Question: please give correct answers/solutions for all 9 questions!!! Please re-correct ans chose the blank and blue dot filled in answers. Sales Discounts and Sales Allowances

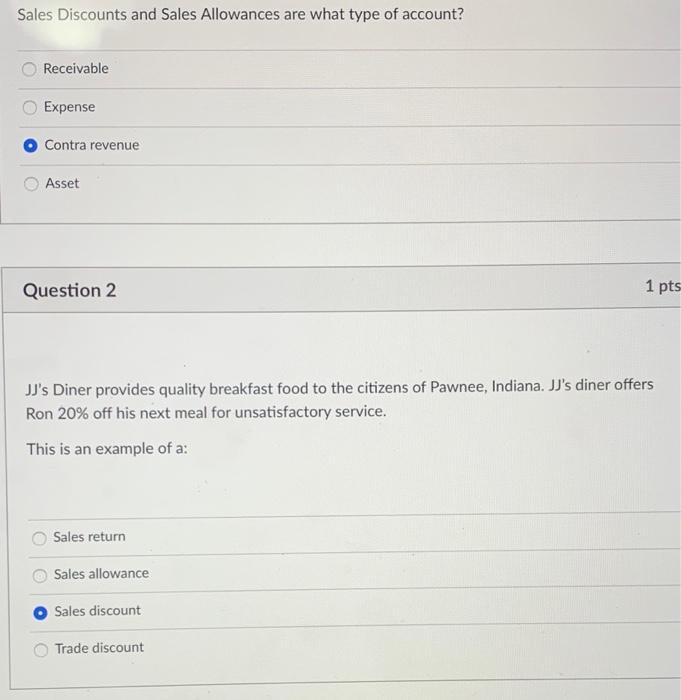

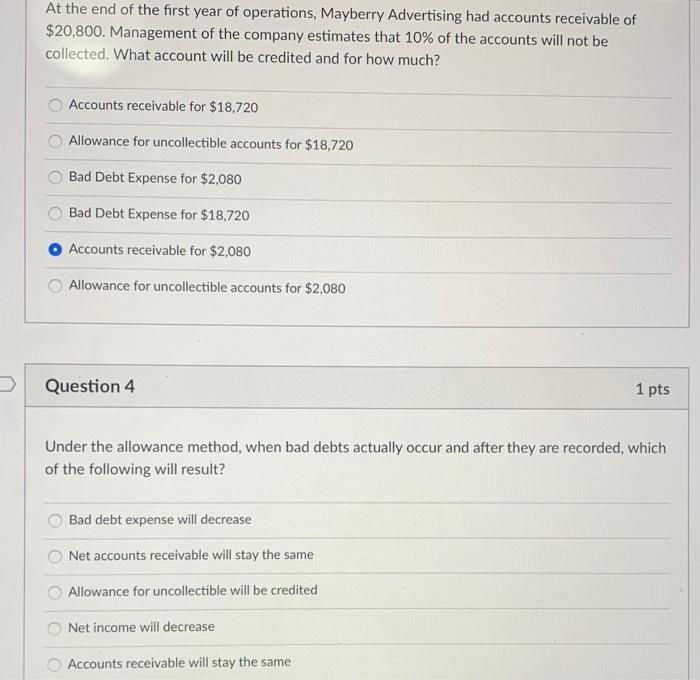

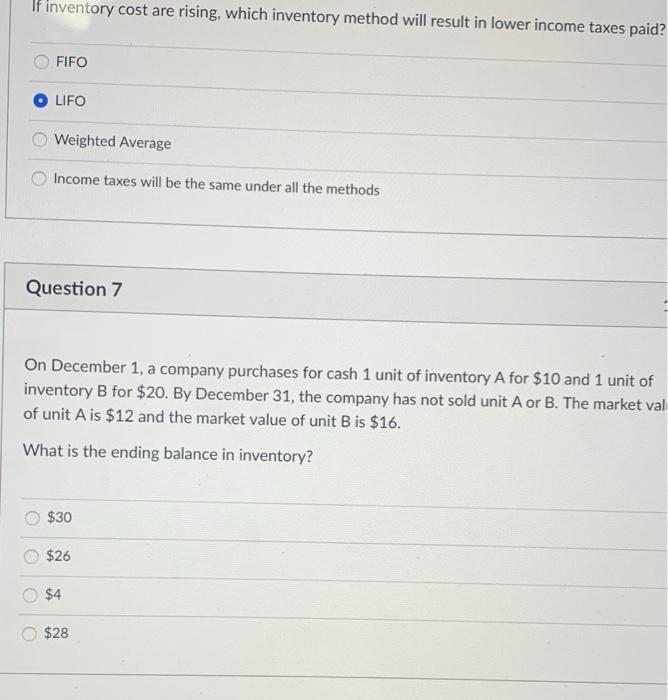

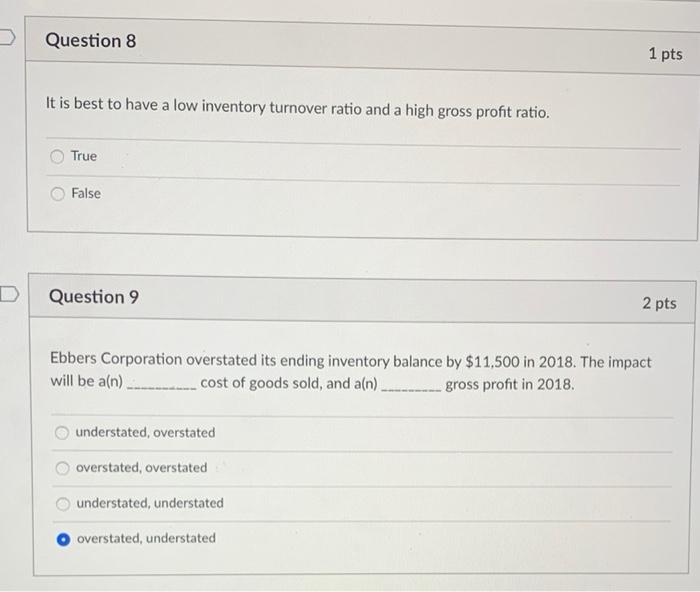

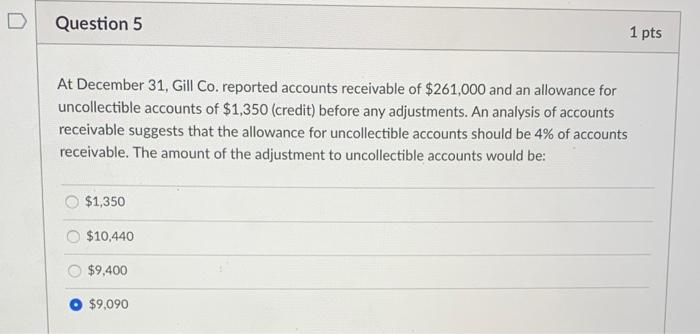

Sales Discounts and Sales Allowances are what type of account? Receivable Expense Contra revenue Asset Question 2 1 pts JJ's Diner provides quality breakfast food to the citizens of Pawnee, Indiana. JJ's diner offers Ron 20% off his next meal for unsatisfactory service. This is an example of a: Sales return Sales allowance Sales discount Trade discount At the end of the first year of operations, Mayberry Advertising had accounts receivable of $20,800. Management of the company estimates that 10% of the accounts will not be collected. What account will be credited and for how much? Accounts receivable for $18,720 Allowance for uncollectible accounts for $18,720 Bad Debt Expense for $2,080 Bad Debt Expense for $18,720 Accounts receivable for $2,080 Allowance for uncollectible accounts for $2,080 Question 4 1 pts Under the allowance method, when bad debts actually occur and after they are recorded, which of the following will result? Bad debt expense will decrease Net accounts receivable will stay the same Allowance for uncollectible will be credited Net income will decrease Accounts receivable will stay the same If inventory cost are rising, which inventory method will result in lower income taxes paid? FIFO LIFO Weighted Average Income taxes will be the same under all the methods Question 7 On December 1, a company purchases for cash 1 unit of inventory A for $10 and 1 unit of inventory B for $20. By December 31, the company has not sold unit A or B. The market val of unit A is $12 and the market value of unit B is $16. What is the ending balance in inventory? $30 $26 $4 $28 Question 8 1 pts It is best to have a low inventory turnover ratio and a high gross profit ratio. True False D Question 9 2 pts Ebbers Corporation overstated its ending inventory balance by $11,500 in 2018. The impact will be a(n) - cost of goods sold, and a(n) gross profit in 2018. understated, overstated overstated, overstated understated, understated overstated, understated D Question 5 1 pts At December 31, Gill Co. reported accounts receivable of $261,000 and an allowance for uncollectible accounts of $1,350 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 4% of accounts receivable. The amount of the adjustment to uncollectible accounts would be: $1,350 $10,440 $9,400 $9,090

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts