Question: Please give excel solution or show formulas for excel. FSA- Assignment 1 The balance sheet of DCC Corp., as of the end of Quarter 2,

Please give excel solution or show formulas for excel.

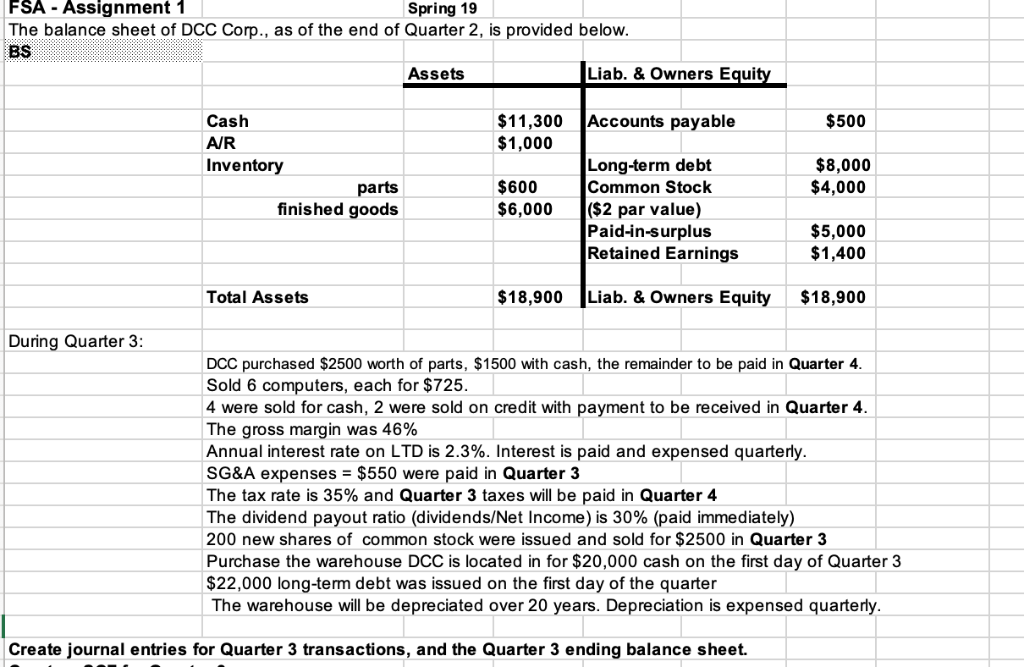

FSA- Assignment 1 The balance sheet of DCC Corp., as of the end of Quarter 2, is provided below BS Spring 19 Assets Liab. & Owners Equi $500 Cash A/R Inventory $11,300 Accounts payable $1,000 Long-term debt Common Stock $8,000 $4,000 parts finished goods $600 $6,000($2 par value) Paid-in-surplus Retained Earnings $5,000 $1,400 Total Assets $18,900Liab.& Owners Equity $18,900 During Quarter 3 DCC purchased $2500 worth of parts, $1500 with cash, the remainder to be paid in Quarter 4 Sold 6 computers, each for $725 4 were sold for cash, 2 were sold on credit with payment to be received in Quarter 4 The gross margin was 46% Annual interest rate on LTD is 2.3%. Interest is paid and expensed quarterly SG&A expenses $550 were paid in Quarter 3 The tax rate is 35% and Quarter 3 taxes will be paid in Quarter 4 The dividend payout ratio (dividends/Net Income) is 30% (paid immediately) 200 new shares of common stock were issued and sold for $2500 in Quarter 3 Purchase the warehouse DCC is located in for $20,000 cash on the first day of Quarter 3 $22,000 long-term debt was issued on the first day of the quarter The warehouse will be depreciated over 20 years. Depreciation is expensed quarterly Create journal entries for Quarter 3 transactions, and the Quarter 3 ending balance sheet. FSA- Assignment 1 The balance sheet of DCC Corp., as of the end of Quarter 2, is provided below BS Spring 19 Assets Liab. & Owners Equi $500 Cash A/R Inventory $11,300 Accounts payable $1,000 Long-term debt Common Stock $8,000 $4,000 parts finished goods $600 $6,000($2 par value) Paid-in-surplus Retained Earnings $5,000 $1,400 Total Assets $18,900Liab.& Owners Equity $18,900 During Quarter 3 DCC purchased $2500 worth of parts, $1500 with cash, the remainder to be paid in Quarter 4 Sold 6 computers, each for $725 4 were sold for cash, 2 were sold on credit with payment to be received in Quarter 4 The gross margin was 46% Annual interest rate on LTD is 2.3%. Interest is paid and expensed quarterly SG&A expenses $550 were paid in Quarter 3 The tax rate is 35% and Quarter 3 taxes will be paid in Quarter 4 The dividend payout ratio (dividends/Net Income) is 30% (paid immediately) 200 new shares of common stock were issued and sold for $2500 in Quarter 3 Purchase the warehouse DCC is located in for $20,000 cash on the first day of Quarter 3 $22,000 long-term debt was issued on the first day of the quarter The warehouse will be depreciated over 20 years. Depreciation is expensed quarterly Create journal entries for Quarter 3 transactions, and the Quarter 3 ending balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts