Question: Please follow the format specified below. Dropdown Value: Salaries Expense Utilities Expense Interest Expense Insurance Expense Buildings Accumulated Depreciation - Buildings Furniture Accumulated Depreciation -

Please follow the format specified below.

Dropdown Value:

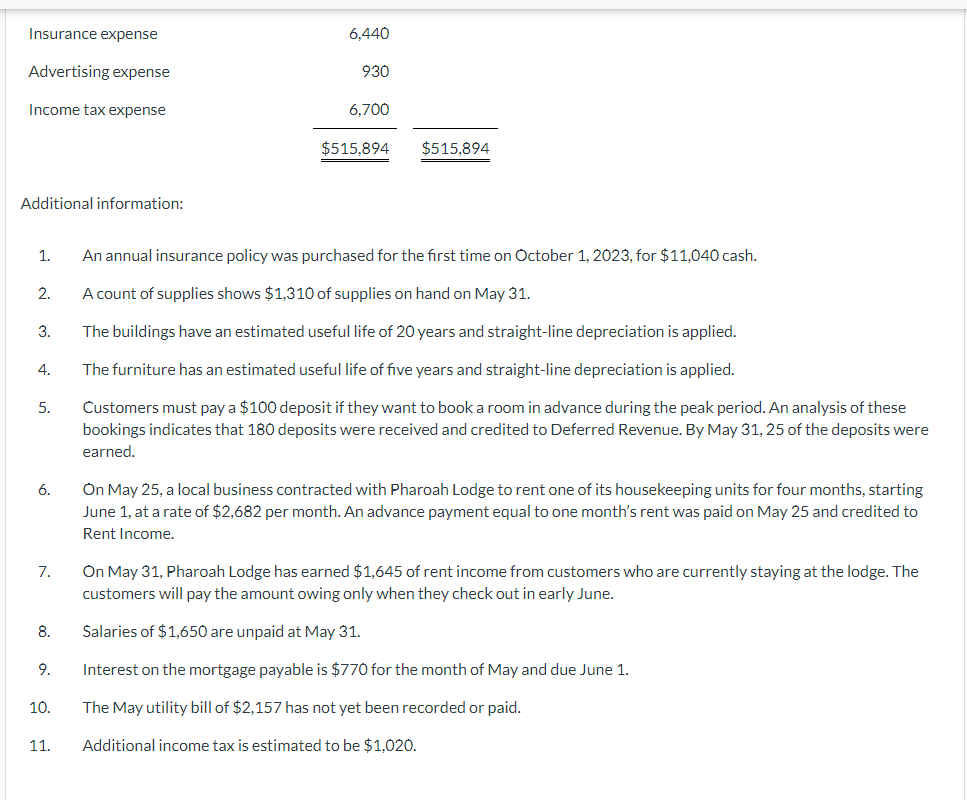

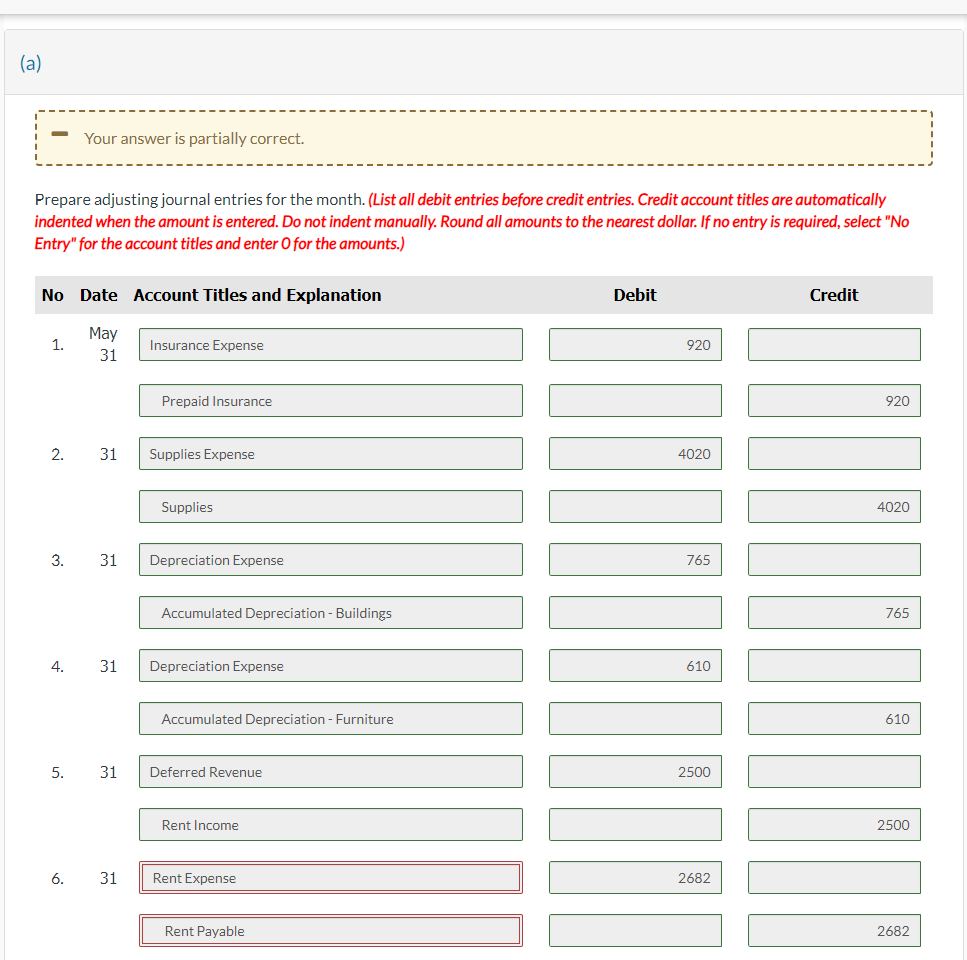

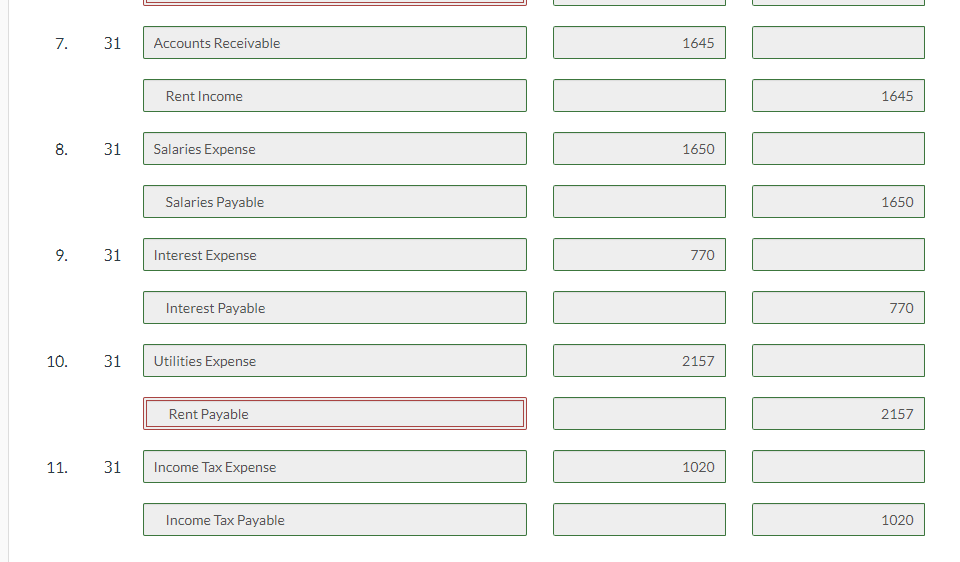

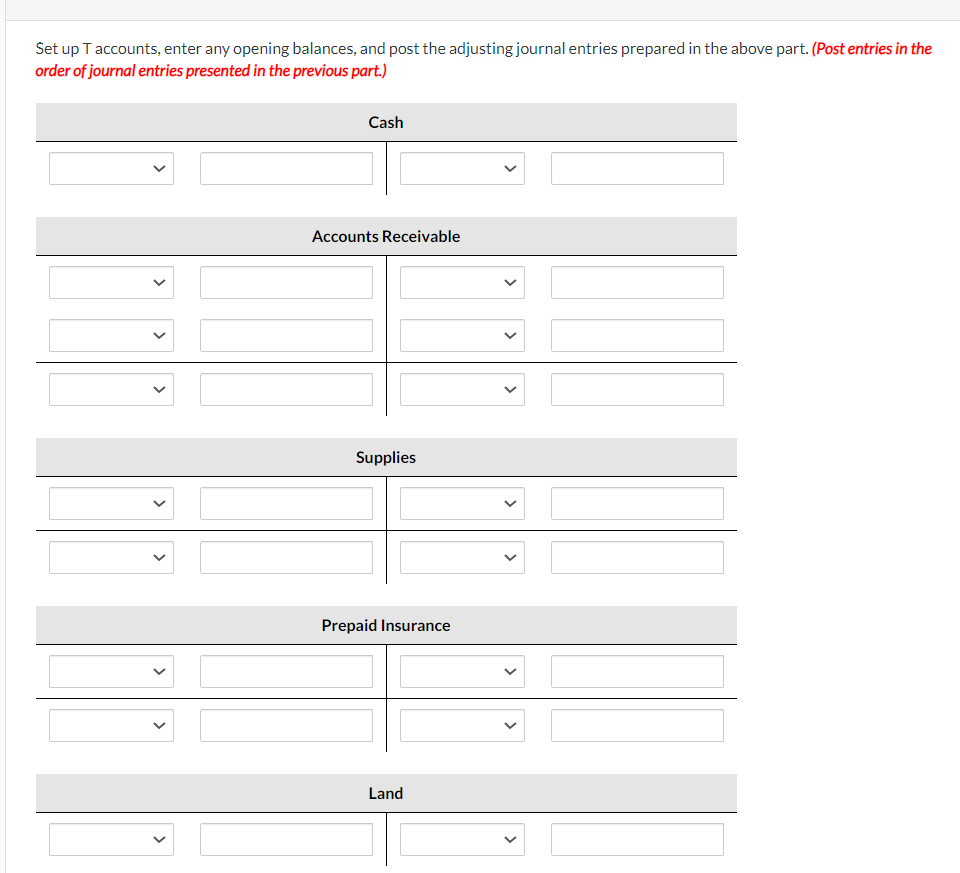

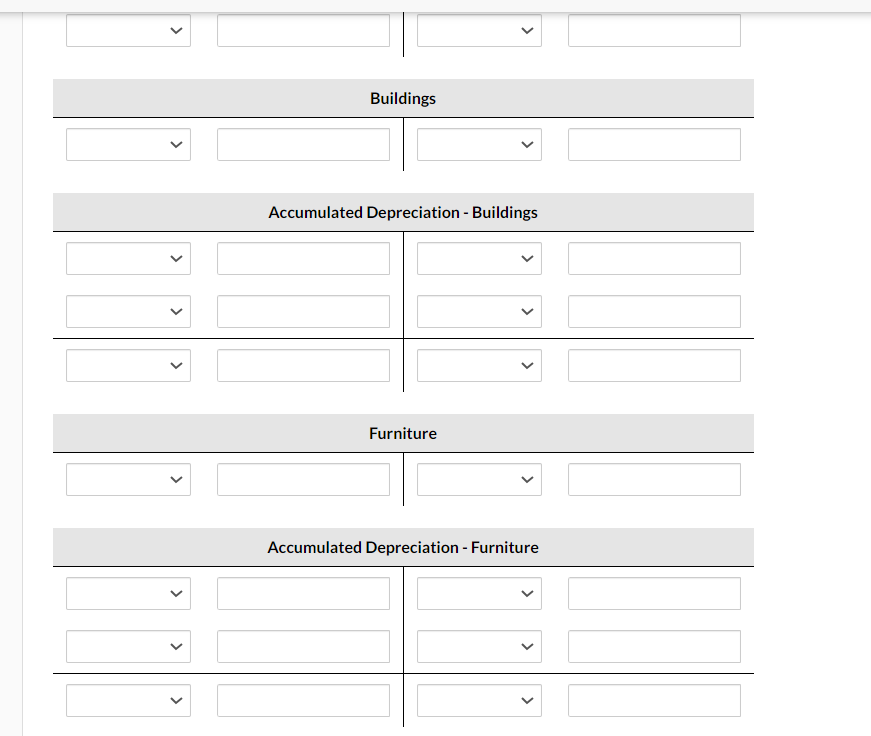

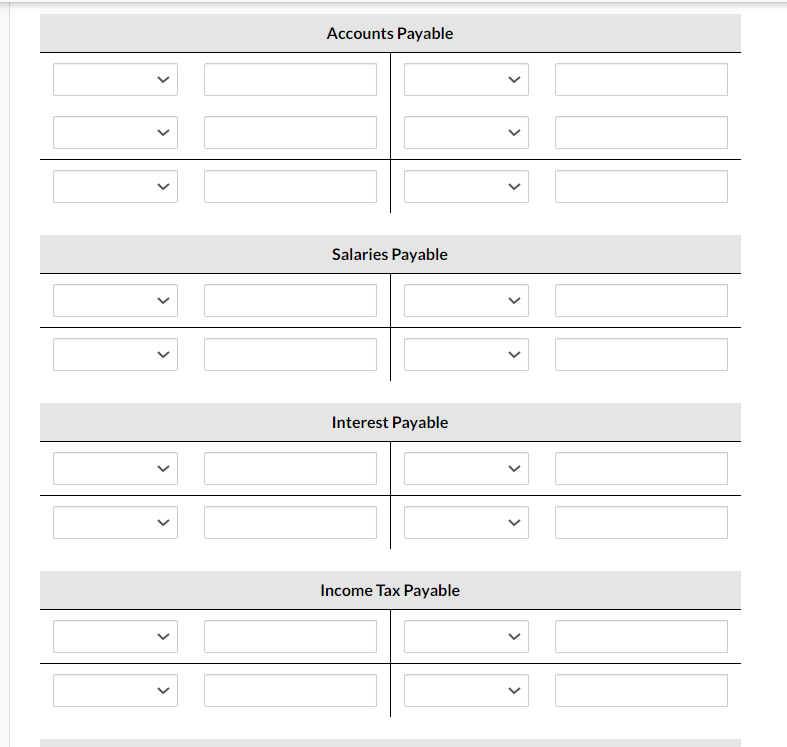

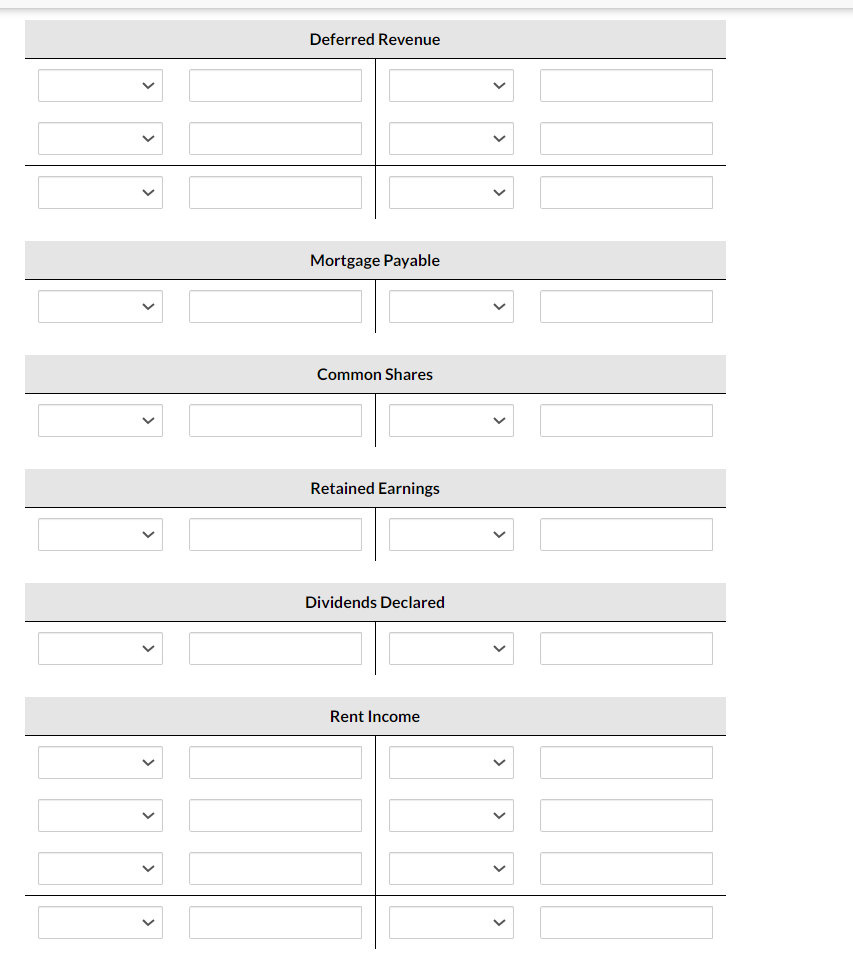

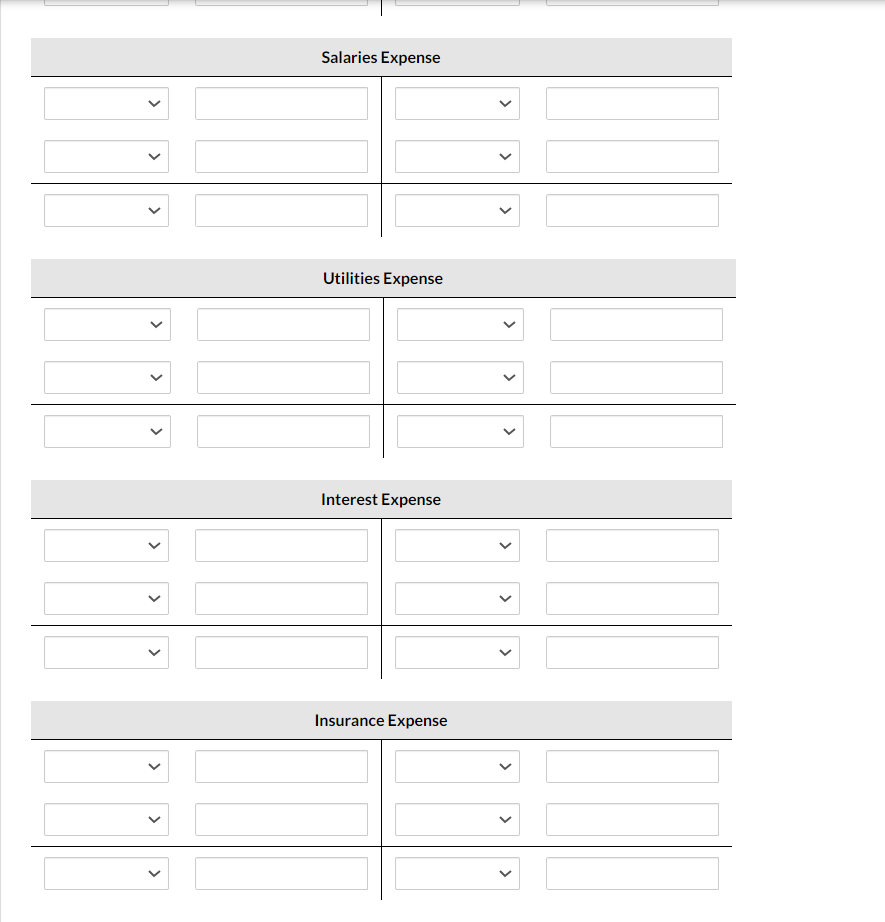

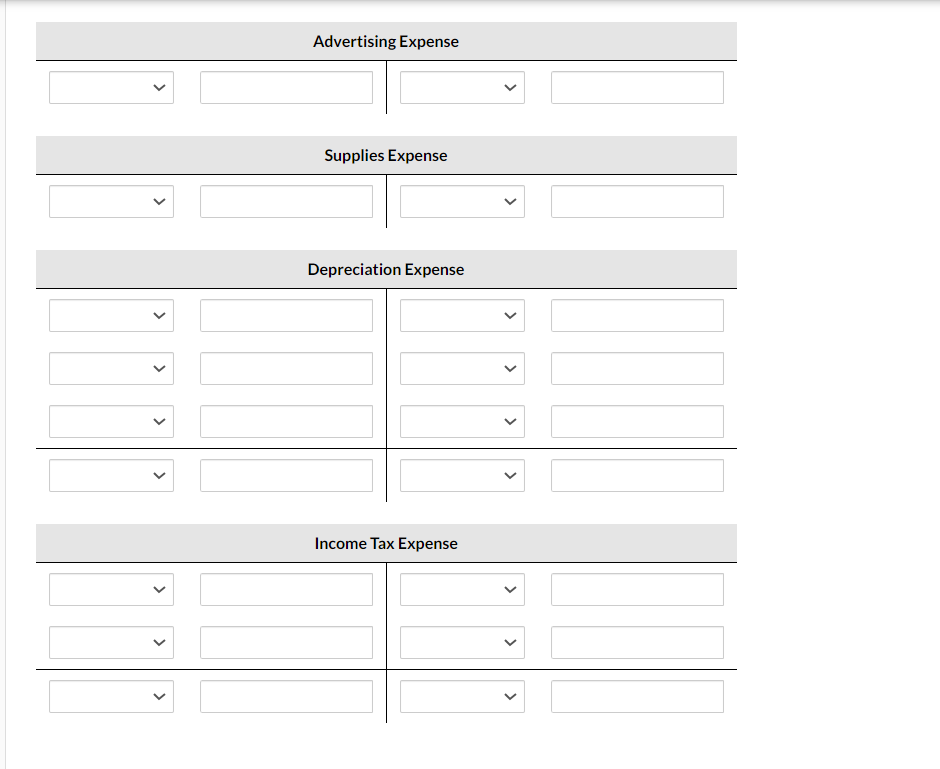

Salaries Expense Utilities Expense Interest Expense Insurance Expense Buildings Accumulated Depreciation - Buildings Furniture Accumulated Depreciation - Furniture Deferred Revenue Mortgage Payable Common Shares Retained Earnings Dividends Declared Rent Income Prepare adjusting journal entries for the month. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round all amounts to the nearest dollar. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) May 31 Bal. May 31 Adj. Set up T accounts, enter any opening balances, and post the adjusting journal entries prepared in the above part. (Post entries in the order of journal entries presented in the previous part.) Accounts Payable 1. An annual insurance policy was purchased for the first time on October 1,2023 , for $11,040 cash. 2. A count of supplies shows $1,310 of supplies on hand on May 31 . 3. The buildings have an estimated useful life of 20 years and straight-line depreciation is applied. 4. The furniture has an estimated useful life of five years and straight-line depreciation is applied. 5. Customers must pay a $100 deposit if they want to book a room in advance during the peak period. An analysis of these bookings indicates that 180 deposits were received and credited to Deferred Revenue. By May 31, 25 of the deposits were earned. 6. On May 25, a local business contracted with Pharoah Lodge to rent one of its housekeeping units for four months, starting June 1, at a rate of $2,682 per month. An advance payment equal to one month's rent was paid on May 25 and credited to Rent Income. 7. On May 31, Pharoah Lodge has earned $1,645 of rent income from customers who are currently staying at the lodge. The customers will pay the amount owing only when they check out in early June. 8. Salaries of $1,650 are unpaid at May 31. 9. Interest on the mortgage payable is $770 for the month of May and due June 1. 10. The May utility bill of $2,157 has not yet been recorded or paid. 11. Additional income tax is estimated to be $1,020. Advertising Expense Supplies Expense Depreciation Expense \begin{tabular}{|c|c|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} Income Tax Expense 7. 31 Accounts Receivable 1645 Rent Income 1645 8. 31 Salaries Expense 1650 Salaries Payable 1650 9. 31 Interest Expense 770 Interest Payable 4 1645 31 Salaries Expense \begin{tabular}{r} 770 \\ \hline \\ \hline \end{tabular} 10. 31 Utilities Expense 2157 770 Rent Payable 2157 11. 31 Income Tax Expense 1020 Income Tax Payable \begin{tabular}{r} 1020 \\ \\ \hline \end{tabular} 1020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts