Question: please give an step by step answer without Excel Problem 23.26. Suppose a three-year corporate bond provides a coupon of 7% per year payable semiannually

please give an step by step answer without Excel

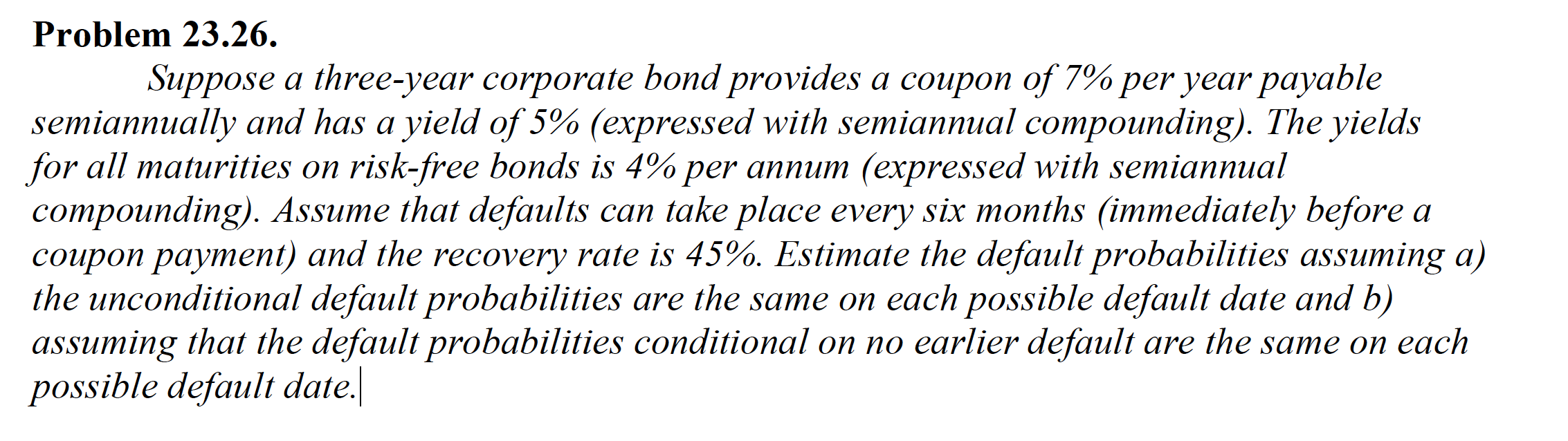

Problem 23.26. Suppose a three-year corporate bond provides a coupon of 7\% per year payable semiannually and has a yield of 5\% (expressed with semiannual compounding). The yields for all maturities on risk-free bonds is 4\% per annum (expressed with semiannual compounding). Assume that defaults can take place every six months (immediately before a coupon payment) and the recovery rate is 45%. Estimate the default probabilities assuming a) the unconditional default probabilities are the same on each possible default date and b) assuming that the default probabilities conditional on no earlier default are the same on each possible default date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts