Question: Please follow the format provided. I have already started the solution but i am just stuck in the capital gain reserve and further. Please stop

Please follow the format provided. I have already started the solution but i am just stuck in the capital gain reserve and further. Please stop copying the answers from other posts. if you cannot solve this problem according to the format in the table please don't answer it.

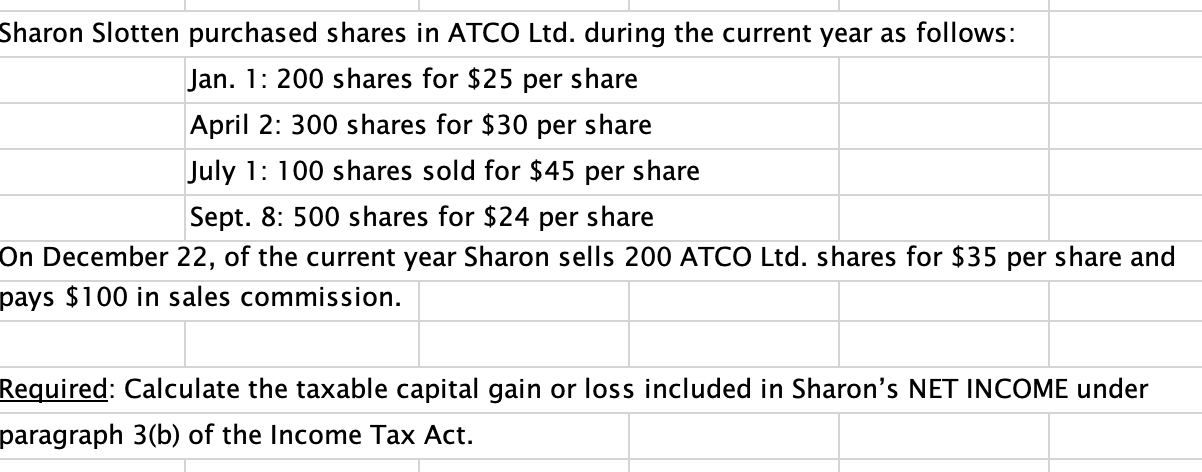

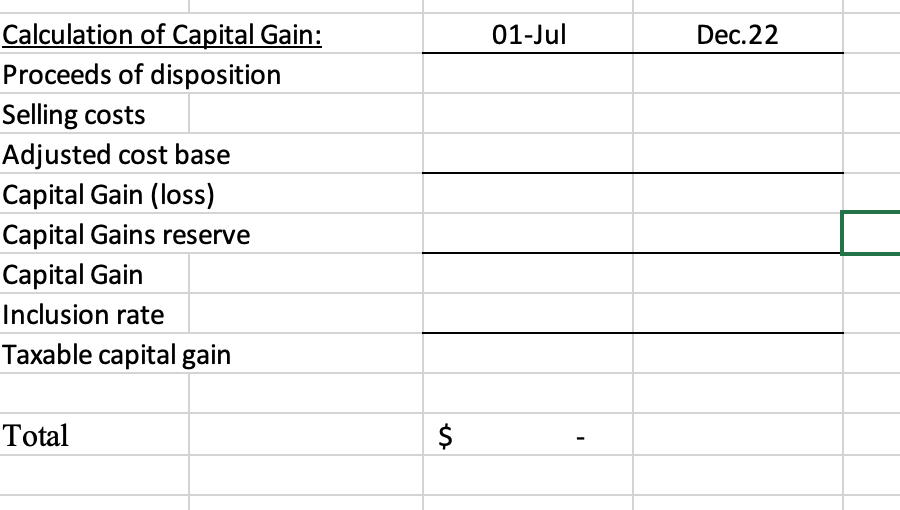

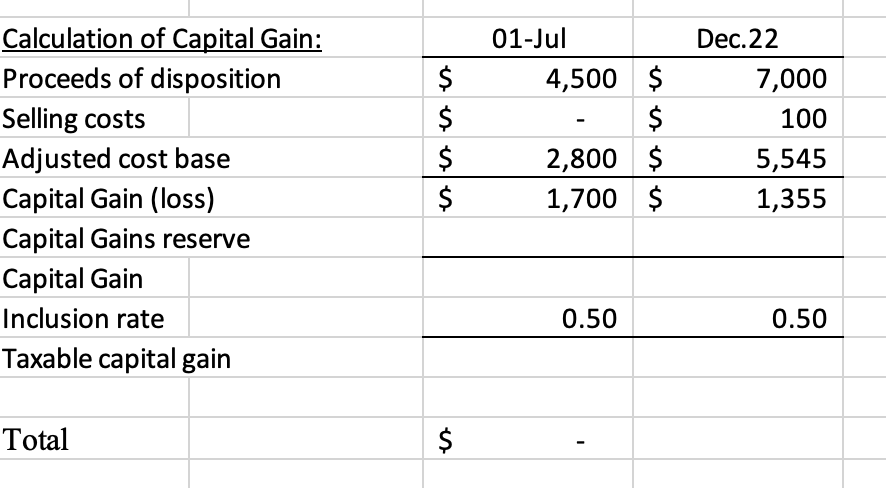

Sharon Slotten purchased shares in ATCO Ltd. during the current year as follows: Jan. 1: 200 shares for $25 per share April 2: 300 shares for $30 per share July 1: 100 shares sold for $45 per share Sept. 8: 500 shares for $24 per share On December 22, of the current year Sharon sells 200 ATCO Ltd. shares for $35 per share and pays $100 in sales commission. Required: Calculate the taxable capital gain or loss included in Sharon's NET INCOME under paragraph 3(b) of the Income Tax Act. Calculation of Capital Gain: \begin{tabular}{|c|c|} \hline 01-Jul & Dec. 22 \\ \hline \end{tabular} Proceeds of disposition Selling costs Adjusted cost base Capital Gain (loss) Capital Gains reserve Capital Gain Inclusion rate Taxable capital gain Total $ Calculation of Capital Gain: Proceeds of disposition \begin{tabular}{rr|rr} \multicolumn{2}{c|}{ 01-Jul } & \multicolumn{2}{c}{ Dec.22 } \\ \hline$ & 4,500 & $ & 7,000 \\ $ & & $ & 100 \\ $ & 2,800 & $ & 5,545 \\ \hline$ & 1,700 & $ & 1,355 \\ \hline \end{tabular} Selling costs Adjusted cost base Capital Gain (loss) Capital Gains reserve Capital Gain Inclusion rate Taxable capital gain \begin{tabular}{rr} 0.50 & 0.50 \\ \hline \end{tabular} Total $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts