Question: please fix the red boxed answers those are incorrect Debra is a junior at State College. To offset the cost of attending college full-time, Debra

please fix the red boxed answers

those are incorrect

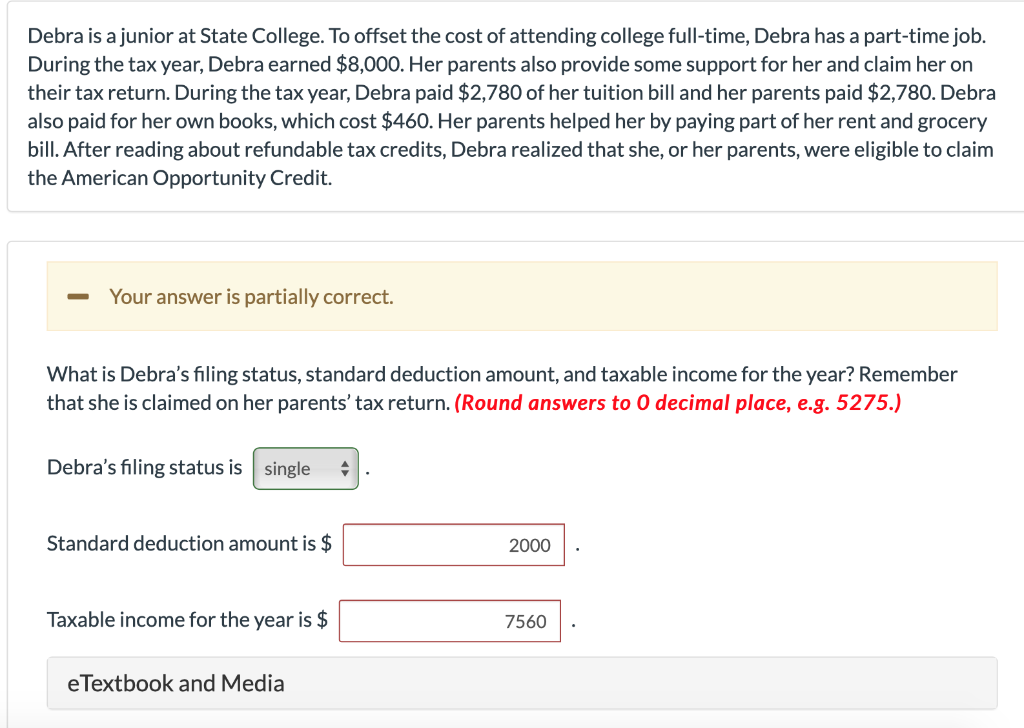

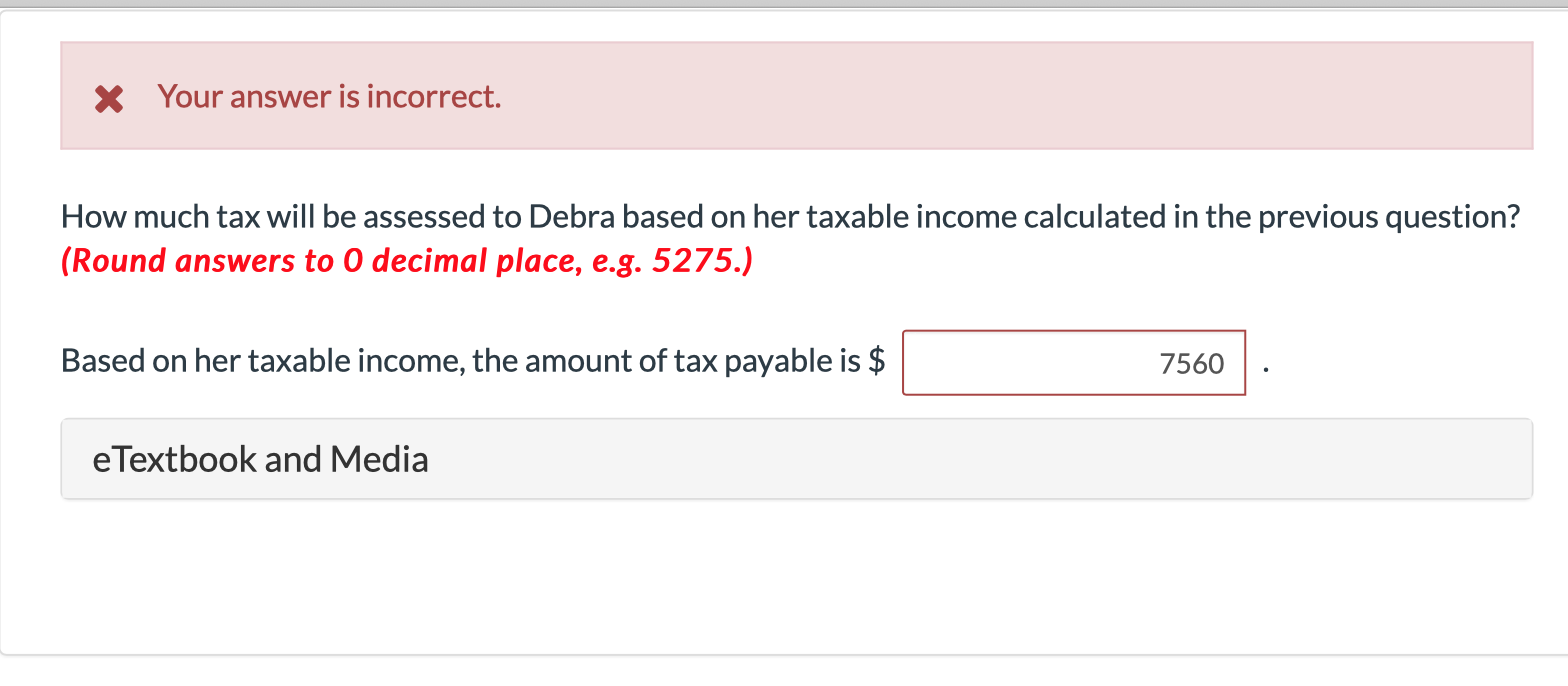

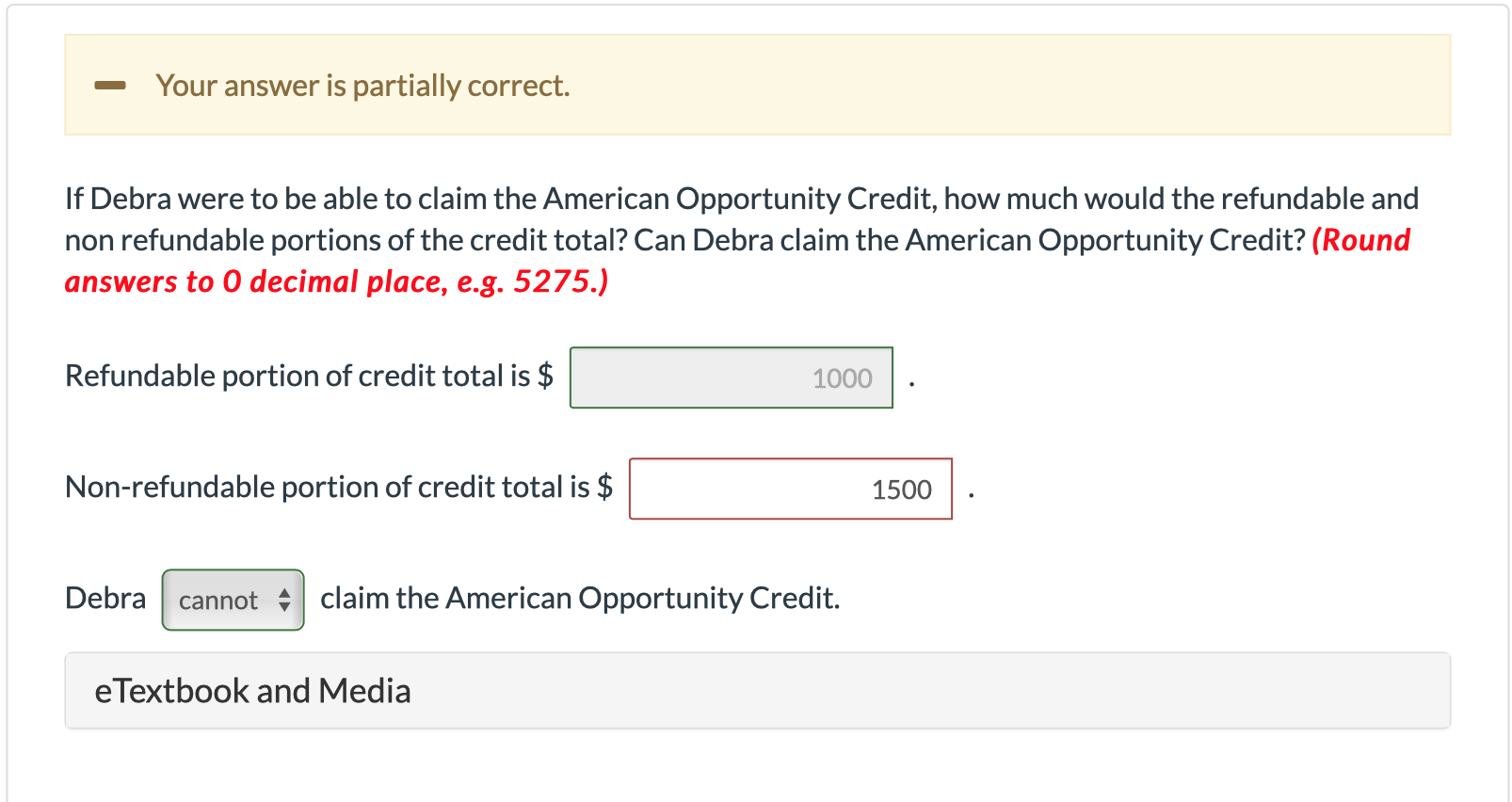

Debra is a junior at State College. To offset the cost of attending college full-time, Debra has a part-time job. During the tax year, Debra earned $8,000. Her parents also provide some support for her and claim her on their tax return. During the tax year, Debra paid $2,780 of her tuition bill and her parents paid $2,780. Debra also paid for her own books, which cost $460. Her parents helped her by paying part of her rent and grocery bill. After reading about refundable tax credits, Debra realized that she, or her parents, were eligible to claim the American Opportunity Credit. - Your answer is partially correct. What is Debra's filing status, standard deduction amount, and taxable income for the year? Remember that she is claimed on her parents' tax return. (Round answers to O decimal place, e.g. 5275.) Debra's filing status is singl Standard deduction amount is $ 2000 Taxable income for the year is $ 7560 e Textbook and Media X Your answer is incorrect. How much tax will be assessed to Debra based on her taxable income calculated in the previous question? (Round answers to O decimal place, e.g. 5275.). Based on her taxable income, the amount of tax payable is $ 7560 e Textbook and Media - Your answer is partially correct. If Debra were to be able to claim the American Opportunity Credit, how much would the refundable and non refundable portions of the credit total? Can Debra claim the American Opportunity Credit? (Round answers to 0 decimal place, e.g. 5275.) Refundable portion of credit total is $ 1000 Non-refundable portion of credit total is $ 1500 Debra cannot claim the American Opportunity Credit. eTextbook and Media Debra is a junior at State College. To offset the cost of attending college full-time, Debra has a part-time job. During the tax year, Debra earned $8,000. Her parents also provide some support for her and claim her on their tax return. During the tax year, Debra paid $2,780 of her tuition bill and her parents paid $2,780. Debra also paid for her own books, which cost $460. Her parents helped her by paying part of her rent and grocery bill. After reading about refundable tax credits, Debra realized that she, or her parents, were eligible to claim the American Opportunity Credit. - Your answer is partially correct. What is Debra's filing status, standard deduction amount, and taxable income for the year? Remember that she is claimed on her parents' tax return. (Round answers to O decimal place, e.g. 5275.) Debra's filing status is singl Standard deduction amount is $ 2000 Taxable income for the year is $ 7560 e Textbook and Media X Your answer is incorrect. How much tax will be assessed to Debra based on her taxable income calculated in the previous question? (Round answers to O decimal place, e.g. 5275.). Based on her taxable income, the amount of tax payable is $ 7560 e Textbook and Media - Your answer is partially correct. If Debra were to be able to claim the American Opportunity Credit, how much would the refundable and non refundable portions of the credit total? Can Debra claim the American Opportunity Credit? (Round answers to 0 decimal place, e.g. 5275.) Refundable portion of credit total is $ 1000 Non-refundable portion of credit total is $ 1500 Debra cannot claim the American Opportunity Credit. eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts