Question: Please give a detailed response, I really struggle with this class, thank you. Parts a, b, and c On January 1, 2020, Crow Company changed

Please give a detailed response, I really struggle with this class, thank you.

Parts a, b, and c

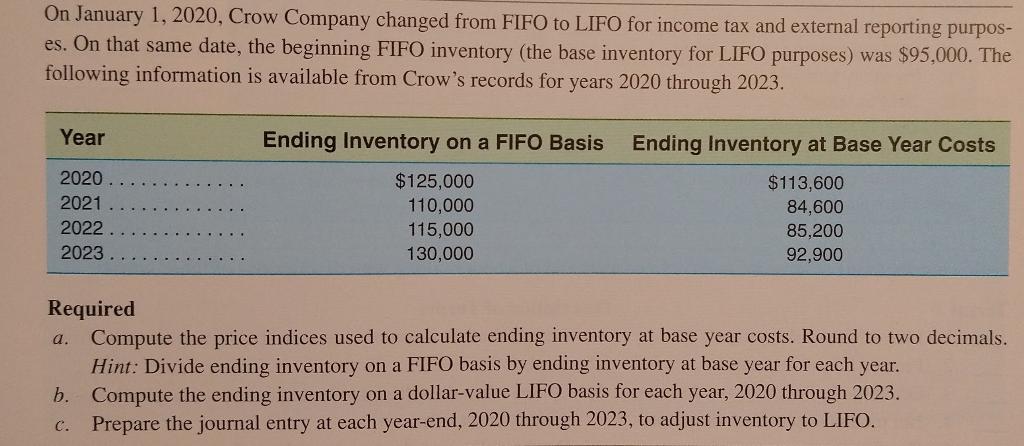

On January 1, 2020, Crow Company changed from FIFO to LIFO for income tax and external reporting purpos- es. On that same date, the beginning FIFO inventory (the base inventory for LIFO purposes) was $95,000. The following information is available from Crow's records for years 2020 through 2023. Year Ending Inventory on a FIFO Basis Ending Inventory at Base Year Costs 2020 2021 2022 2023 $125,000 110,000 115,000 130,000 $113,600 84,600 85,200 92,900 a. Required Compute the price indices used to calculate ending inventory at base year costs. Round to two decimals. Hint: Divide ending inventory on a FIFO basis by ending inventory at base year for each year. b. Compute the ending inventory on a dollar-value LIFO basis for each year, 2020 through 2023. Prepare the journal entry at each year-end, 2020 through 2023, to adjust inventory to LIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts