Question: Please give a brief EXPLANATION FOR DEPRECIATION Please use information below to complete excel spread. Straight line depreciation: subtract the book value of $75 from

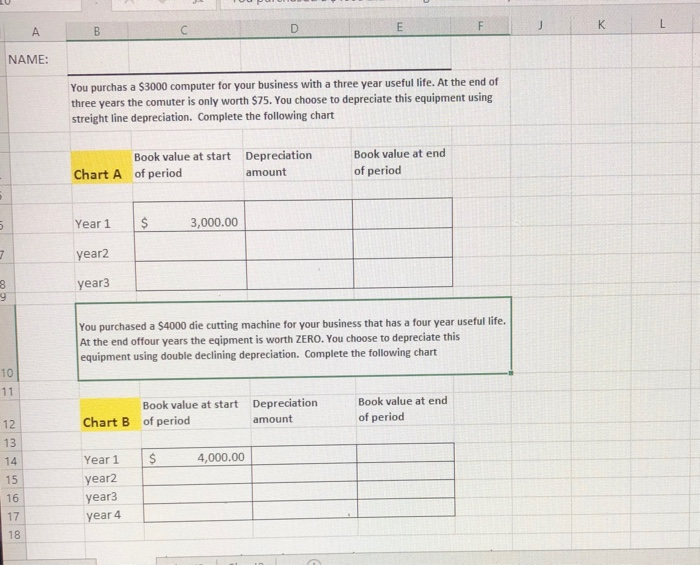

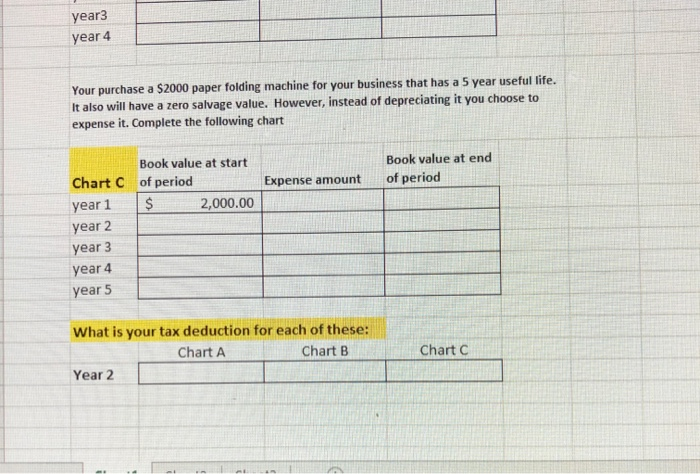

Please give a brief EXPLANATION FOR DEPRECIATION Please use information below to complete excel spread. Straight line depreciation: subtract the book value of $75 from the original purchase price and then divide the balance into 3 equal amounts of depreciation. That should end with the $75 balance after year 3. Double declining depreciation: since it is a four-year plan, divide the book value by 4 which would be 25%. Since it is double declining depreciation, you have to double the depreciation percent of 25% and make it 50%. Then use that 50% for each year making sure that you are depreciating the amount of the book value that is the result of the previous year's depreciation. So if you had a item worth $100 and you wanted to depreciate it over 5 years using double declining depreciation, then you would multiply the $100 x.40 (not 20 because it is double). The result would be $40 (now your book value). Your next year you would multiply $0 x 40 (your double declining depreciation), which would be $20 (your book value for year 3). And so on for each year. Expensing means that you will be taking a tax deduction for the entire book value the first year that you have the item. The tax deduction for the item for each year would be the depreciation amount for that particular year. NAME: You purchas a $3000 computer for your business with a three year useful life. At the end of three years the comuter is only worth $75. You choose to depreciate this equipment using streight line depreciation. Complete the following chart Chart A Book value at start of period Depreciation amount Book value at end of period Year 1 $ 3,000.00 year2 99 year3 You purchased a $4000 die cutting machine for your business that has a four year useful life. At the end offour years the egipment is worth ZERO. You choose to depreciate this equipment using double declining depreciation. Complete the following chart Chart B Book value at start of period Depreciation amount Book value at end of period $ 4,000.00 Year 1 year2 year3 year 4 year3 year 4 Your purchase a $2000 paper folding machine for your business that has a 5 year useful life. It also will have a zero salvage value. However, instead of depreciating it you choose to expense it. Complete the following chart Book value at start of period 2,000.00 Book value at end of period Expense amount Chart year 1 year 2 year 3 year 4 year 5 What is your tax deduction for each of these: Chart A Chart B Year 2 Chart

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts