Question: Please give detailed answer 2. (25 points) The market value balance sheet of a company is as the following. The number of shares outstanding is

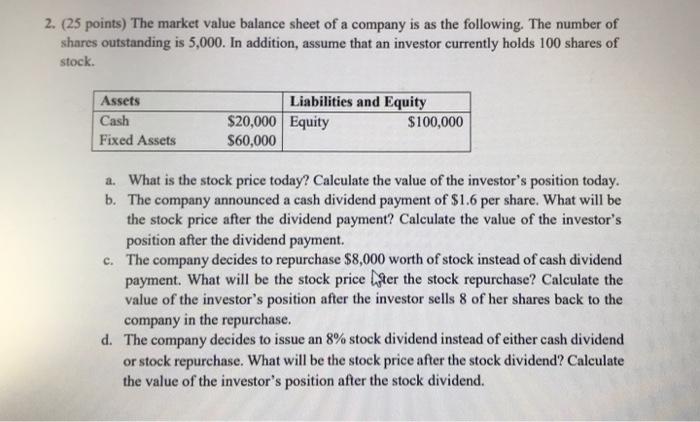

2. (25 points) The market value balance sheet of a company is as the following. The number of shares outstanding is 5,000. In addition, assume that an investor currently holds 100 shares of stock. Assets Liabilities and Equity Cash $100,000 $20,000 Equity $60,000 Fixed Assets a. What is the stock price today? Calculate the value of the investor's position today. b. The company announced a cash dividend payment of $1.6 per share. What will be the stock price after the dividend payment? Calculate the value of the investor's position after the dividend payment. c. The company decides to repurchase $8,000 worth of stock instead of cash dividend payment. What will be the stock price ter the stock repurchase? Calculate the value of the investor's position after the investor sells 8 of her shares back to the company in the repurchase. d. The company decides to issue an 8% stock dividend instead of either cash dividend or stock repurchase. What will be the stock price after the stock dividend? Calculate the value of the investor's position after the stock dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts