Question: Please Give me Correct Answer...! Q. No. 1 Max Marks - 10 DIFFERENTIAL COST ANALYSIS Dawan Company is considering the introduction of a new product

Please Give me Correct Answer...!

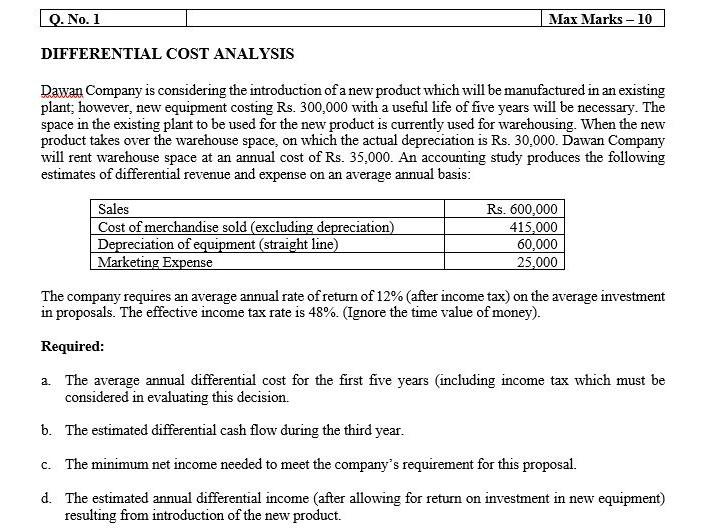

Q. No. 1 Max Marks - 10 DIFFERENTIAL COST ANALYSIS Dawan Company is considering the introduction of a new product which will be manufactured in an existing plant, however, new equipment costing Rs. 300,000 with a useful life of five years will be necessary. The space in the existing plant to be used for the new product is currently used for warehousing. When the new product takes over the warehouse space, on which the actual depreciation is Rs. 30.000. Dawan Company will rent warehouse space at an annual cost of Rs. 35.000. An accounting study produces the following estimates of differential revenue and expense on an average annual basis: Sales Rs. 600,000 Cost of merchandise sold (excluding depreciation) 415,000 Depreciation of equipment (straight line) 60,000 Marketing Expense 25,000 The company requires an average annual rate of return of 12% (after income tax) on the average investment in proposals. The effective income tax rate is 48%. (Ignore the time value of money). Required: 2. The average annual differential cost for the first five years (including income tax which must be considered in evaluating this decision. b. The estimated differential cash flow during the third year. C. The minimum net income needed to meet the company's requirement for this proposal. d. The estimated annual differential income (after allowing for return on investment in new equipment) resulting from introduction of the new product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts