Question: Please fully explain every answer. Thanks. You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss

Please fully explain every answer. Thanks.

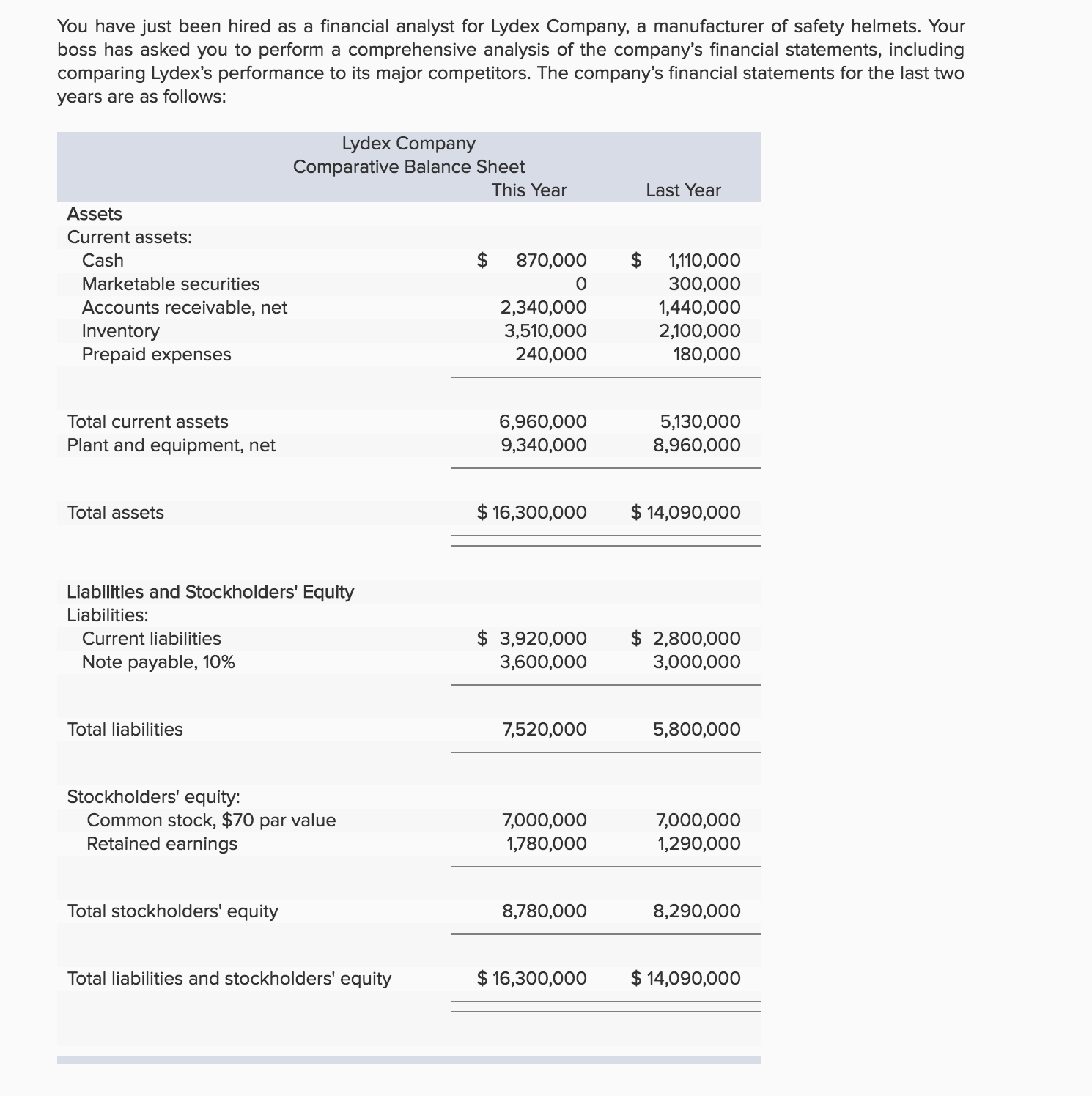

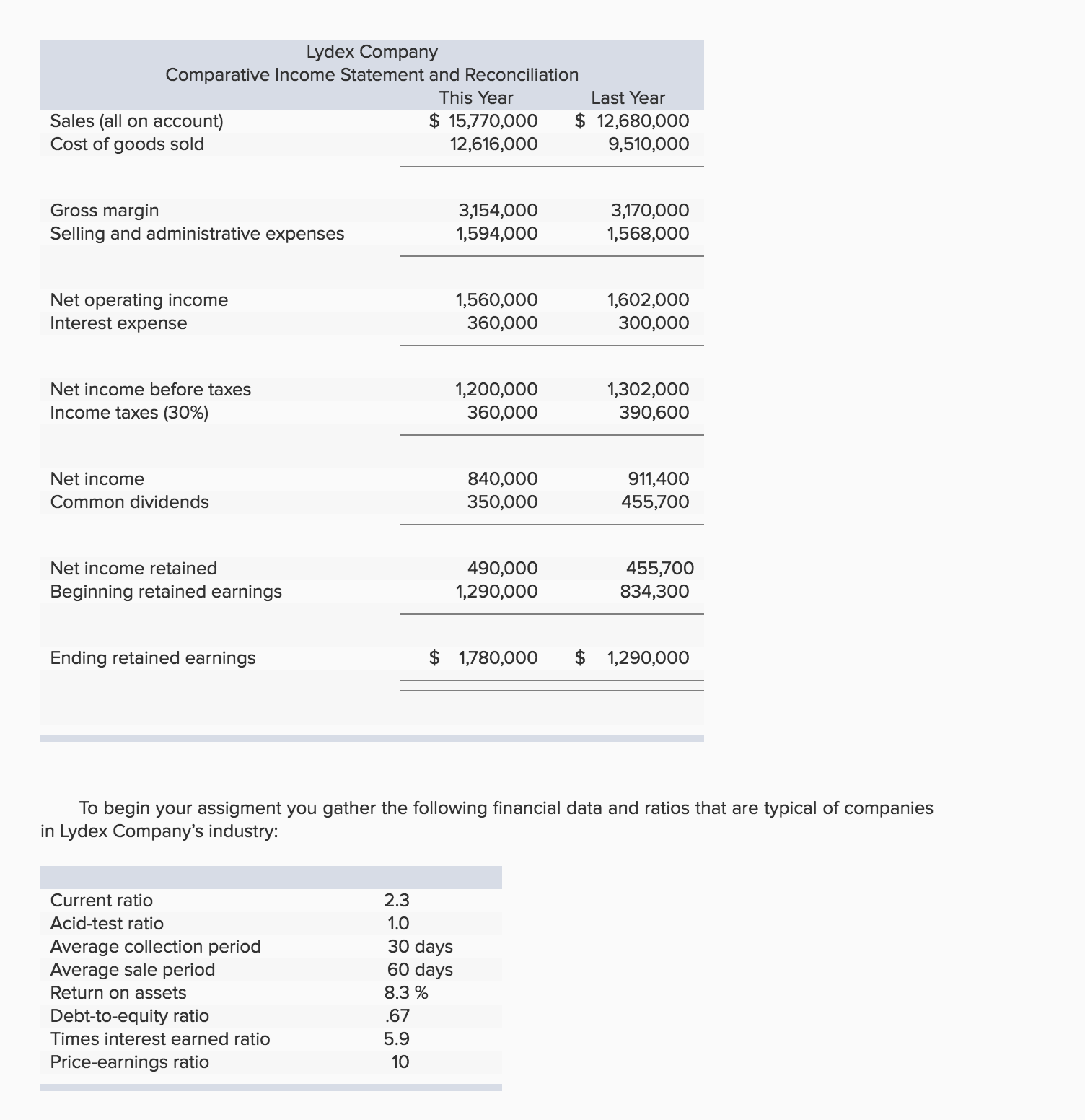

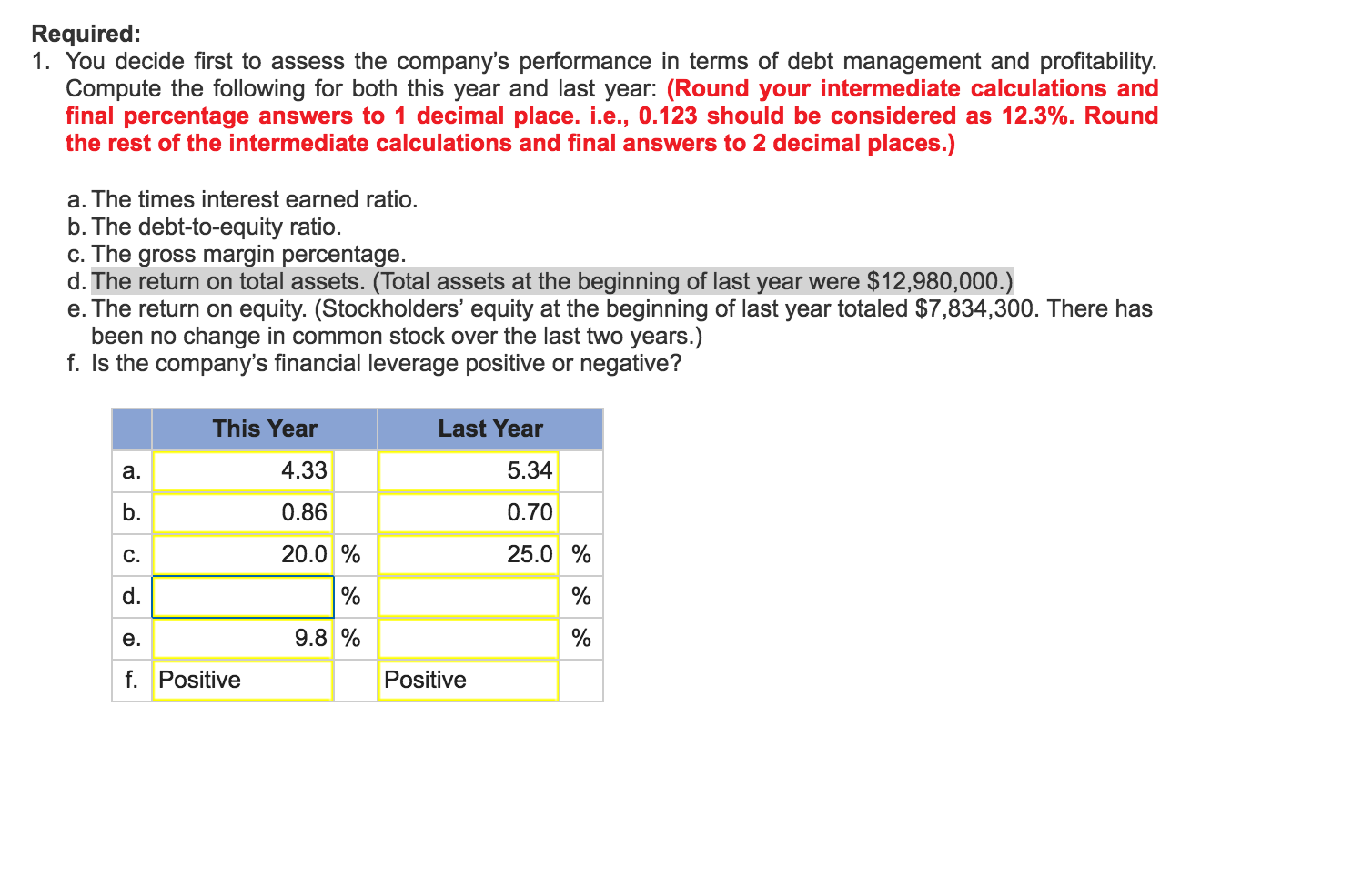

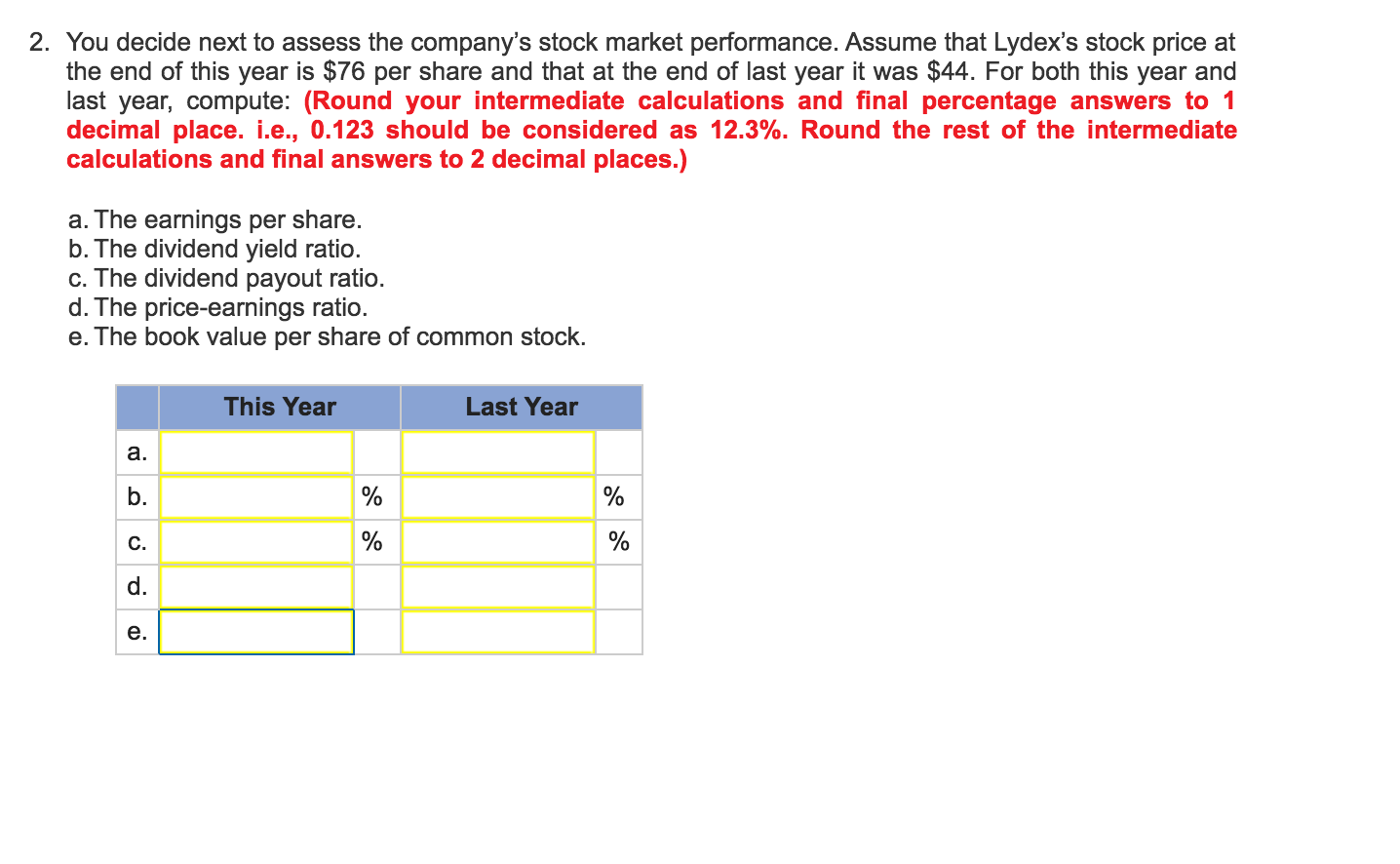

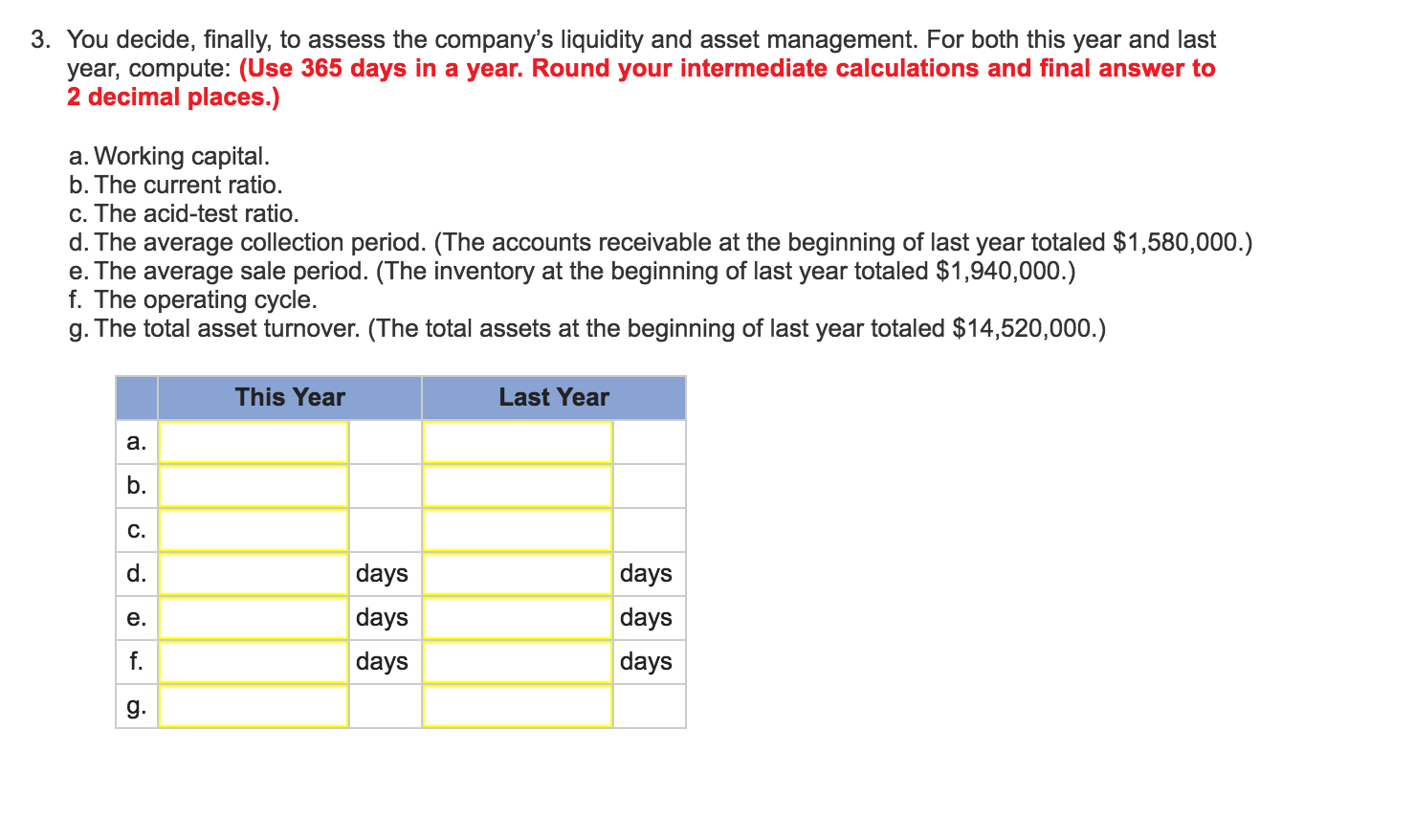

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, including comparing Lydex's performance to its major competitors. The company's financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses $ 870,000 $ 1,110,000 300,000 1,440,000 2,100,000 180,000 0 2,340,000 3,510,000 240,000 6,960,000 9,340,000 5,130,000 8,960,000 otal current assets Plant and equipment, net otal assets $16,300,000 $14,090,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 10% $ 3,920,000 3,600,000 $ 2,800,000 3,000,000 Total liabilities 7,520,00O 5,800,000 Stockholders' equity: Common stock, $70 par value Retained earnings 7,000,000 1,780,000 7,000,000 1,290,0000 Total stockholders' equity 8,780,000 8,290,000 Total liabilities and stockholders' equity $16,300,000 $14,090,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts