Question: Please fully explain your answer!! 4. Your best friend consults you for investment advice. You learn that his tax rate is 35%, and he has

Please fully explain your answer!!

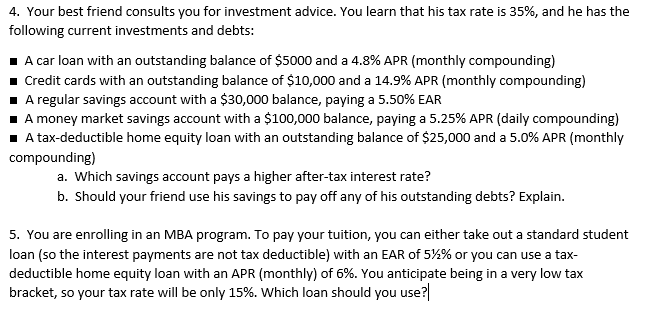

4. Your best friend consults you for investment advice. You learn that his tax rate is 35%, and he has the following current investments and debts: A car loan with an outstanding balance of $5000 and a 4.8% APR (monthly compounding) Credit cards with an outstanding balance of $10,000 and a 14.9% APR (monthly compounding) A regular savings account with a $30,000 balance, paying a 5.50% EAR A money market savings account with a $100,000 balance, paying a 5.25% APR (daily compounding) A tax-deductible home equity loan with an outstanding balance of $25,000 and a 5.0% APR (monthly compounding) a. Which savings account pays a higher after-tax interest rate? b. Should your friend use his savings to pay off any of his outstanding debts? Explain. 5. You are enrolling in an MBA program. To pay your tuition, you can either take out a standard student loan (so the interest payments are not tax deductible) with an EAR of 57% or you can use a tax- deductible home equity loan with an APR (monthly) of 6%. You anticipate being in a very low tax bracket, so your tax rate will be only 15%. Which loan should you use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts