Question: please give me answer for 11th question. 628 Chapter 16 Decision Analysis Chapter 16 Decision Analysis 629 PROBLEMS AND EXERCISES *8. For Slaggert Systems decision

please give me answer for 11th question.

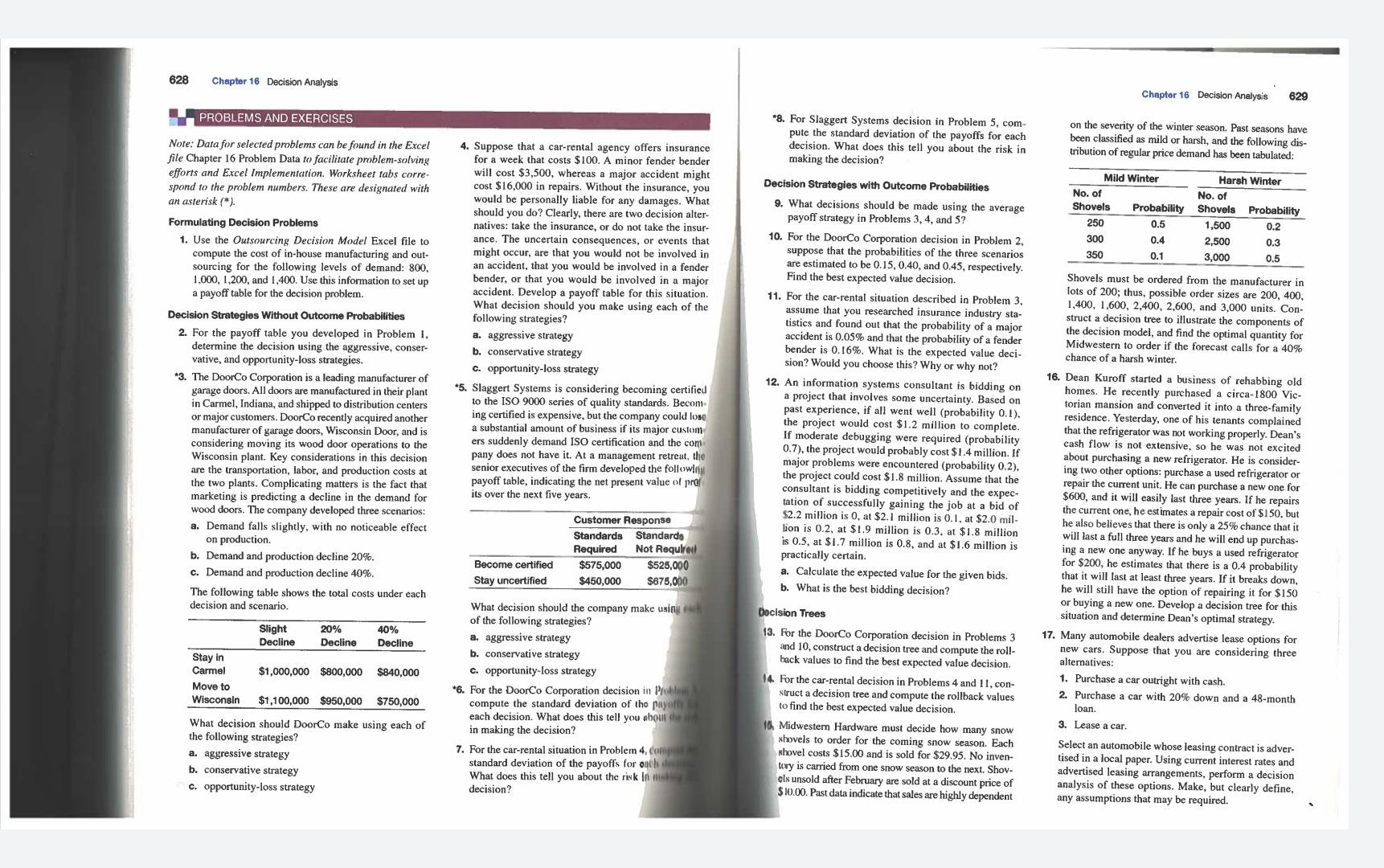

628 Chapter 16 Decision Analysis Chapter 16 Decision Analysis 629 PROBLEMS AND EXERCISES *8. For Slaggert Systems decision in Problem 5, com- pute the standard deviation of the payoffs for each decision. What does this tell you about the risk in making the decision? on the severity of the winter season. Past seasons have been classified as mild or harsh, and the following dis- tribution of regular price demand has been tabulated: Mild Winter No. of Shovels Probability 250 0.5 300 0.4 350 0.1 Harsh Winter No. of Shovels Probability 1,500 0.2 2,500 0.3 3,000 0.5 Note: Data for selected problems can be found in the Excel file Chapter 16 Problem Data to facilitate problem-solving efforts and Excel Implementation. Worksheet tabs corre- spond to the problem numbers. These are designated with an asterisk (*). Formulating Decision Problems 1. Use the Outsourcing Decision Model Excel file to compute the cost of in-house manufacturing and out- sourcing for the following levels of demand: 800, 1,000,1,200, and 1,400. Use this information to set up a payoff table for the decision problem. Decision Strategies Without Outcome Probabilities 2. For the payoff table you developed in Problem I, determine the decision using the aggressive, conser- vative, and opportunity-loss strategies. *3. The DoorCo Corporation is a leading manufacturer of garage doors. All doors are manufactured in their plant in Carmel, Indiana, and shipped to distribution centers or major customers. DoorCo recently acquired another manufacturer of garage doors, Wisconsin Door, and is considering moving its wood door operations to the Wisconsin plant. Key considerations in this decision are the transportation, labor, and production costs at the two plants. Complicating matters is the fact that marketing is predicting a decline in the demand for wood doors. The company developed three scenarios: a. Demand falls slightly, with no noticeable effect on production b. Demand and production decline 20%. c. Demand and production decline 40%. The following table shows the total costs under each decision and scenario. 4. Suppose that a car-rental agency offers insurance for a week that costs $100. A minor fender bender will cost $3,500, whereas a major accident might cost $16,000 in repairs. Without the insurance, you would be personally liable for any damages. What should you do? Clearly, there are two decision alter- natives: take the insurance, or do not take the insur- ance. The uncertain consequences, or events that might occur, are that you would not be involved in an accident, that you would be involved in a fender bender, or that you would be involved in a major accident. Develop a payoff table for this situation. What decision should you make using each of the following strategies? a. aggressive strategy b. conservative strategy c. opportunity-loss strategy *5. Slaggert Systems is considering becoming certified to the ISO 9000 series of quality standards. Becom ing certified is expensive, but the company could love a substantial amount of business if its major custom ers suddenly demand ISO certification and the com pany does not have it. At a management retreat, the senior executives of the firm developed the following payoff table, indicating the net present value of praf its over the next five years. Decision Strategies with Outcome Probabilities 9. What decisions should be made using the average payoff strategy in Problems 3, 4, and 5? 10. For the DoorCo Corporation decision in Problem 2, suppose that the probabilities of the three scenarios are estimated to be 0.15, 0.40, and 0.45, respectively. Find the best expected value decision. 11. For the car-rental situation described in Problem 3, assume that you researched insurance industry sta- tistics and found out that the probability of a major accident is 0.05% and that the probability of a fender bender is 0.16%. What is the expected value deci- sion? Would you choose this? Why or why not? 12. An information systems consultant is bidding on a project that involves some uncertainty. Based on past experience, if all went well (probability 0.1). the project would cost $1.2 million to complete. If moderate debugging were required (probability 0.7), the project would probably cost $1.4 million. If hi major problems were encountered (probability 0.2). the project could cost $1.8 million. Assume that the consultant is bidding competitively and the expec- tation of successfully gaining the job at a bid of $2.2 million is 0, at $2.1 million is 0.1. at $2.0 mil- lion is 0.2, at $1.9 million is 0.3, at $1.8 million is 0.5, at $1.7 million is 0.8, and at $1.6 million is practically certain a. Calculate the expected value for the given bids. b. What is the best bidding decision? repair the Customer Response Standards Standarde Required Not Requlrout $575,000 $525,000 $450,000 $675,000 Shovels must be ordered from the manufacturer in lots of 200; thus, possible order sizes are 200, 400, 1,400, 1.600, 2,400, 2,600, and 3,000 units. Con- struct a decision tree to illustrate the components of the decision model, and find the optimal quantity for Midwestern to order if the forecast calls for a 40% chance of a harsh winter. 16. Dean Kuroff started a business of rehabbing old homes. He recently purchased a circa-1800 Vic- torian mansion and converted it into a three-family residence. Yesterday, one of his tenants complained that the refrigerator was not working properly. Dean's cash flow is not extensive, so he was not excited about purchasing a new refrigerator. He is is consider- ing two other options: purchase a used refrigerator or current unit. He can purchase a new one for $600, and it will easily last three years. If he he repairs the current one, he estimates a repair cost of $150, but he also believes that there is only a 25% chance that will last a full three years and he will end up purchas- ing a new one anyway. If he buys a used refrigerator for $200, he estimates that there is a 0.4 probability that it will last at least three years. If it breaks down, he will still have the option of repairing it for $150 or buying a new one. Develop a decision tree for this situation and determine Dean's optimal strategy. 17. Many automobile dealers advertise lease options for new cars. Suppose that you are considering three alternatives: 1. Purchase a car outright with cash. 2. Purchase a car with 20% down and a 48-month loan. 3. Lease a car. Select an automobile whose leasing contract is adver- tised in a local paper. Using current interest rates and advertised leasing arrangements, perform a decision analysis of these options. Make, but clearly define, any assumptions that may be required. Become certified Stay uncertified Decision Trees 20% Slight Decline Decline 40% Decline $1,000,000 $800,000 $840,000 Stay in Carmel Move to Wisconsin $1,100,000 $950,000 $750,000 What decision should the company make using of the following strategies? a. aggressive strategy b. conservative strategy c. opportunity-loss strategy *6. For the DoorCo Corporation decision in Polen compute the standard deviation of the payoff each decision. What does this tell you about the in making the decision? 7. For the car-rental situation in Problem 4, standard deviation of the payoffs for och des What does this tell you about the risk In decision? 13. For the DoorCo Corporation decision in Problems 3 and 10, construct a decision tree and compute the roll- hack values to find the best expected value decision. 14. For the car rental decision in Problems 4 and 11, con- struct a decision tree and compute the rollback values to find the best expected value decision. 16 Midwestern Hardware must decide how many snow shovels to order for the coming snow season. Each whovel costs $15.00 and is sold for $29.95. No inven- tory is carried from one snow season to the next. Shov- cls unsold after February are sold at a discount price of $10.00. Past data indicate that sales are highly dependent What decision should DoorCo make using each of the following strategies? a. aggressive strategy b. conservative strategy C. opportunity-loss strategyStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock