Question: Please give a full explanation! thx QUESTION 5 Clarification - Flash Enterprises Continuing Fact Pattern: You have numerous Flash Enterprises problems that will show up

Please give a full explanation! thx

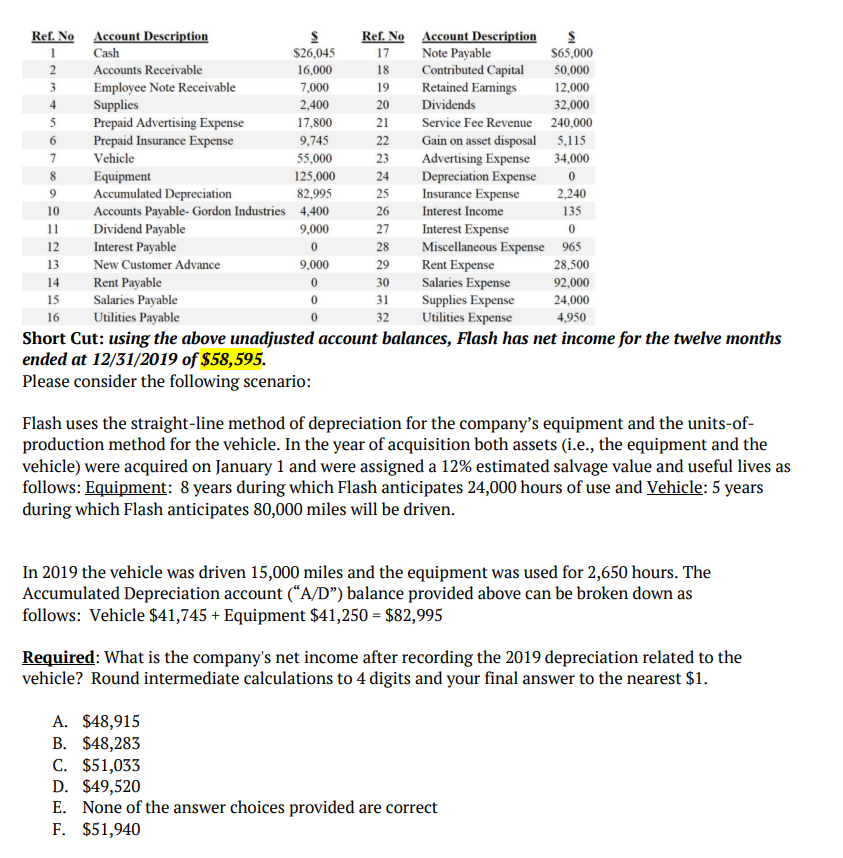

QUESTION 5 Clarification - Flash Enterprises Continuing Fact Pattern: You have numerous Flash Enterprises problems that will show up in a random order throughout the exam. Each Flash question is a small selection from a large comprehensive problem. Treat each Flash Enterprise question as stand alone, meaning you should ignore the scenarios that are not mentioned and include in your answer only the specific scenarios requested. Facts: Flash Enterprises provides you with the below unadjusted account balances as of 12/31/2019, all o which are normal: Please consider the following scenario: Flash uses the straight-line method of depreciation for the company's equipment and the units-ofproduction method for the vehicle. In the year of acquisition both assets (i.e., the equipment and the vehicle) were acquired on January 1 and were assigned a 12% estimated salvage value and useful lives as follows: Equipment: 8 years during which Flash anticipates 24,000 hours of use and Vehicle: 5 years during which Flash anticipates 80,000 miles will be driven. In 2019 the vehicle was driven 15,000 miles and the equipment was used for 2,650 hours. The Accumulated Depreciation account ("A/D) balance provided above can be broken down as follows: Vehicle $41,745 + Equipment $41,250=$82,995 Required: What is the company's net income after recording the 2019 depreciation related to the vehicle? Round intermediate calculations to 4 digits and your final answer to the nearest $1. A. $48,915 B. $48,283 C. $51,033 D. $49,520 E. None of the answer choices provided are correct F. $51,940 QUESTION 5 Clarification - Flash Enterprises Continuing Fact Pattern: You have numerous Flash Enterprises problems that will show up in a random order throughout the exam. Each Flash question is a small selection from a large comprehensive problem. Treat each Flash Enterprise question as stand alone, meaning you should ignore the scenarios that are not mentioned and include in your answer only the specific scenarios requested. Facts: Flash Enterprises provides you with the below unadjusted account balances as of 12/31/2019, all o which are normal: Please consider the following scenario: Flash uses the straight-line method of depreciation for the company's equipment and the units-ofproduction method for the vehicle. In the year of acquisition both assets (i.e., the equipment and the vehicle) were acquired on January 1 and were assigned a 12% estimated salvage value and useful lives as follows: Equipment: 8 years during which Flash anticipates 24,000 hours of use and Vehicle: 5 years during which Flash anticipates 80,000 miles will be driven. In 2019 the vehicle was driven 15,000 miles and the equipment was used for 2,650 hours. The Accumulated Depreciation account ("A/D) balance provided above can be broken down as follows: Vehicle $41,745 + Equipment $41,250=$82,995 Required: What is the company's net income after recording the 2019 depreciation related to the vehicle? Round intermediate calculations to 4 digits and your final answer to the nearest $1. A. $48,915 B. $48,283 C. $51,033 D. $49,520 E. None of the answer choices provided are correct F. $51,940

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts