Question: Please format answer how the question is asked TAKE- HOME PROBLEM SET #2: CHAPTERS 6 THROUGH 10 On June 30, 2018, Rodopoulos Marketing Group borrowed

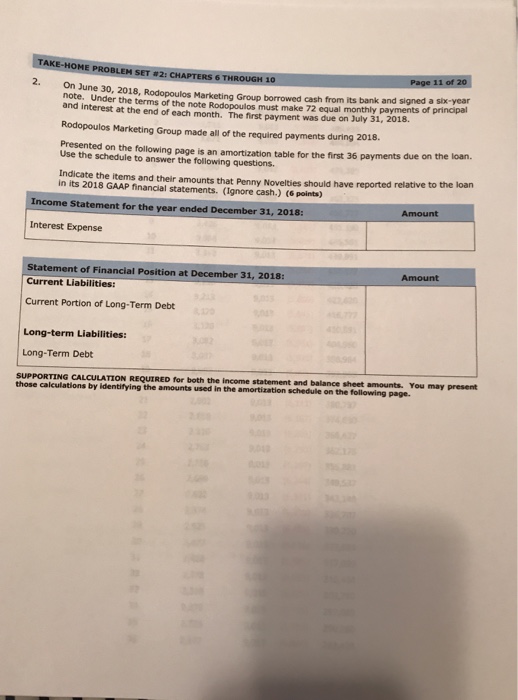

TAKE- HOME PROBLEM SET #2: CHAPTERS 6 THROUGH 10 On June 30, 2018, Rodopoulos Marketing Group borrowed cash from its bank and signed a six-year note. Under the terms of the note Rodopoulos must make 72 equal monthly payments of principal and interest at the end of each month. The first payment was due on July 31, 2018. Rodopoulos Marketing Group made all of the required payments during 2018. loan Presented on the following page is an amortization table for the first 36 payments due on the Use the schedule to answer the following questions Indicate the items and their amounts that Penny Novelties should have reported relative to the loan in its 2018 GAAP financial statements. (Ignore cash.) (6 points) Income Statement for the year ended December 31, 2018 Interest Expense Amount Statement of Financial Position at December 31, 2018: Current Liabilities: Current Portion of Long-Term Debt Long-term Liabilities: Long-Term Debt and balance sheet amounts. You may present SUPPORTING CALCULATION REQUIRED for both the inco e statement those calculations by identifying the amounts used in the amortization schedule on the following page TAKE- HOME PROBLEM SET #2: CHAPTERS 6 THROUGH 10 On June 30, 2018, Rodopoulos Marketing Group borrowed cash from its bank and signed a six-year note. Under the terms of the note Rodopoulos must make 72 equal monthly payments of principal and interest at the end of each month. The first payment was due on July 31, 2018. Rodopoulos Marketing Group made all of the required payments during 2018. loan Presented on the following page is an amortization table for the first 36 payments due on the Use the schedule to answer the following questions Indicate the items and their amounts that Penny Novelties should have reported relative to the loan in its 2018 GAAP financial statements. (Ignore cash.) (6 points) Income Statement for the year ended December 31, 2018 Interest Expense Amount Statement of Financial Position at December 31, 2018: Current Liabilities: Current Portion of Long-Term Debt Long-term Liabilities: Long-Term Debt and balance sheet amounts. You may present SUPPORTING CALCULATION REQUIRED for both the inco e statement those calculations by identifying the amounts used in the amortization schedule on the following page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts