Question: please give me the answer as soon as possible E Marked out of 1.00 P Flag question consider the following two investment projects: Investment A

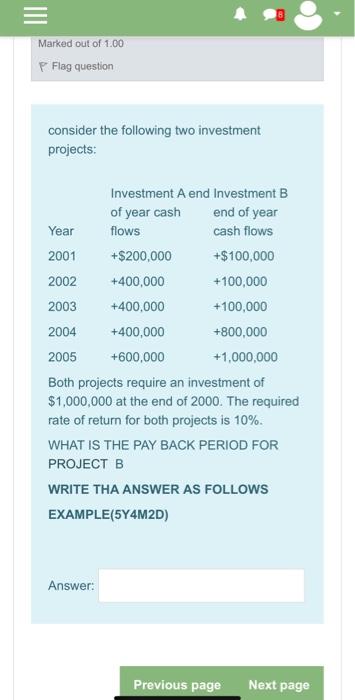

E Marked out of 1.00 P Flag question consider the following two investment projects: Investment A end Investment B of year cash end of year Year flows cash flows 2001 +$200,000 +$100,000 2002 +400,000 +100,000 2003 +400,000 +100,000 2004 +400,000 +800,000 2005 +600,000 +1,000,000 Both projects require an investment of $1,000,000 at the end of 2000. The required rate of return for both projects is 10%. WHAT IS THE PAY BACK PERIOD FOR PROJECT B WRITE THA ANSWER AS FOLLOWS EXAMPLE(5Y4M2D) Answer: Previous page Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts