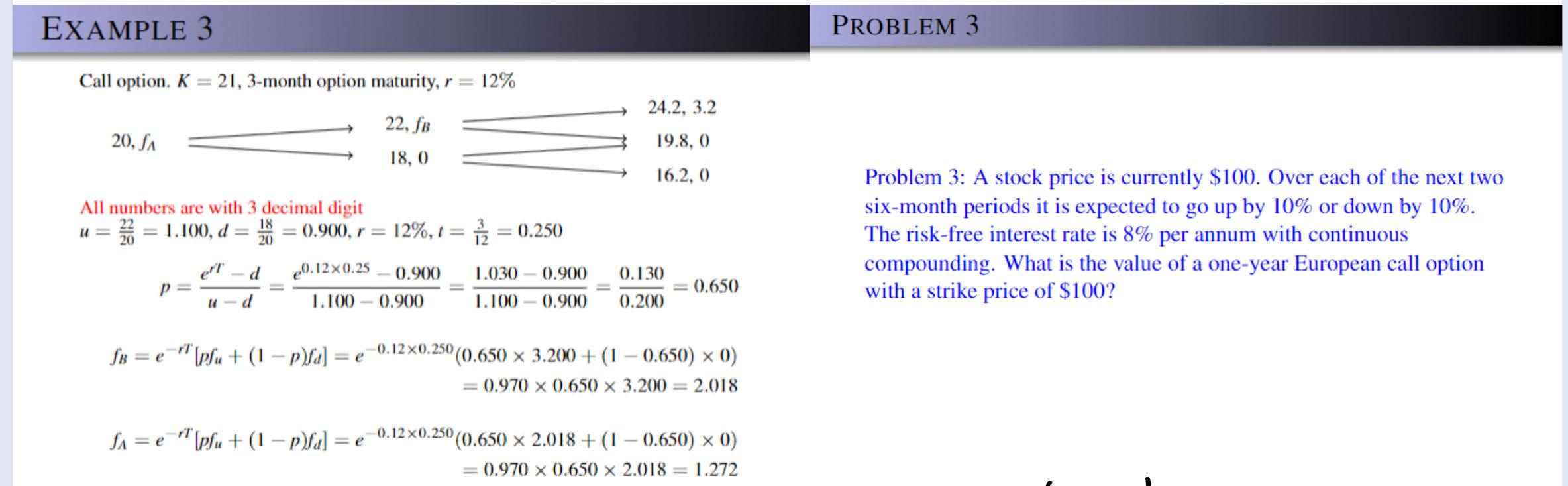

Question: Please follow the example formula to solve the problem. Call option. K=21,3-month option maturity, r=12% Allnumbersarewith3decimaldigitu=2022=1.100,d=2018=0.900,r=12%,t=123=0.250six-monthperiodsitisexpectedtogoupby10%ordownby10%.Therisk-freeinterestrateis8%perannumwithcontinuous p=uderTd=1.1000.900e0.120.250.900=1.1000.9001.0300.900=0.2000.130=0.650compounding.Whatisthevalueofaone-yearEuropeancalloption fB=erT[pfu+(1p)fd]=e0.120.250(0.6503.200+(10.650)0) =0.9700.6503.200=2.018 f=erT[pfu+(1p)fd]=e0.120.250(0.6502.018+(10.650)0) =0.9700.6502.018=1.272

Please follow the example formula to solve the problem.

Please follow the example formula to solve the problem.

Call option. K=21,3-month option maturity, r=12% Allnumbersarewith3decimaldigitu=2022=1.100,d=2018=0.900,r=12%,t=123=0.250six-monthperiodsitisexpectedtogoupby10%ordownby10%.Therisk-freeinterestrateis8%perannumwithcontinuous p=uderTd=1.1000.900e0.120.250.900=1.1000.9001.0300.900=0.2000.130=0.650compounding.Whatisthevalueofaone-yearEuropeancalloption fB=erT[pfu+(1p)fd]=e0.120.250(0.6503.200+(10.650)0) =0.9700.6503.200=2.018 f=erT[pfu+(1p)fd]=e0.120.250(0.6502.018+(10.650)0) =0.9700.6502.018=1.272

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock