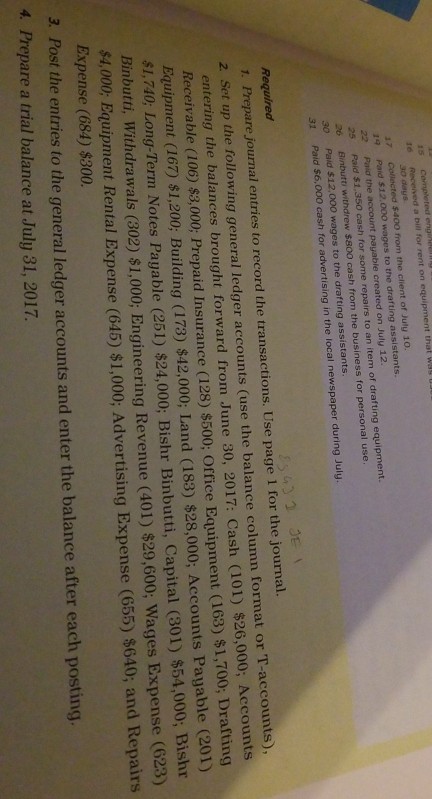

Question: Please full calculation and explanation. Number 2 and 3. CHAPTER 2 Analyzing anu g a sole proprietorship, completed the rollowing transactions during July 2017, the

Please full calculation and explanation. Number 2 and 3.

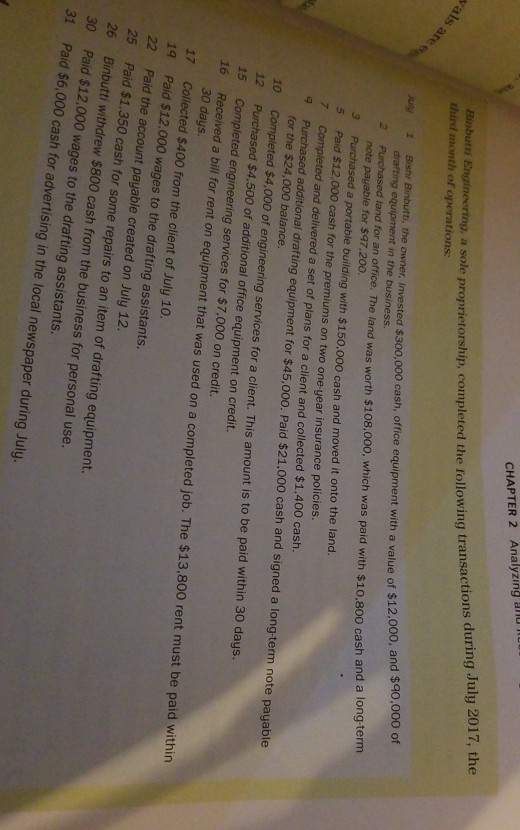

CHAPTER 2 Analyzing anu g a sole proprietorship, completed the rollowing transactions during July 2017, the month of operations: 90,000 of Bishr Binbutt, the owner, invested $300,000 cash, office equipment with a value of $12,000, ands in the business. land for an office. The land was worth $108,000, which was paid with $10,800 cash and a long-term note payable for $97.200. a portable building with $150.000 cash and moved it onto the land. $12,000 cash for the premiums on two one -year insurance policies. Completed and delivered a set of plans for a client and collected $1,400 cash. q PL additional drafting equipment for $45,000. Paid $21,000 cash and signed a long-term note payable 10 12 15 Completed $4,000 of engineerin g services for a client. This amount is to be paid within 30 days Purchased $4,500 of additional office equipment on credit. Completed engineering services for $7,000 on credit. 16 Received a bill for rent on equipment that was used on a completed job. The $13,800 rent must be paid within 30 days Collected $400 from the client of July 10. Paid $12,000 wages to the drafting assistants. 17 19 22 25 Paid the account payable created on July 12. Paid $1.350 cash for some repairs to an item of drafting equipment. Binbutti withdrew $800 cash from the business for personal use. 26 30 Paid $12,000 wages to the drafting assistants. 31 Paid $6,000 cash for advertising in the local newspaper during July

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts