Question: Please give me the correct answer only with full details, else i will give dislike. X Limited started construction on a building for its own

Please give me the correct answer only with full details, else i will give dislike.

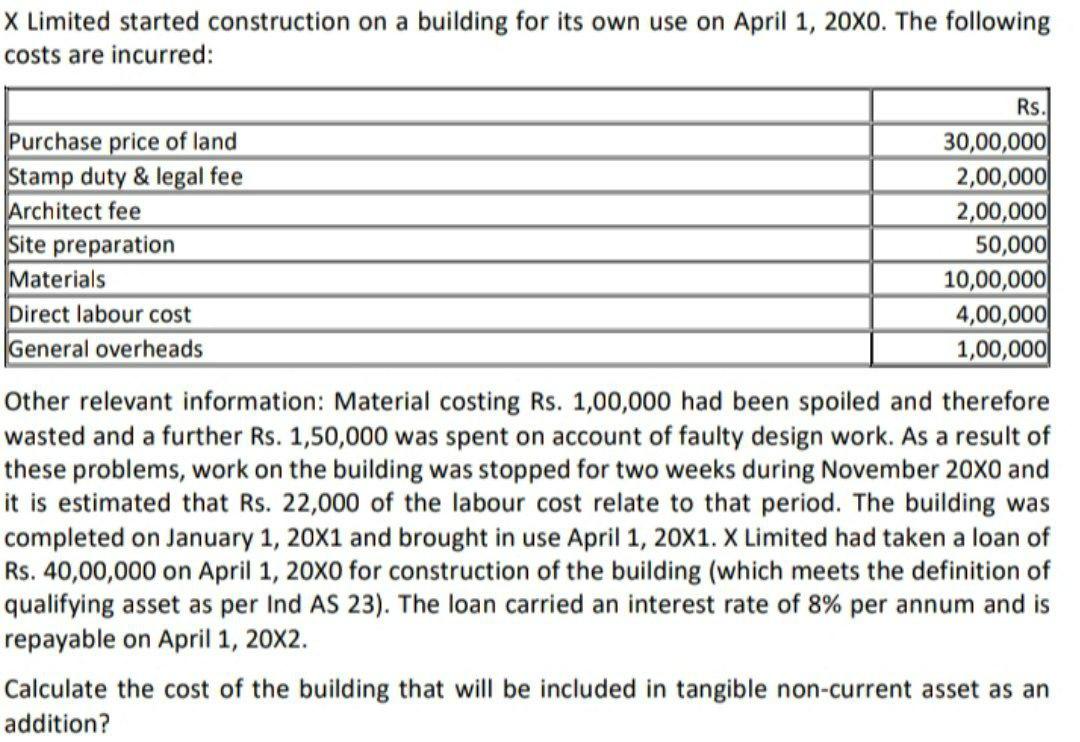

X Limited started construction on a building for its own use on April 1, 20X0. The following costs are incurred: Purchase price of land Stamp duty & legal fee Architect fee Site preparation Materials Direct labour cost General overheads Rs. 30,00,000 2,00,000 2,00,000 50,000 10,00,000 4,00,000 1,00,000 Other relevant information: Material costing Rs. 1,00,000 had been spoiled and therefore wasted and a further Rs. 1,50,000 was spent on account of faulty design work. As a result of these problems, work on the building was stopped for two weeks during November 20x0 and it is estimated that Rs. 22,000 of the labour cost relate to that period. The building was completed on January 1, 20X1 and brought in use April 1, 20X1. X Limited had taken a loan of Rs. 40,00,000 on April 1, 20X0 for construction of the building (which meets the definition of qualifying asset as per Ind AS 23). The loan carried an interest rate of 8% per annum and is repayable on April 1, 20x2. Calculate the cost of the building that will be included in tangible non-current asset as an addition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts