Question: Please get the correct answer with steps, thank you. The current yield curve for default free zero coupon bonds is as follows: 4d) If you

Please get the correct answer with steps, thank you.

Please get the correct answer with steps, thank you.

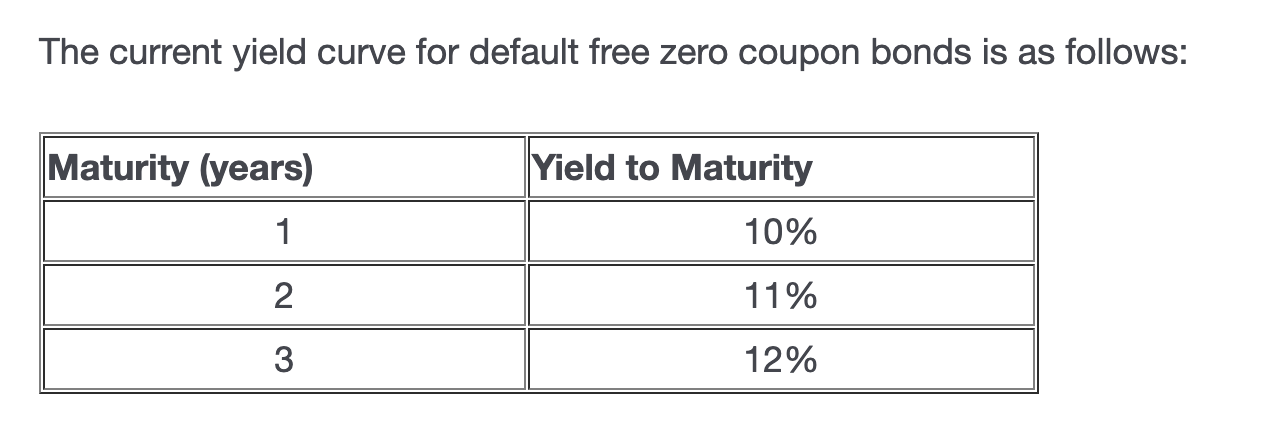

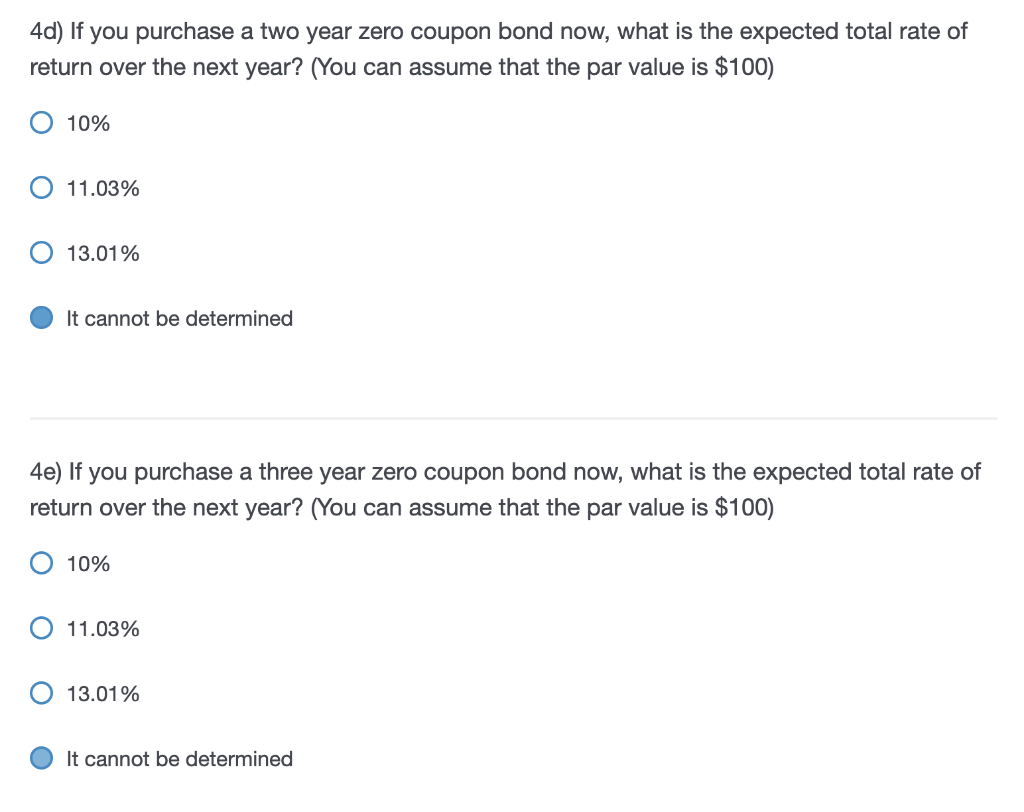

The current yield curve for default free zero coupon bonds is as follows: 4d) If you purchase a two year zero coupon bond now, what is the expected total rate of return over the next year? (You can assume that the par value is $100 ) 10%11.03%13.01% It cannot be determined 4e) If you purchase a three year zero coupon bond now, what is the expected total rate of return over the next year? (You can assume that the par value is $100 ) 10% 11.03% 13.01% It cannot be determined The current yield curve for default free zero coupon bonds is as follows: 4d) If you purchase a two year zero coupon bond now, what is the expected total rate of return over the next year? (You can assume that the par value is $100 ) 10%11.03%13.01% It cannot be determined 4e) If you purchase a three year zero coupon bond now, what is the expected total rate of return over the next year? (You can assume that the par value is $100 ) 10% 11.03% 13.01% It cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts