Question: please give me proper answer as soon as possible please don't post answer on excel please solve it properly Am A is a company that

please give me proper answer as soon as possible please don't post answer on excel please solve it properly

please give me proper answer as soon as possible please don't post answer on excel please solve it properly

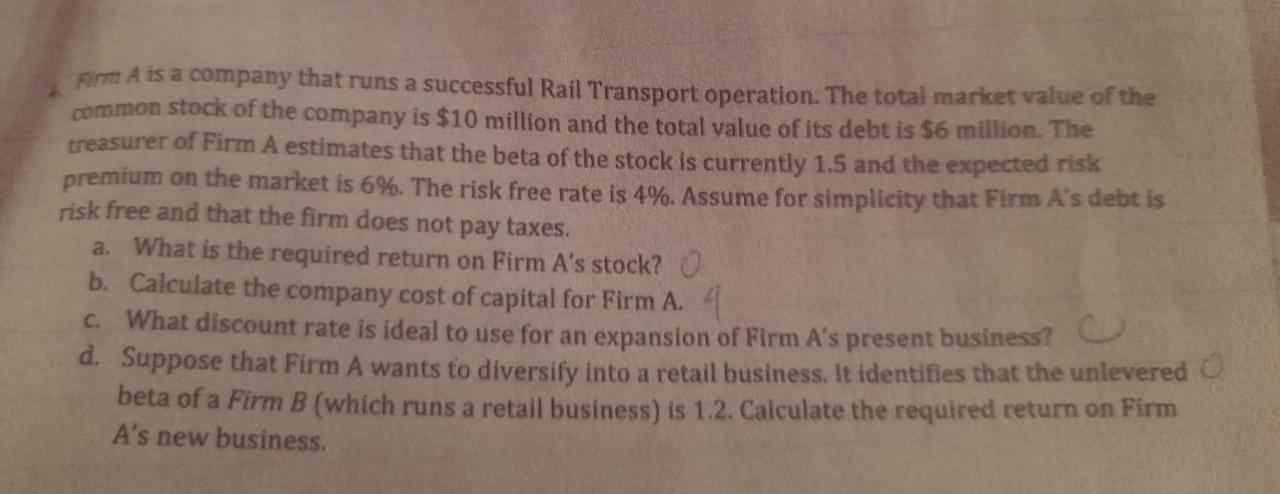

Am A is a company that runs a successful Rail Transport operation. The total market value of the common stock of the company is $10 million and the total value of its debt is $6 million. The treasurer of Firm A estimates that the beta of the stock is currently 1.5 and the expected risk premium on the market is 6%. The risk free rate is 4%. Assume for simplicity that Firm A's debt is risk free and that the firm does not pay taxes. a. What is the required return on Firm A's stock? O b. Calculate the company cost of capital for Firm A. 4 c. What discount rate is ideal to use for an expansion of Firm A's present business? d. Suppose that Firm A wants to diversify into a retail business. It identifies that the unlevered O beta of a Firm B (which runs a retail business) is 1.2. Calculate the required return on Firm A's new business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts