Question: please give a detailed answer (with all calculations) 2. VaR Disclaimer: These exercises make very simple assumptions about the underlying distributions for illustration purposes. For

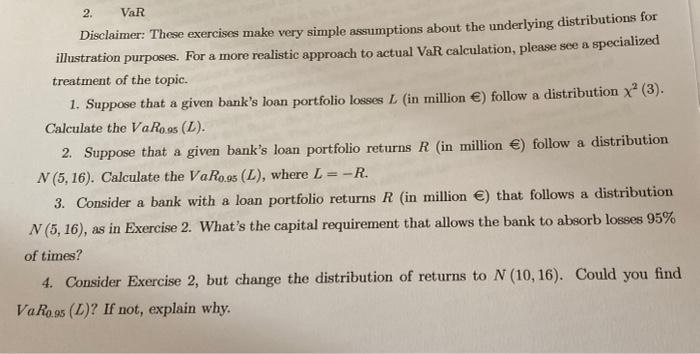

2. VaR Disclaimer: These exercises make very simple assumptions about the underlying distributions for illustration purposes. For a more realistic approach to actual VaR calculation, please see a specialized treatment of the topic. 1. Suppose that a given bank's loan portfolio losses L (in million ) follow a distribution x(3). Calculate the VaRoos (L). 2. Suppose that a given bank's loan portfolio returns R (in million ) follow a distribution N (5,16). Calculate the VaRoss (L), where L = -R. 3. Consider a bank with a loan portfolio returns R (in million ) that follows a distribution N (5, 16), as in Exercise 2. What's the capital requirement that allows the bank to absorb losses 95% of times? 4. Consider Exercise 2, but change the distribution of returns to N (10,16). Could you find VaRoos (D)? If not, explain why. 2. VaR Disclaimer: These exercises make very simple assumptions about the underlying distributions for illustration purposes. For a more realistic approach to actual VaR calculation, please see a specialized treatment of the topic. 1. Suppose that a given bank's loan portfolio losses L (in million ) follow a distribution x(3). Calculate the VaRoos (L). 2. Suppose that a given bank's loan portfolio returns R (in million ) follow a distribution N (5,16). Calculate the VaRoss (L), where L = -R. 3. Consider a bank with a loan portfolio returns R (in million ) that follows a distribution N (5, 16), as in Exercise 2. What's the capital requirement that allows the bank to absorb losses 95% of times? 4. Consider Exercise 2, but change the distribution of returns to N (10,16). Could you find VaRoos (D)? If not, explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts