Question: *******Please fully explain how you calculated question 1. (ignore the number in the box) P7-3 Comparing and Contrasting the Effects of Inventory Costing Methods on

*******Please fully explain how you calculated question 1. (ignore the number in the box)

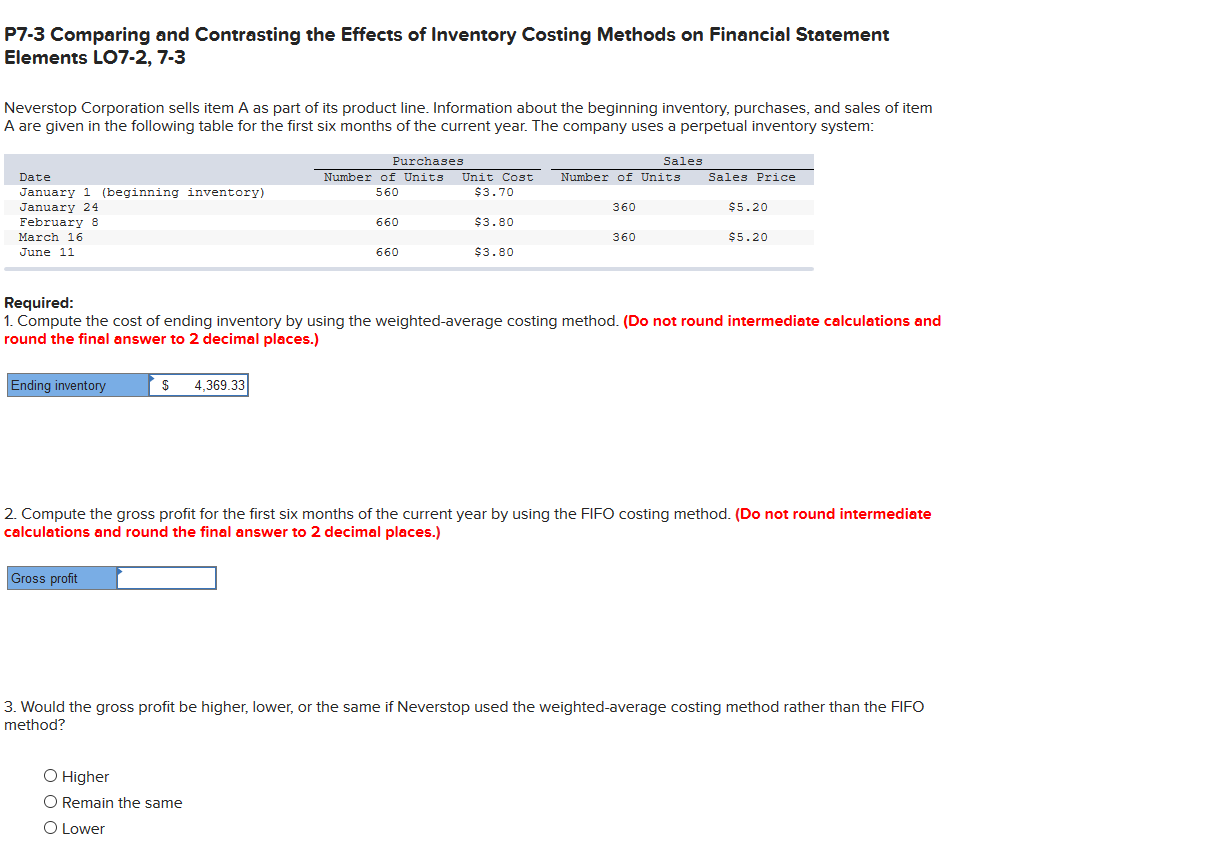

P7-3 Comparing and Contrasting the Effects of Inventory Costing Methods on Financial Statement Elements LO7-2, 7-3 Neverstop Corporation sells item A as part of its product line. Information about the beginning inventory, purchases, and sales of item A are given in the following table for the first six months of the current year. The company uses a perpetual inventory system: Purchases Number of Units Unit Cost 560 $3.70 Sales Number of Units Sales Price 360 $5.20 Date January 1 (beginning inventory) January 24 February 8 March 16 June 11 660 $3.80 360 $5.20 660 $3.80 Required: 1. Compute the cost of ending inventory by using the weighted average costing method. (Do not round intermediate calculations and round the final answer to 2 decimal places.) Ending inventory $ 4,369.33 2. Compute the gross profit for the first six months of the current year by using the FIFO costing method. (Do not round intermediate calculations and round the final answer to 2 decimal places.) Gross profit 3. Would the gross profit be higher, lower, or the same if Neverstop used the weighted-average costing method rather than the FIFO method? O Higher O Remain the same O Lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts