Question: please get me answers to the following attacchments: (Present value of an annuity) What is the present value of a(n) 9-year annuity that pays (

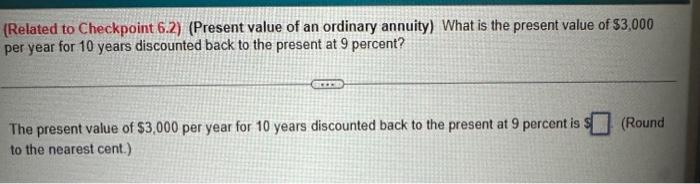

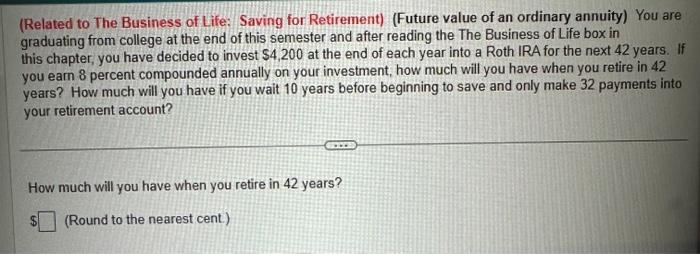

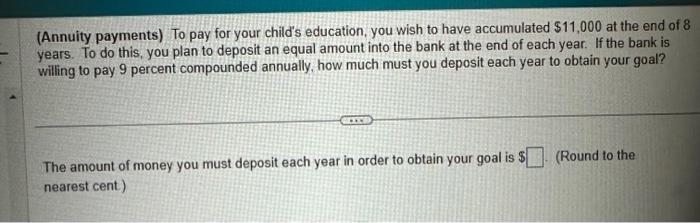

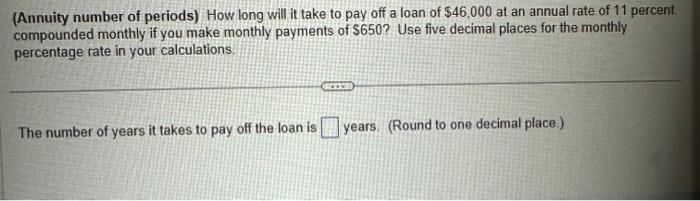

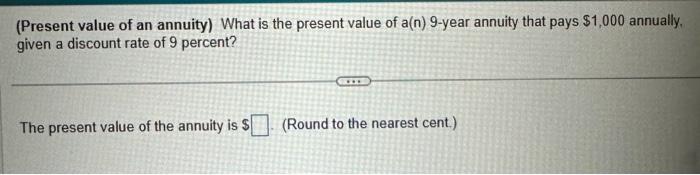

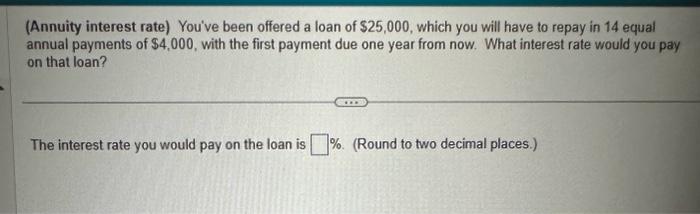

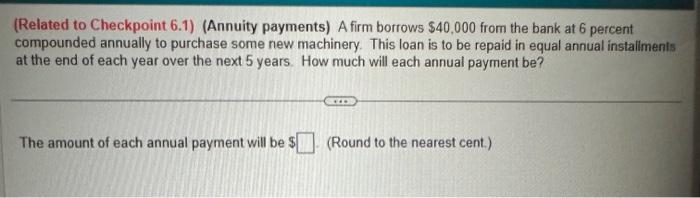

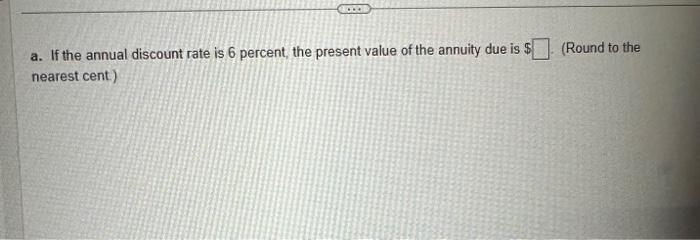

(Present value of an annuity) What is the present value of a(n) 9-year annuity that pays \\( \\$ 1,000 \\) annually, given a discount rate of 9 percent? The present value of the annuity is \\( \\$ \\) (Round to the nearest cent) (Annuity interest rate) You've been offered a loan of \\( \\$ 25,000 \\), which you will have to repay in 14 equal annual payments of \\( \\$ 4,000 \\), with the first payment due one year from now. What interest rate would you pay on that loan? The interest rate you would pay on the loan is \\%. (Round to two decimal places.) (Annuity payments) To pay for your child's education, you wish to have accumulated \\( \\$ 11,000 \\) at the end of 8 years. To do this, you plan to deposit an equal amount into the bank at the end of each year. If the bank is willing to pay 9 percent compounded annually, how much must you deposit each year to obtain your goal? The amount of money you must deposit each year in order to obtain your goal is \\( \\$ \\) (Round to the nearest cent) a. If the annual discount rate is 6 percent, the present value of the annuity due is \\( \\$ \\) (Round to the nearest cent) (Related to Checkpoint 6.1) (Annuity payments) A firm borrows \\( \\$ 40,000 \\) from the bank at 6 percent compounded annually to purchase some new machinery. This loan is to be repaid in equal annual installments at the end of each year over the next 5 years. How much will each annual payment be? The amount of each annual payment will be \\$ (Round to the nearest cent.) (Related to Checkpoint 6.2) (Present value of an ordinary annuity) What is the present value of \\( \\$ 3,000 \\) per year for 10 years discounted back to the present at 9 percent? The present value of \\( \\$ 3,000 \\) per year for 10 years discounted back to the present at 9 percent is (Round to the nearest cent.) (Related to The Business of Life: Saving for Retirement) (Future value of an ordinary annuity) You are graduating from college at the end of this semester and after reading the The Business of Life box in this chapter, you have decided to invest \\( \\$ 4,200 \\) at the end of each year into a Roth IRA for the next 42 years. If you earn 8 percent compounded annually on your investment, how much will you have when you retire in 42 years? How much will you have if you wait 10 years before beginning to save and only make 32 payments into your retirement account? How much will you have when you retire in 42 years? (Round to the nearest cent.) (Annuity number of periods) How long will it take to pay off a loan of \\( \\$ 46,000 \\) at an annual rate of 11 percent compounded monthly if you make monthly payments of \\$650? Use five decimal places for the monthly percentage rate in your calculations. The number of years it takes to pay off the loan is years. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts