Question: Please follow the table that is given. Ty Pharoah Services Company records adjusting entries on an annual basis. The following information is available to be

Please follow the table that is given.

Ty

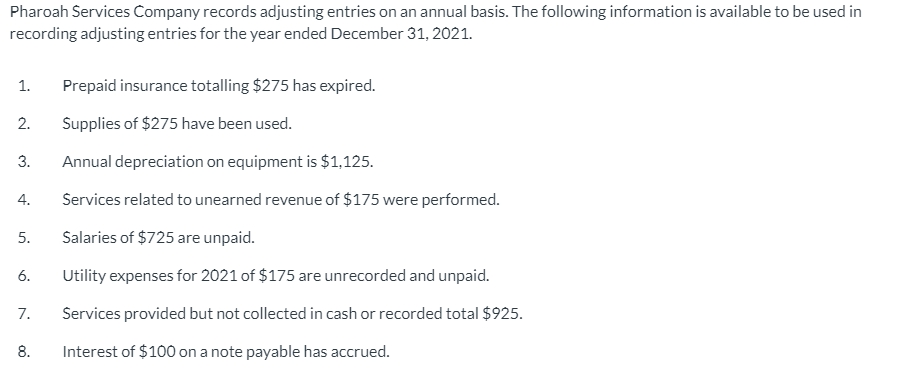

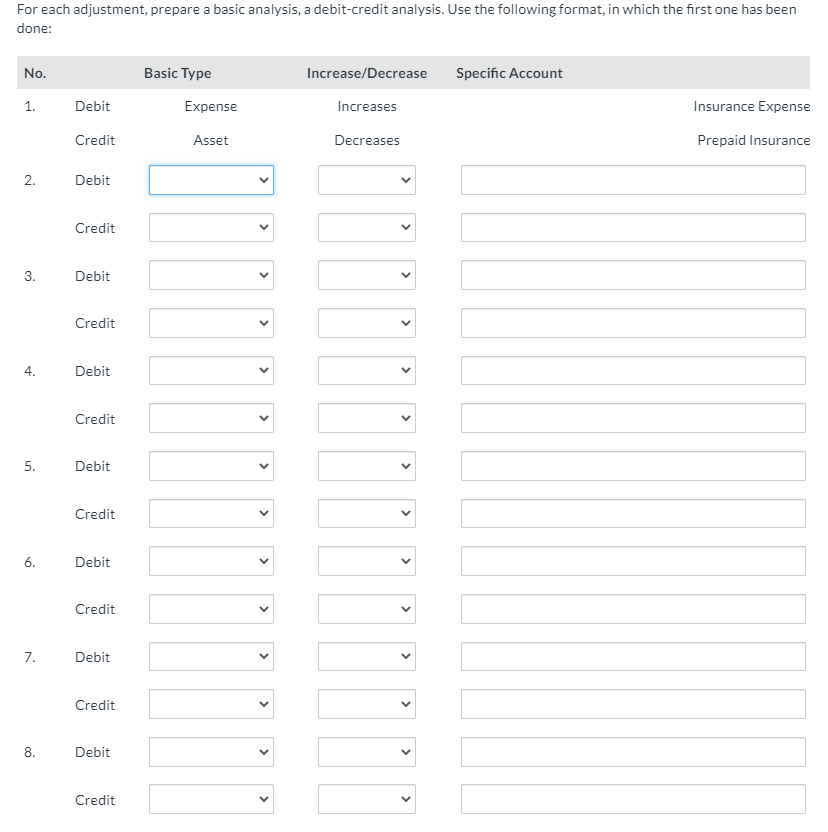

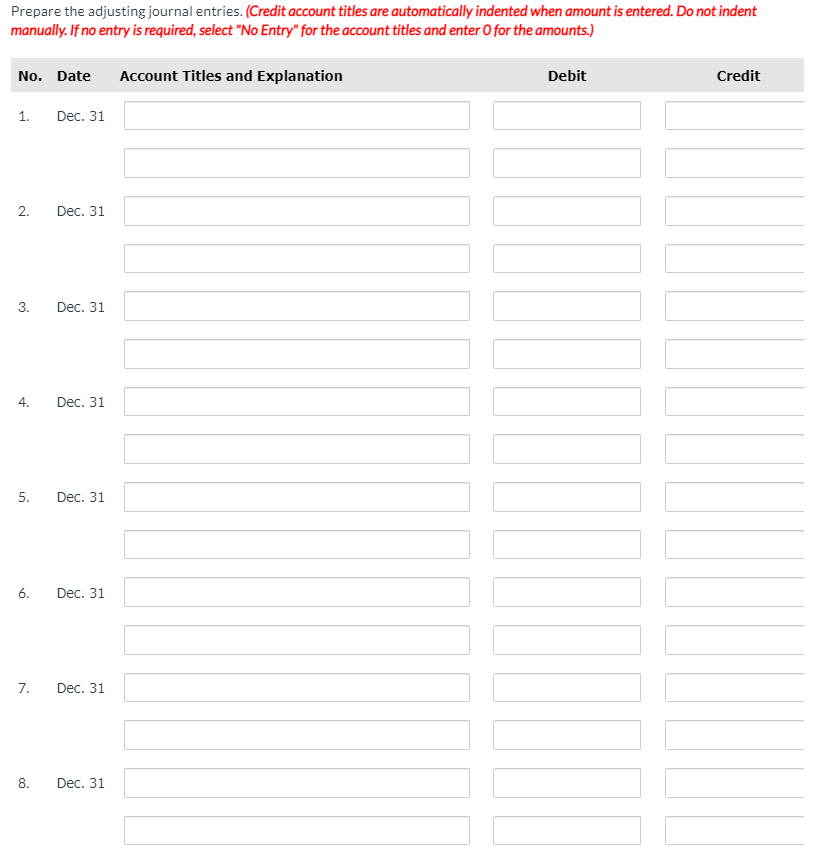

Pharoah Services Company records adjusting entries on an annual basis. The following information is available to be used in recording adjusting entries for the year ended December 31, 2021. 1. Prepaid insurance totalling $275 has expired. 2. Supplies of $275 have been used. 3. Annual depreciation on equipment is $1,125. 4. Services related to unearned revenue of $175 were performed. 5. Salaries of $725 are unpaid. 6. Utility expenses for 2021 of $175 are unrecorded and unpaid. 7. Services provided but not collected in cash or recorded total $925. 8. Interest of $100 on a note payable has accrued. For each adjustment, prepare a basic analysis, a debit-credit analysis. Use the following format, in which the first one has been done: No. Basic Type Increase/Decrease Specific Account 1. Debit Expense Increases Insurance Expense Credit Asset Decreases Prepaid Insurance 2. Debit Credit 4. Debit > Credit > 5. Debit > > 6. Debit > Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts