Question: Please fully answer and make sure its correct, will upvote if done properly. Thank you! American Emergency Vehicles (AEV) is considering whether to expand its

Please fully answer and make sure its correct, will upvote if done properly. Thank you!

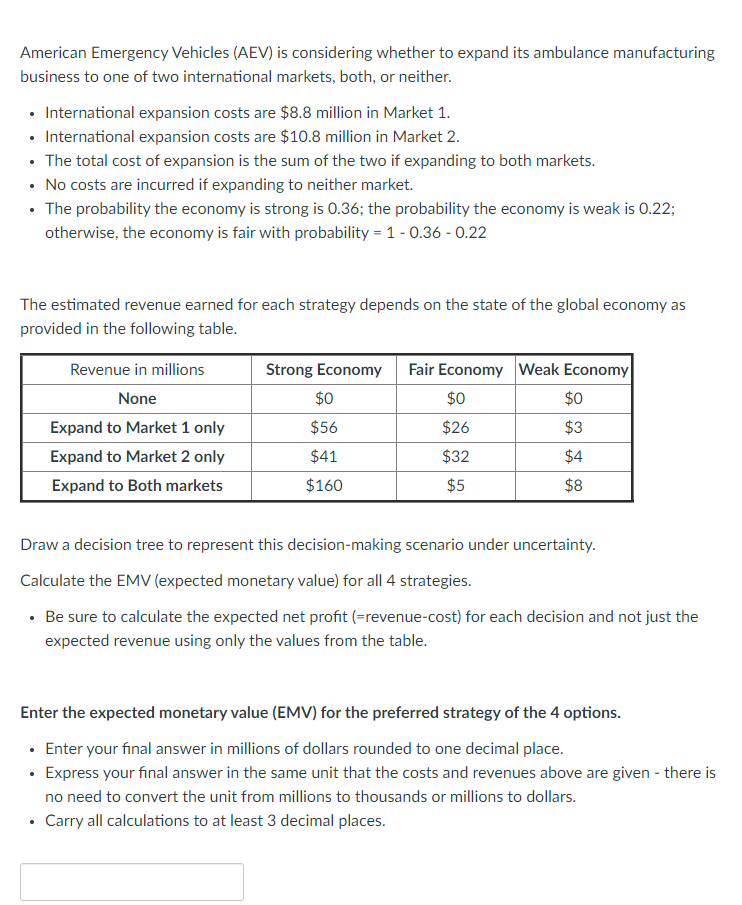

American Emergency Vehicles (AEV) is considering whether to expand its ambulance manufacturing business to one of two international markets, both, or neither. - International expansion costs are $8.8 million in Market 1. - International expansion costs are $10.8 million in Market 2. - The total cost of expansion is the sum of the two if expanding to both markets. - No costs are incurred if expanding to neither market. - The probability the economy is strong is 0.36 ; the probability the economy is weak is 0.22 ; otherwise, the economy is fair with probability =10.360.22 The estimated revenue earned for each strategy depends on the state of the global economy as provided in the following table. Draw a decision tree to represent this decision-making scenario under uncertainty. Calculate the EMV (expected monetary value) for all 4 strategies. - Be sure to calculate the expected net profit (=revenue-cost) for each decision and not just the expected revenue using only the values from the table. Enter the expected monetary value (EMV) for the preferred strategy of the 4 options. - Enter your final answer in millions of dollars rounded to one decimal place. - Express your final answer in the same unit that the costs and revenues above are given - there is no need to convert the unit from millions to thousands or millions to dollars. - Carry all calculations to at least 3 decimal places. American Emergency Vehicles (AEV) is considering whether to expand its ambulance manufacturing business to one of two international markets, both, or neither. - International expansion costs are $8.8 million in Market 1. - International expansion costs are $10.8 million in Market 2. - The total cost of expansion is the sum of the two if expanding to both markets. - No costs are incurred if expanding to neither market. - The probability the economy is strong is 0.36 ; the probability the economy is weak is 0.22 ; otherwise, the economy is fair with probability =10.360.22 The estimated revenue earned for each strategy depends on the state of the global economy as provided in the following table. Draw a decision tree to represent this decision-making scenario under uncertainty. Calculate the EMV (expected monetary value) for all 4 strategies. - Be sure to calculate the expected net profit (=revenue-cost) for each decision and not just the expected revenue using only the values from the table. Enter the expected monetary value (EMV) for the preferred strategy of the 4 options. - Enter your final answer in millions of dollars rounded to one decimal place. - Express your final answer in the same unit that the costs and revenues above are given - there is no need to convert the unit from millions to thousands or millions to dollars. - Carry all calculations to at least 3 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts