Question: please give me the answer as well as some explaination. thanks QUESTION 5 In the foreseeable future, the real risk-free rate of interest, r*, is

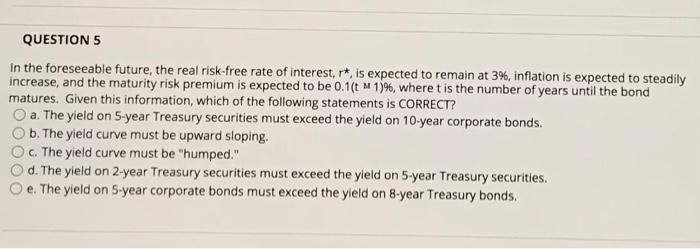

QUESTION 5 In the foreseeable future, the real risk-free rate of interest, r*, is expected to remain at 3%, inflation is expected to steadily increase, and the maturity risk premium is expected to be 0.1(t M 13%, where t is the number of years until the bond matures. Given this information, which of the following statements is CORRECT? a. The yield on 5-year Treasury securities must exceed the yield on 10-year corporate bonds. b. The yield curve must be upward sloping. c. The yield curve must be "humped." d. The yield on 2-year Treasury securities must exceed the yield on 5-year Treasury securities. e. The yield on 5-year corporate bonds must exceed the yield on 8-year Treasury bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts