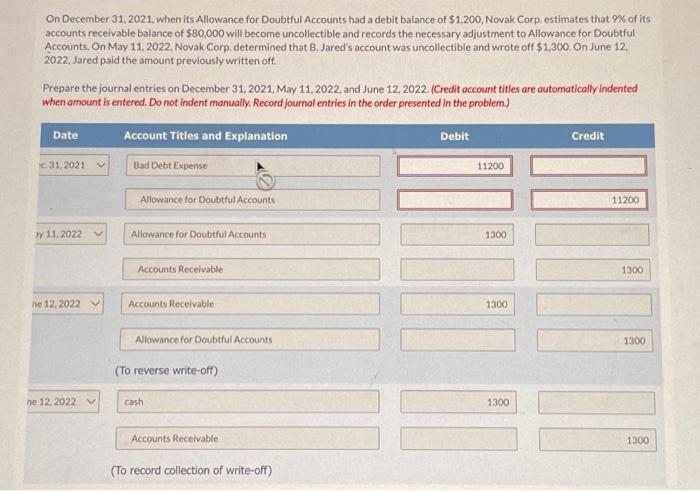

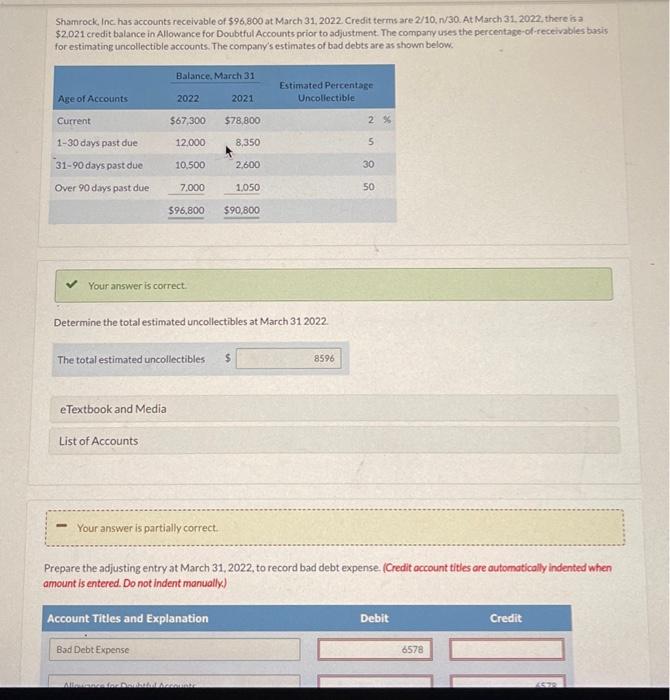

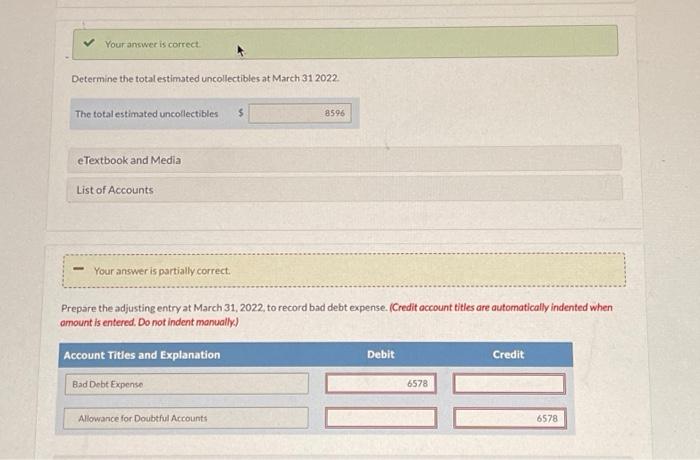

Shamrock, Inc. has accounts receivable of $96,800 at March 31,2022 Credit terms are 2/10,n/30. At March 31, 2022, there is a $2,021 eredit balance in Allowance for Doubtful Accountsprior to adjustment. The companv uses the percentage- of -receivables basis for estimating uncollectible accounts. The company sestimates of bad debts are as shown below. Your answer is correct. Determine the total estimated uncollectibles at March 312022. The total estimated uncollectibles eTextbook and Media List of Accounts - Your answer is partially correct. Prepare the adjusting entry at March 31,2022, to record bad debt expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) On December 31,2021 , when its Allowance for Doubtful Accounts had a debit balance of $1,200, Novak Corp. estimates that 9% of its. accounts receivable balance of $80,000 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts, On May 11,2022, Novak Corp. determined that B, Jared's account was uncollectible and wrote off $1,300, On June 12 . 2022, Jared paid the amount previously written oft. Prepare the journal entries on December 31, 2021, May 11, 2022, and June 12, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem) Monty Company had the following select transactions. Prepare journal entries to record the transactions. Monty prepares adjusting entries once a year on December 31 . (Credit account tities are dutomatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Do not round intermedibte coleudations Round final answers to 0 decimal places, es 5.275) (To record interest on Slocombenote) 4/1/23V Cash Intereat Receivable Interest Revenue Notes Receivable (To record collection of Goodwin Note) Cash Interest Receivable Interest Revenue Notes Recelvable 95600 (To record note dishonored.) Determine the total estimated uncollectibles at March 312022. The total estimated uncollectibles - Your answer is partially correct. Prepare the adjusting entry at March 31, 2022, to record bad debt expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts