Question: Please follow rounding instructions (in red), or it will be wrong, thanks! Question 8 5 pts You are a senior manager at Nittany Aircraft and

Please follow rounding instructions (in red), or it will be wrong, thanks!

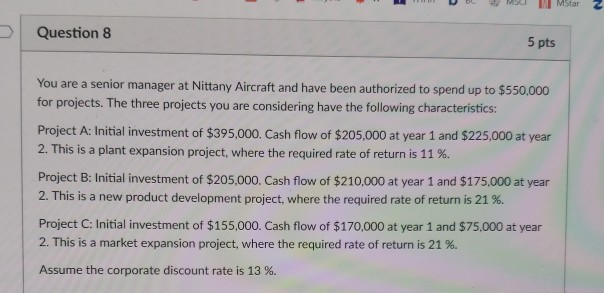

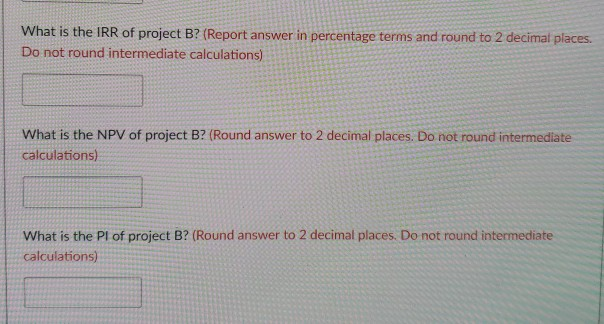

Question 8 5 pts You are a senior manager at Nittany Aircraft and have been authorized to spend up to $550,000 for projects. The three projects you are considering have the following characteristics: Project A: Initial investment of $395,000. Cash flow of $205,000 at year 1 and $225,000 at year 2. This is a plant expansion project, where the required rate of return is 11 %. Project B: Initial investment of $205,000. Cash flow of $210,000 at year 1 and $175,000 at year 2. This is a new product development project, where the required rate of return is 21 %. Project C: Initial investment of $155,000. Cash flow of $170,000 at year 1 and $75,000 at year 2. This is a market expansion project, where the required rate of return is 21 %. Assume the corporate discount rate is 13 %. What is the IRR of project B? (Report answer in percentage terms and round to 2 decimal places. Do not round intermediate calculations) What is the NPV of project B? (Round answer to 2 decimal places. Do not round intermediate calculations) What is the Pl of project B? (Round answer to 2 decimal places. Do not round intermediate calculations)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts