Question: Please FULLY solve this (single problem) multiple step question prompt. Answer ALL parts please Tableau DA 3-3: Mini-Case, Analyzing adjusting entries and preparing an adjusted

![questions displayed below.] Roland Company began operations on December 1 and needs](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f79c391fe8d_41666f79c38b30bc.jpg)

![the questions displayed below.] a. M\&R Company provided $2,300 in services to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f79c4180ad2_42566f79c4122cef.jpg)

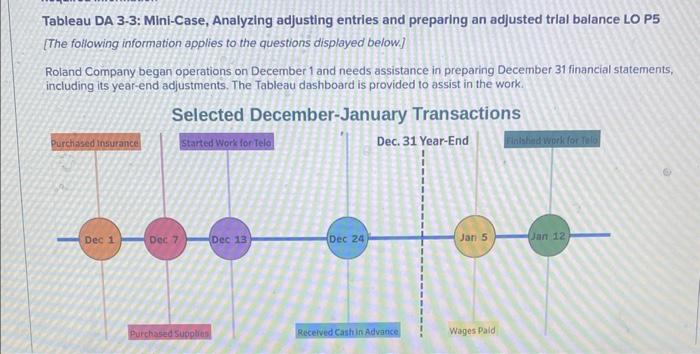

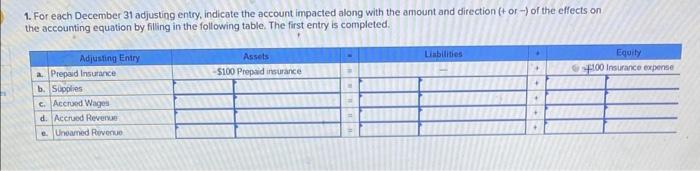

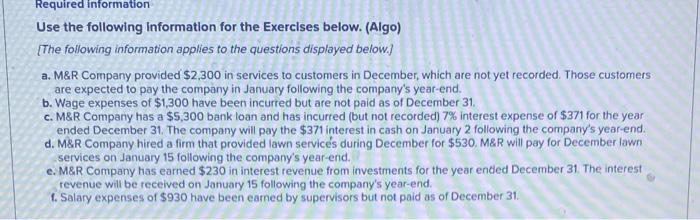

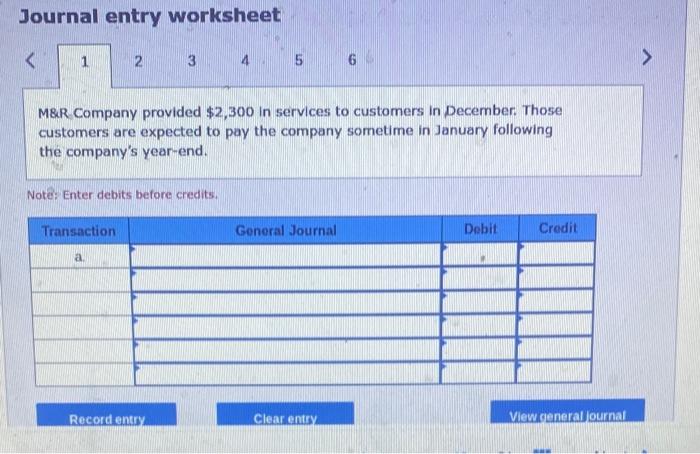

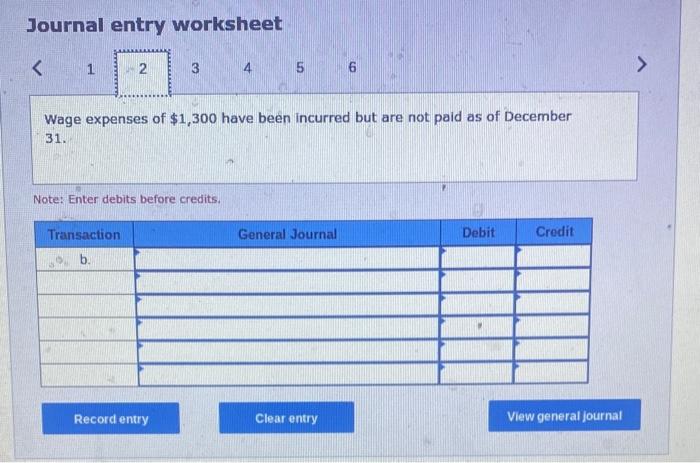

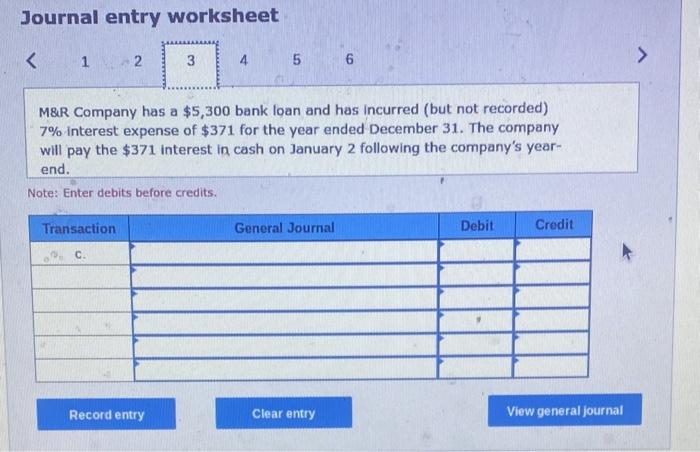

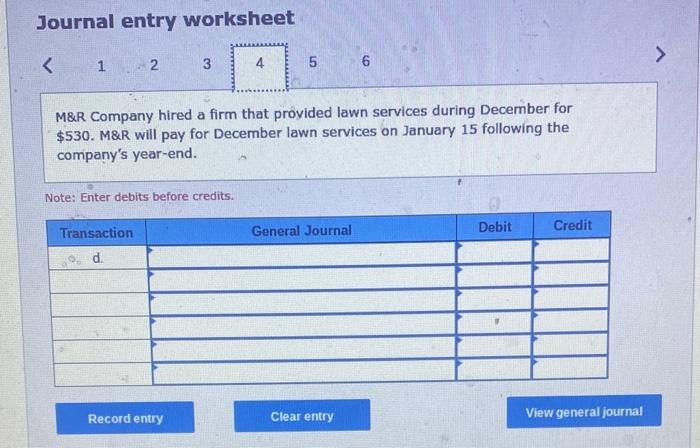

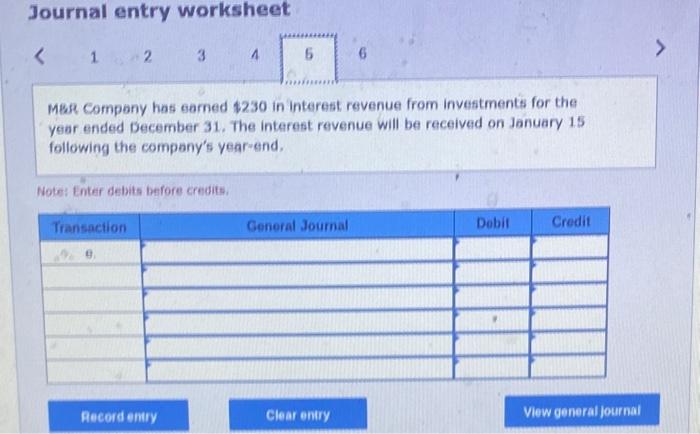

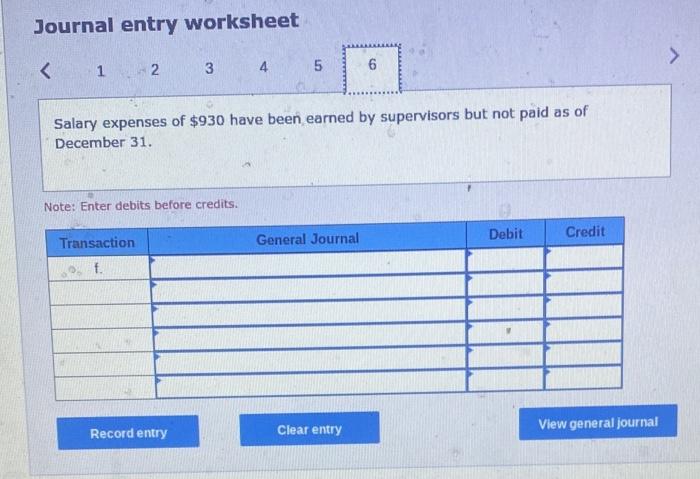

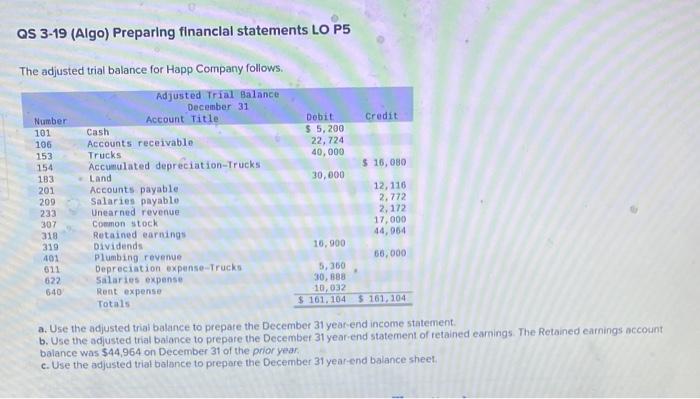

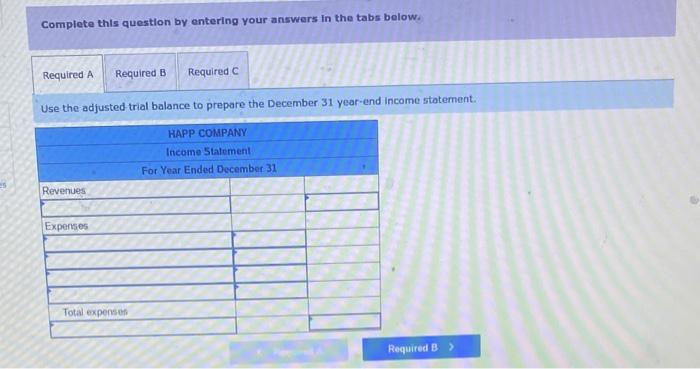

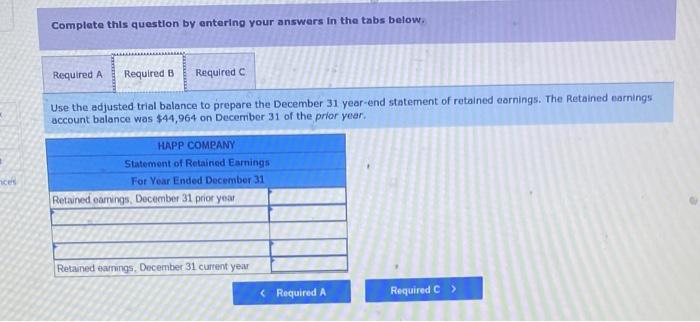

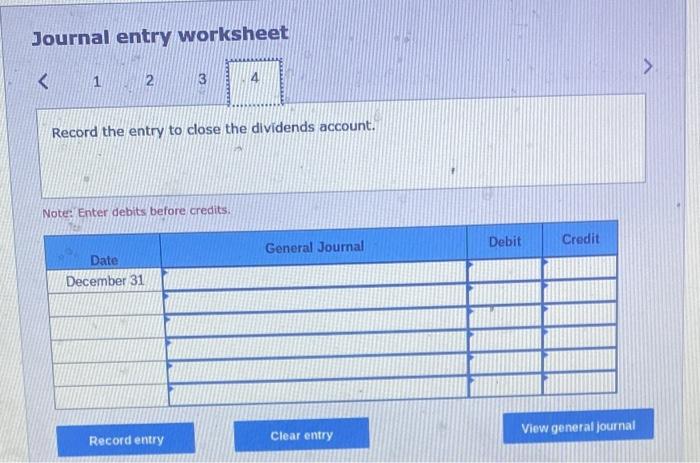

Tableau DA 3-3: Mini-Case, Analyzing adjusting entries and preparing an adjusted trlal balance LO P5 [The following information applies to the questions displayed below.] Roland Company began operations on December 1 and needs assistance in preparing December 31 financial statements, including its year-end adjustments. The Tableau dashboard is provided to assist in the work. Selected December-January Transactions Additional Information as of December 31 elo Job Completion at Year-End ABX Job Completion at Year-End Supplies Remaining at Year-End Wages Earned By Workers but not yet Paid at Year-End 1. For each December 31 adjusting entry, indicate the account impacted along with the amount and direction ( + or ) of the effects on the accounting equation by filling in the following table. The first entry is completed. 2. Enter the December 31 adjustments in the following table for prepaid insurance, supplies, accrued wages, accrued revenue, and unearned revenue. Then, complete the adjusted trial balance by entering the adjusted balance for each of the accounts. Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] a. M\&R Company provided $2,300 in services to customers in December, which are not yet recorded. Those customers are expected to pay the company in January following the company's year-end. b. Wage expenses of $1,300 have been incurred but are not paid as of December 31. c. M\&R Company has a $5,300 bank loan and has incurred (but not recorded) 7% interest expense of $371 for the year ended December 31. The company will pay the $371 interest in cash on January 2 following the company's year-end. d. M\&R Company hired a firm that provided lawn servics during December for $530. M\&R will pay for December lawn services on January 15 following the company's year-end. e. M\&R Company has earned $230 in interest revenue from investments for the year ented December 31 . The interest revenue will be received on January 15 following the company's year-end. 4. Salary expenses of $930 have been earned by supervisors but not paid as of December 31 . Journal entry worksheet 2 3 M\&R Company provided $2,300 in services to customers in December. Those customers are expected to pay the company sometime in January following the company's year-end. Note: Enter debits before credits. Journal entry worksheet Wage expenses of $1,300 have been incurred but are not paid as of December 31. Note: Enter debits before credits. Journal entry worksheet M\&R Company has a $5,300 bank loan and has incurred (but not recorded) 7% interest expense of $371 for the year ended December 31 . The company will pay the $371 interest in cash on January 2 following the company's yearend. Note: Enter debits before credits. Journal entry worksheet M\&R Company hired a firm that provided lawn services during December for \$530. M\&R will pay for December lawn services on January 15 following the company's year-end. Note: Enter debits before credits. Journal entry worksheet 12 MBR Company has earned $230 in interest revenue from investments for the year ended December 31. The interest revenue will be received on January 15 following the compony's year-end. Notes Enter debits before credits. Journal entry worksheet 12 Salary expenses of $930 have been earned by supervisors but not paid as of December 31. Note: Enter debits before credits. QS 3-19 (Algo) Preparing financlal statements LO P5 The adjusted trial balance for Happ Company follows. a. Use the adjusted trial balance to prepare the December 31 year-end income statement: b. Use the adjusted trial baiance to prepare the December 31 year-end statement of retained earnings. The Retained earnings account balance was $44,964 on December 31 of the prior year. c. Use the adjusted trial balance to prepare the December 31 year-end balance sheet. Complete this question by entering your answers in the tabs below. Use the adjusted trial balance to prepare the December 31 year-end income stotement. Complete thls question by entering your answers in the tabs below. Use the adjusted trial balance to prepare the December 31 year-end statement of retained earnings. The Retained earnings account balance was $44,964 on December 31 of the prior year. Use the adjusted trial balance to prepare the December 31 year-end balance sheet. (Amounts to be deducted should be Undiantad with s mimue elinn The ledger of Mai Company includes the following accounts with normal balances as of December 31: Retained Earnings $9,100; Dividends $850; Services Revenue $14,000; Wages Expense $8,900; and Rent Expense $1,800. Prepare its December 31 closing entries. Journal entry worksheet Record the entry to close revenue accounts. Note: Enter debits before credits. Journal entry worksheet: Note: Enter debits before credits. Journal entry worksheet 1 Record the entry to close expense accounts. Note: Enter debits before credits. Journal entry worksheet Record the entry to close the income summary account. Note: Enter debits before credits. Journal entry worksheet 1 Record the entry to close the dividends account. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts