Question: Please give me complete solutions. Also, here is a helpful link you can refer to that tackles the same problem using different numbers, but I

Please give me complete solutions. Also, here is a helpful link you can refer to that tackles the same problem using different numbers, but I didn't get the logic and I don't know if it is correct. Hope it helps.

https://www.chegg.com/homework-help/questions-and-answers/problem-3-considering-whether-invest-following-option-embedded-tailored-bond-called-struct-q30061212

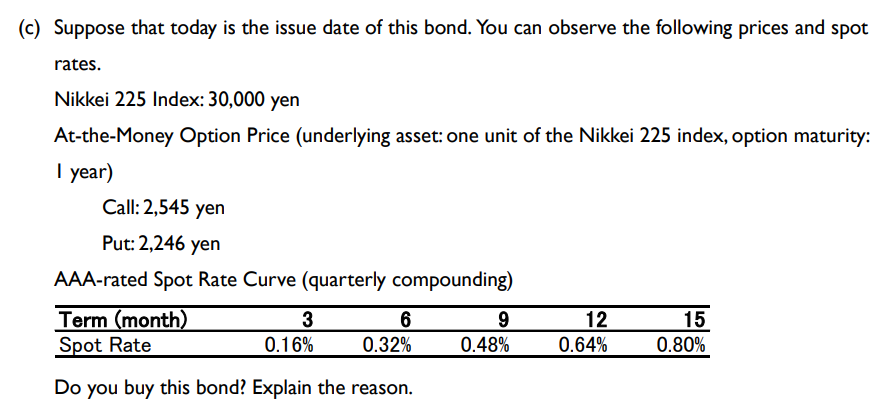

You are considering whether to invest in the following option-embedded tailored bond (so called "structured bond"). Equity-linked Bond Name: Equity-index-linked Note Issuer: BankW (Rating:AAA) Face Value: 100 Japanese Yen Issue Price: I00\% Term to Maturity: 15 months Coupon Rate: 4.8% (annual) Coupon Frequency: Quarterly Payment Redemption Price: Smaller of Face Value and the Calculated Value by the Following Formula 100Nikkei225IndexatIssuanceNikkei225IndexatRedemption (a) Draw the graph which shows the relationship between the redemption price of this bond and the Nikkei 225 Index at redemption. Redemstion brice (b) From (a) you can see that this bond can be expressed as the combination of some assets. Describe this combination in detail. c) Suppose that today is the issue date of this bond. You can observe the following prices and spot rates. Nikkei 225 Index: 30,000 yen At-the-Money Option Price (underlying asset: one unit of the Nikkei 225 index, option maturity: I year) Call: 2,545 yen Put: 2,246 yen AAA-rated Spot Rate Curve (quarterly compounding) Do you buy this bond? Explain the reason

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts